How to Organize Business Receipts Without the Hassle

Tired of receipt chaos? Learn how to organize business receipts with simple, real-world methods for paper, digital, and automated systems.

That mountain of paper receipts isn't just clutter - it's a source of stress and a real financial risk. The secret to finally getting your business receipts organized for good is to build a simple, repeatable system you can actually stick with. Forget complicated methods. The best approach is always the one that starts with corralling everything in one place and then processing it on a regular schedule.

Tackling the Paper Receipt Pile for Good

Even with everything going digital, those pesky physical receipts are still a reality for most of us. From client lunches to last-minute supply runs, the slips of paper pile up fast, and before you know it, you've got a major source of anxiety on your hands. The goal here isn't just about tidying up; it's about creating a reliable workflow that brings order to the financial chaos.

First things first: you need a central collection point. This could be a specific tray on your desk, a dedicated folder in your briefcase, or even a classic shoebox. Honestly, the tool doesn't matter nearly as much as the habit. By creating a single "inbox" for all your receipts, you stop them from getting lost in coat pockets, your wallet, or the center console of your car.

Carve Out a Weekly Routine

Once you've got a place to drop them, the next move is to process them consistently. I’ve found the best way to do this is to block out a small chunk of time every single week. Maybe it's 15 minutes on a Friday afternoon. During this time, your only job is to go through that inbox and sort the receipts into logical categories.

This simple routine is what keeps the pile from getting overwhelming. It’s a core part of learning https://tailride.so/blog/how-to-organise-receipts in a way that actually works. Consistency is what turns this dreaded chore into a simple, stress-free habit.

This push to get organized isn't just a personal productivity hack; it's part of a huge industry trend. The global market for cloud-based receipt management is expected to hit approximately USD 11.36 billion by 2034. The biggest piece of that pie? Receipt capture and scanning apps, making up a massive 37.4% share. This shows just how much businesses are leaning on automation to make financial tracking easier.

Choosing Your Physical Storage System

After you’ve sorted your receipts, you still need a place to keep the physical copies (if your record-keeping policy requires it). My advice? Keep it simple. The most effective tools are often the cheapest and easiest to use.

A huge mistake people make is over-complicating their filing system. If it’s too complex, you just won’t use it. The best system is the one you can maintain without thinking twice - that’s what ensures you're always ready for tax season.

So, where should you put them? A quick look at a few common methods can help you decide what fits your style.

Choosing Your Physical Receipt Organization System

A quick comparison of common methods for storing physical business receipts to help you decide which one best suits your needs and workflow.

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Accordion Files | Small businesses or individuals with moderate receipt volume; great for portability. | Inexpensive, compact, and comes with pre-labeled or blank dividers for easy categorization. | Can become bulky quickly; not ideal for very high volumes of receipts. |

| Labeled Binders | Businesses that need to store receipts for long periods and want them protected. | Highly scalable (just add pages), keeps receipts flat and protected in plastic sleeves. | Takes up more shelf space; requires purchasing both binders and sleeves. |

| Simple Envelopes | Solopreneurs or businesses with very few paper receipts each month. | Extremely cheap and easy to set up; can be filed away neatly in a drawer. | Not very durable; receipts can get crumpled; difficult to review contents quickly. |

Ultimately, whether you choose a binder, an accordion file, or a simple set of envelopes, the key is picking one you'll actually maintain. The goal is progress, not a picture-perfect system that's too much work to keep up with.

Creating Your Digital Receipt Archive

While having a physical filing system is a decent start, the real game-changer is going digital. This is how you create a permanent, searchable record of every single business expense. Think about it: no more faded thermal paper, no more frantically searching for a lost slip, and no more boxes overflowing with paper. You’re essentially building a secure financial library that you can tap into from anywhere.

The bedrock of any solid digital system is a logical folder structure. Cloud storage services like Google Drive or Dropbox are perfect for this. The key is to set up folders that perfectly mirror your main expense categories - the same ones you’ll be using for your bookkeeping and tax filings.

Building Your Folder Framework

Let's start simple. Create a main folder, something like "Business Receipts 2024." From there, you'll build out subfolders that make immediate sense for how your business spends money.

