Smarter Invoice Data Extraction for Business Growth

Unlock business efficiency with modern invoice data extraction. This guide explains how AI-powered tools save time, cut costs, and eliminate errors.

Tags

So, what are we really talking about when we say "invoice data extraction"?

At its simplest, it's the process of automatically grabbing the important information from an invoice - like the vendor name, date, and total amount - and neatly organizing it into a structured format. Think of it less like a simple copy-and-paste tool and more like a smart assistant that can read a messy PDF and instantly understand what matters, prepping that data for your accounting software. The whole point is to finally ditch the soul-crushing manual data entry and the costly mistakes that come with it.

What Is Invoice Data Extraction, Really?

Imagine your accounts payable team is like a librarian in a massive, old-school library. For every new book (or invoice) that arrives, they have to sit down and painstakingly copy every important detail by hand into a giant ledger: the title, author, publication date, page count. This is exactly what manual invoice processing looks like. It’s slow, repetitive, and just begging for errors.

Now, swap that out with a futuristic scanner. This device doesn’t just see the words on the page; it understands them. It instantly identifies the author, catalogs the title, and logs all the key details into a digital database in a split second. That’s the magic of modern invoice data extraction.

The Trouble with Doing It by Hand

For far too long, AP departments have been stuck in that manual "librarian" mode. Someone gets an invoice, reads it, and then has to key all the information into an ERP system or a spreadsheet. It’s a huge bottleneck that grinds the whole financial process to a halt.

At its core, manual invoice handling is a hidden tax on your business's efficiency. Every minute spent on data entry is a minute not spent on financial analysis, strategy, or growth.

This old way of doing things is a minefield of problems:

- •Costly Human Errors: One tiny typo - a misplaced decimal or a swapped digit - can cause overpayments, accidental duplicate payments, or even compliance headaches.

- •Wasted Time and Resources: Your skilled finance pros are stuck doing grunt work instead of focusing on high-value tasks that actually move the business forward.

- •Painfully Slow Payment Cycles: Manual processing slows down approvals, which means you miss out on early payment discounts and can even strain relationships with your vendors.

Making the Switch to Automated Intelligence

AI-powered extraction completely flips the script. It’s your smart scanner, using sophisticated technology to read, understand, and record invoice data automatically. This isn't just about going faster; it’s about fundamentally rethinking how your financial operations work.

The efficiency gains are massive. In fact, some reports show that over 60% of businesses are planning to bring in AI for document processing by 2025. This shift can drop the cost per invoice to around $2.36 and shrink processing time from many minutes down to just seconds. For more on how AI is shaking up the accounting world, you can find some great data on SuperagI.com.

How AI Makes Invoice Extraction Intelligent

Ever wonder what’s actually happening inside an AI-powered invoice extraction tool? It’s not just one piece of magic software. Think of it as a team of specialists working together, each with a very specific job, to turn a messy document into clean, organized data.

The whole process kicks off the second an invoice hits your system, whether it’s a crisp PDF, a scanned document, or even a quick photo snapped on a phone. The first job is simply to figure out what's written on the page.

The Foundation: Optical Character Recognition

The first specialist on the team is Optical Character Recognition, or OCR. This is the "eyes" of the operation. Its only job is to look at the document and convert any text it finds - printed or handwritten - into digital characters that a computer can read.

An OCR tool can spot the letters "I-N-V-O-I-C-E" and the numbers "1-2-3," but that's it. It has no clue what any of it actually means. It’s a vital first step, but by itself, OCR just gives you a jumble of raw text. To make sense of it, you need to bring in the brains.

The Brain: Natural Language Processing

If OCR gives the system its eyes, Natural Language Processing (NLP) gives it a brain. NLP takes that raw text from the OCR and starts to understand the context and meaning behind the words. It’s the difference between just reading words on a page and actually understanding the story they tell.

For instance, an invoice could have several dates: "Invoice Date," "Due Date," and "Shipping Date." A basic OCR tool just sees three random dates. But NLP is smart enough to understand the unique purpose of each one.

NLP is like a financial translator. It can identify key pieces of information like vendor names, specific line items, or tax details. It doesn’t just see a number; it recognizes it as the “Total Amount Due” because of the words around it.