- •Marketing & Advertising: This is where you'll stash receipts for Facebook ads, new business cards, or that sponsorship for a local event.

- •Office Supplies: Everything from printer ink and pens to that new software subscription goes in here.

- •Travel & Meals: The perfect home for receipts from flights, hotel stays, and client dinners.

- •Utilities: A dedicated spot for your internet, phone, and electricity bills.

This kind of structure instantly cuts through the clutter. When tax time rolls around and you need to find a specific travel receipt from May, you know exactly where to click instead of sifting through a sea of random files. It’s a small effort that pays huge dividends when you need to organize business receipts properly.

Now, a smart folder system is only half the equation. The other, equally important part is consistent file naming. If you skip this, you’ll still find yourself wasting time hunting for the right document. A standardized naming system makes your entire archive instantly searchable.

A huge mistake I see people make is saving scanned receipts with generic names like "scan_001.pdf." That’s just creating a digital junk drawer. A consistent naming format, on the other hand, turns your archive into a powerful, searchable database for your finances.

The Perfect File Naming Convention

Here's a simple format that works wonders: YYYY-MM-DD_Vendor_Amount.

So, let's say you did a supply run to Staples on March 15, 2024, and spent $85.50. That file would be named 2024-03-15_Staples_85.50.pdf. This little system is brilliant because it lets you sort files by date and see the most important details without ever having to open the file itself.

Of course, you need a way to get those paper receipts into your digital system in the first place. This is where a good mobile scanner app becomes your best friend. Look for one that uses Optical Character Recognition (OCR) technology. This not only snaps a clear image but also reads and extracts the text, making your receipts searchable by keyword.

One last thing - and it's a big one. Back up your archive. Cloud services are incredibly reliable, but having a secondary backup on an external hard drive gives you that extra layer of security and peace of mind. Your digital receipt archive is a critical business asset, so protect it like one.

Choosing Smart Categories for Your Expenses

Let's be honest: just dumping all your scanned receipts into one big digital folder is chaos. Sure, they're saved, but you can't learn anything from them. Smart categorization is what turns that mess into a goldmine of financial insight. It's about more than just surviving tax season - it's about getting a crystal-clear, real-time picture of where your money is actually going.

Think of your categories as the building blocks for understanding your business's financial health. When you organize business receipts with clear, consistent labels that align with common tax deductions, you’re not just doing bookkeeping; you're building a powerful tool for smarter decision-making.

The world of expense management is definitely not standing still. By 2025, expect mobile-first tools to be the standard, letting you snap and categorize receipts right from your phone. AI and machine learning are also stepping in to automate the whole process, which is a huge relief for busy entrepreneurs. You can read more about these expense management key trends on primesourcex.com.

Core Categories for Every Business

When you're just starting, keep it simple. Don't try to invent a category for every little thing. A handful of broad categories will cover most of your spending and give you a solid foundation to work from.

- •Office Supplies: This is your catch-all for everything from printer paper and pens to that new ergonomic chair you bought.

- •Software & Subscriptions: All those recurring digital costs go here - think project management tools, cloud storage, or industry-specific apps.

- •Meals & Entertainment: Perfect for client lunches, team dinners, or coffee meetings. Just remember to keep an eye on current tax rules for what you can actually deduct.

- •Advertising & Marketing: This bucket is for all the ways you get the word out, like social media ads, website hosting, new business cards, or even printed flyers.

The real goal here is consistency. You want categories that are specific enough to be useful but broad enough that you aren't creating a new one every time you go to the store. A few well-managed categories are way better than a hundred confusing ones.

Knowing When to Add Sub-Categories

As your business scales, you'll probably notice some of your main categories getting a bit bloated. A single "Travel" category, for example, might hide a lot of important details. When that happens, it's the perfect time to break it down with sub-categories.

Think about it this way. That "Travel" expense line doesn't tell you much on its own. But what if you split it up?

- •Travel (Main Category)

- •Flights (Sub-category)

- •Hotels & Lodging (Sub-category)

- •Ground Transport (Sub-category for taxis, Ubers, and rental cars)

Suddenly, you can see at a glance if your flight costs are creeping up or if you're spending way more on hotels than you budgeted. You can apply the same logic everywhere. Splitting a general "Marketing" category into "Digital Ads" and "Print Media" gives you the data you need to make much smarter calls on where to invest your marketing dollars.

Let Automation Handle Your Receipt Management

Let's be honest: manual data entry is a soul-crushing task. It’s not just boring; it’s a huge time sink and a magnet for costly mistakes. If you're still hunched over a keyboard typing in receipt details, it's time for a change. Modern receipt management software can turn this tedious chore into a process that just happens in the background.

The secret sauce is a technology called Optical Character Recognition (OCR). It’s pretty amazing, really. This tech lets the software "read" a picture of a receipt. You just snap a photo, and it instantly pulls out all the important stuff - the vendor, the date, what you bought, and the total. And it does it with surprising accuracy.

This means you can finally say goodbye to deciphering faded thermal paper and painstakingly entering numbers into a spreadsheet. The software does it all for you, saving you a ton of time and keeping your records free from those pesky typos.

How These Tools Take Over the Grunt Work

Platforms like Tailride are designed to handle the entire lifecycle of a receipt, from the moment you get it to the second it's logged in your books. The whole thing is incredibly smooth.

Here’s how it typically works:

- •Snap and Go: Take a quick picture of any paper receipt with your phone. The app starts working its magic immediately.

- •Data Pulled Automatically: OCR scans the image and extracts all the key details in just a few seconds.

- •Smart Sorting: The software is smart enough to categorize the expense for you. Based on the store or rules you set, it knows to put that coffee run under "Meals & Entertainment" or that software subscription under "Office Supplies."

- •Seamless Syncing: All that categorized data gets sent straight to your accounting software, like QuickBooks or Xero. Your books stay perfectly up-to-date without you lifting a finger.

This kind of end-to-end automation completely changes how you organize business receipts. Suddenly, you have a real-time view of your spending, and you didn't have to do any of the manual labor to get there.