This ability to grasp context is what elevates AI extraction far beyond simple data capture. It allows the system to correctly find and label information, no matter how a vendor formats their invoices.

The Learning Curve: Machine Learning

The final piece of the puzzle is Machine Learning (ML), and it’s what makes the whole system get smarter over time. Think of ML as the system’s ability to learn from experience, building a long-term memory that helps it solve new problems.

When the AI gets an invoice from a new vendor with a layout it’s never seen before, it uses ML models to make its best guess at where to find everything. If a person steps in to make a correction - say, to point out the PO number is in a weird spot - the system doesn't just accept the change. It learns from it.

The next time an invoice from that vendor comes through, the AI remembers the previous correction and gets it right on the first try, no help needed. This is what we call a continuous learning loop, and it's why the system becomes more accurate and reliable with every single invoice you process.

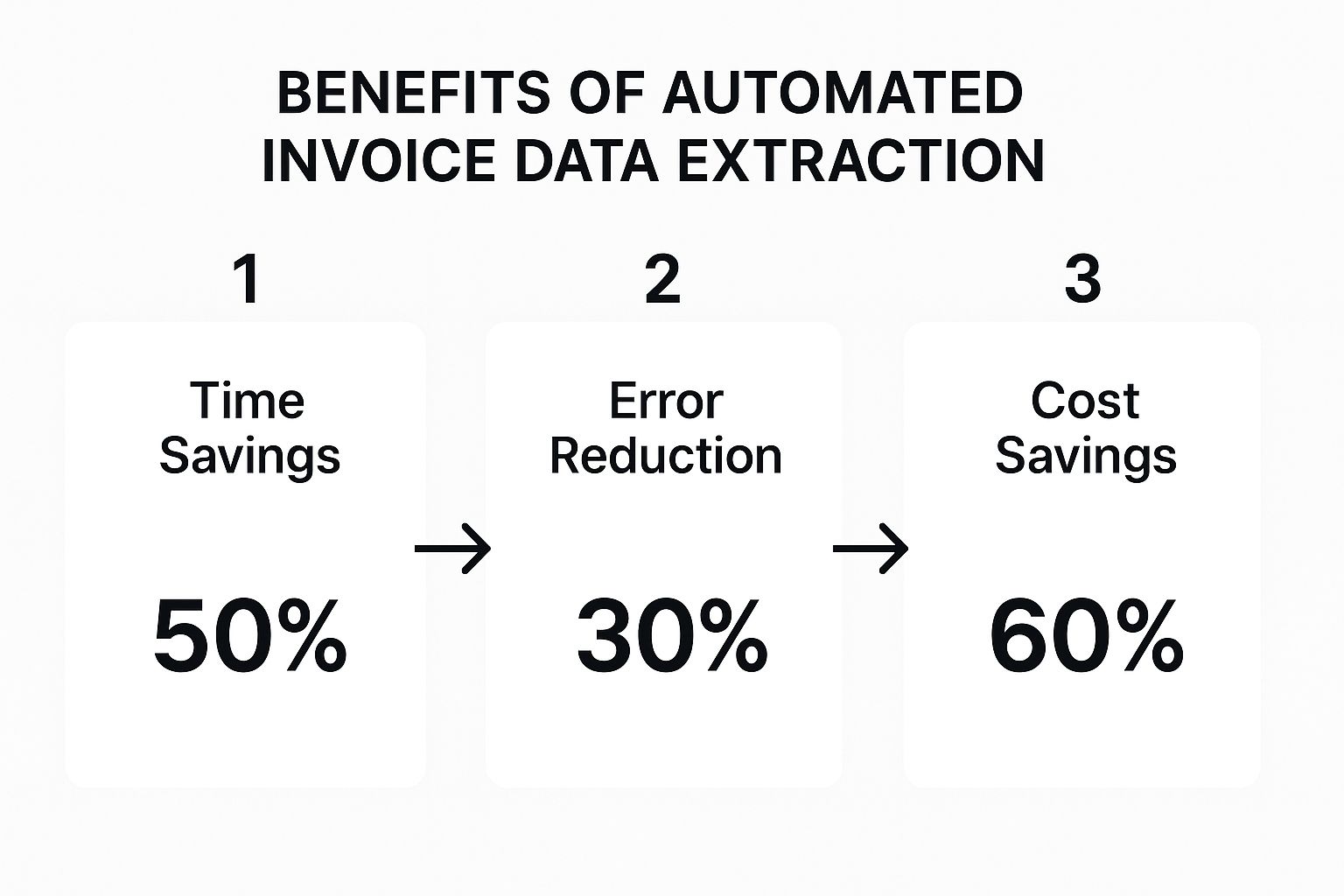

This infographic really drives home how these AI-powered improvements create a positive ripple effect across the business.