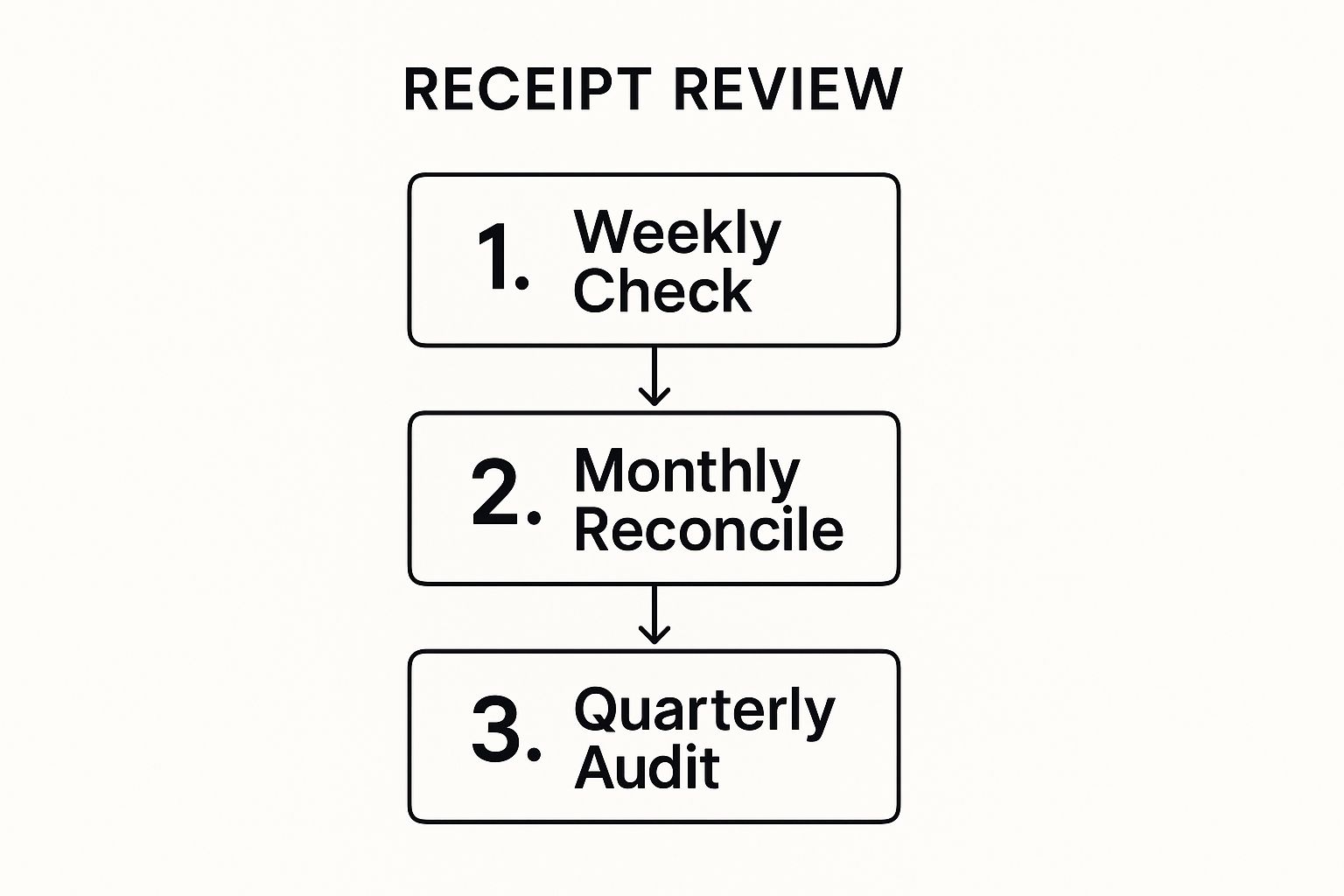

This image shows just how much simpler your review process can become, shifting from constant weekly check-ins to more strategic quarterly audits.

As you can see, a structured, automated system gives you a clear and predictable way to keep an eye on your finances.

Why Everyone Is Jumping on the Automation Bandwagon

The move toward automated receipt and expense tools isn't just a fleeting trend - it's a massive shift in how businesses operate. Companies are demanding more efficient systems, better compliance, and the ability to manage expenses from anywhere.

By getting rid of manual data entry, you're not just saving time. You're freeing up brainpower to focus on what actually matters - growing your business - while knowing your financial records are always accurate and ready for an audit.

The numbers back this up. The global market for business expense management software is booming, expected to jump from USD 6.62 billion in 2024 to a staggering USD 12.22 billion by 2029. That's a compound annual growth rate of over 13%. This huge investment from businesses everywhere really highlights how valuable it is to automate these financial tasks.

Making Your New System a Lasting Habit

Okay, let's be real. A brilliant system for organizing receipts is completely useless if it just sits there collecting digital dust. The real trick isn't just creating the folders or picking an app; it's about weaving receipt management into your daily and weekly routine until it becomes second nature. This is where you turn a good idea into a habit that actually reduces your stress.

The most successful business owners I know don't wait for a bookkeeping emergency. They build small, consistent financial checkpoints right into their schedules. It’s not about losing an entire day to paperwork. It’s about creating tiny, repeatable actions that prevent that dreaded end-of-the-month scramble and keep you feeling in control.

Building Your Financial Cadence

Think of this like any other critical business activity. You wouldn't just blow off a client meeting, right? So don't skip your financial check-in. The key is finding a rhythm that clicks with your workflow and then guarding that time like a hawk.

Here are a few strategies I’ve seen work wonders:

- •The Daily Toss: At the end of each day, spend literally two minutes emptying your wallet, pocket, or bag into your physical "receipt inbox." For digital receipts, just forward them to that dedicated email folder you set up. This simple act stops the clutter before it even starts.

- •Finance Friday: Block out just 30 minutes on your calendar every Friday afternoon. Use this time to scan any paper receipts from the week and make sure all your digital ones are filed away and categorized. It's a tiny commitment with a massive payoff.

- •Monthly Money Date: Set aside an hour on the first of every month to look over the previous month's spending. This gives you a bird's-eye view, helping you spot spending trends, check your budget, and catch any weird charges before they become real problems.

A common mistake is waiting until you feel "motivated" to get organized. Motivation is fickle, but habits are reliable. Schedule your receipt management like it's a non-negotiable appointment, and soon enough, it'll feel as automatic as checking your email.

Understanding Record-Keeping Requirements

Part of making any system stick is knowing the rules of the game. You absolutely have to know how long you’re legally required to keep your records. This isn't just about being tidy; it's about staying compliant and protecting your business down the road.

Now, how long is long enough? While you should always check with a tax pro for advice tailored to your situation, there are some solid general guidelines to follow.

| Receipt Retention Guidelines (General) | | :--- | :--- | :--- | | Document Type | Typical Retention Period | Reason | | General Business Receipts | 3 to 7 years | The IRS can audit returns from the last 3 years. Keeping them for 7 is a safer bet. | | Employment Tax Records | At least 4 years | Required by federal law after the date taxes were due or paid. | | Asset Purchase Records | For the life of the asset + 3 years | Needed to track depreciation and calculate gains or losses when you sell the asset. | | Business Property Records | As long as you own the property + 3 years | Crucial for calculating depreciation, amortization, or depletion deductions. |

A digital archive is a lifesaver here. Storing seven years of digital files is infinitely easier (and more secure) than wrestling with stacks of shoeboxes.

By building these habits now, you're not just tidying up your finances for today. You're creating a compliant, audit-ready financial history that will serve your business for years to come.

A Few Lingering Questions About Business Receipts

Even with a perfect system, you're bound to have some questions pop up as you start wrangling your receipts. That's completely normal. Let’s walk through a few of the most common ones I hear from business owners so you can feel confident you’re doing things right.

Getting these little details squared away is more than just being tidy - it's about protecting your business and making sure your financial records are rock-solid if anyone ever comes knocking.

How Long Should I Keep Business Receipts?

This is the big one, and for good reason. The standard advice from tax agencies like the IRS is to hang onto your records for three years from the date you filed your tax return. That covers their typical window for an audit.

But here’s where a little extra caution pays off. If you, for whatever reason, significantly underreport your income (by more than 25%), that look-back period suddenly jumps to six years. To avoid any "what if" scenarios, most accountants (myself included) will give you a simpler, safer rule of thumb: keep everything for seven years. It’s the gold standard, and with a digital system, it’s no harder than keeping them for three.

Are Digital Copies of Receipts Legally Valid?

Yes, absolutely! This is a game-changer for anyone drowning in paper. In almost every situation, a good digital copy - whether it’s a clean scan or a sharp photo - is just as valid as the original paper for tax and accounting purposes.

The only real requirement is that the copy has to be complete and legible. You need to be able to clearly see all the critical info:

- •The vendor’s name and details

- •The date the transaction happened

- •A clear, itemized list of the goods or services

- •The final amount you paid

This is exactly why using a dedicated receipt scanning software is so much better than just taking a quick, shaky picture with your phone. These apps are built to capture all that crucial data flawlessly.

A lot of people still think they need to keep the original paper copy for an audit. Thankfully, that's a myth. As long as your digital version is a true and accurate copy, the IRS and other tax authorities are perfectly happy with it.

What’s the Best Way to Handle Fading Receipts?

You know the ones - those shiny, flimsy receipts from gas stations and restaurants that seem to disappear before your eyes. The ink on thermal paper is notoriously unstable, and relying on the physical copy is a gamble. Leave it in your car on a hot day, and you might as well have a blank piece of paper.

There’s only one real solution here: digitize them on the spot. Make it a reflex. The moment you get a thermal receipt, scan it. This creates a permanent digital record that won't fade away. If you can’t get to it immediately, at least tuck it away in a cool, dark place (like an envelope in a drawer) until you can.

Can I Just Use Bank Statements Instead of Receipts?

I get this question a lot, and the answer is a firm no. Your bank and credit card statements are important, but they are not a replacement for actual, itemized receipts. This is especially true when you're claiming tax deductions.

Think about it: a bank statement just proves a transaction happened. It shows the store name and the total cost. It doesn't show what you bought. For an expense to be deductible, you need proof that it was for your business. A line item from a big-box store could be for office supplies (deductible) or for your family’s groceries (not deductible). Only the itemized receipt tells the full story.

Ready to stop wrestling with receipts and automate the entire process? Tailride connects to your email and online portals, using AI to automatically capture, categorize, and sync every invoice and receipt with your accounting software. Stop the manual entry and see how much time you can save. Learn more and get started in seconds at https://tailride.so.