As you can see, it all starts with saving time, which naturally leads to fewer mistakes and, ultimately, real cost savings.

Let's break down the difference in a head-to-head comparison.

Manual Entry vs AI-Powered Extraction

The shift from someone keying in data by hand to an AI doing the heavy lifting is a big one. This table lays out exactly what that difference looks like in practice.

| Feature | Manual Data Entry | AI-Powered Extraction |

|---|---|---|

| Process | A person physically reads each invoice and types the data into a system. | Software automatically reads, understands, and populates data fields. |

| Speed | Slow and tedious. Can take 5-15 minutes per invoice, depending on complexity. | Nearly instant. Processes hundreds of invoices in the time it takes to do a few by hand. |

| Cost | High labor costs tied directly to the number of invoices and hours worked. | Low per-invoice cost. A subscription model that scales affordably. |

| Accuracy | Prone to human error like typos, transpositions, and fatigue-related mistakes. | Extremely high accuracy (99%+) that improves over time with machine learning. |

| Scalability | Difficult to scale. More invoices mean hiring more people. | Effortlessly scalable. The system handles volume spikes without extra resources. |

| Data Access | Data is locked away until manually entered, causing delays. | Data is available in real-time for immediate analysis and decision-making. |

The takeaway is pretty clear: AI doesn't just do the same job faster; it fundamentally changes how the work gets done, delivering better results across the board.

Together, these three technologies - OCR, NLP, and ML - create a seamless and incredibly powerful workflow. If you're curious about the potential of AI in business by 2025, this is a perfect example of it in action. This synergy is what makes modern data extraction so effective and is a cornerstone of true financial automation. To see how this fits into the bigger picture, check out our guide on https://tailride.so/blog/how-to-automate-invoice-processing.

What You Actually Gain from Automated Extraction

It’s one thing to understand the tech behind AI, but it's another thing entirely to see how it impacts your bottom line. Let's move past the technical jargon and talk about the tangible results that automated invoice data extraction brings to the table. These aren’t just small improvements; they’re a fundamental upgrade to your entire accounts payable operation.

The benefits really boil down to three things every business leader cares about: saving money, moving faster, and getting things right. Each one feeds into the others, creating a powerful loop of financial efficiency. Let's look at how this plays out in the real world.

Unlocking Massive Cost Savings

When we talk about saving money, most people immediately think about cutting down on labor costs. That's a huge piece of the puzzle, for sure, but the financial wins from automating invoice data extraction go much deeper. It helps you find and plug money leaks you probably didn't even know you had.

Just think about all the hidden costs of slow, manual processing. Late payment fees, for example, can quietly eat away at your budget. Automation gets invoices processed and approved on time, every time, making those penalties a thing of the past.

By automating invoice processing, businesses can slash the cost of handling a single invoice by over 80%. This shift frees up your team from mind-numbing data entry and lets them focus on high-value financial strategy.

Plus, faster processing gives you access to a powerful financial tool: early payment discounts. A lot of suppliers offer a 1-2% discount if you pay within 10 days. That might not sound like much, but when you apply it across thousands of invoices, the savings are massive. Suddenly, your AP department isn't just a cost center - it's actively generating savings.

Supercharging Your Team's Efficiency

Picture your finance team as a group of world-class chefs. Making them manually key in invoice data is like forcing them to chop onions all day. It’s a necessary task, but it’s a waste of their talent. Automated extraction takes care of all that prep work, so they can focus on what they do best: cooking up brilliant financial strategies.

This boost in efficiency sends positive ripples throughout the entire company.

- •Faster Approval Cycles: Invoices don't get lost in an email inbox or buried in a pile of papers on someone's desk anymore. Automated workflows send them to the right person instantly, cutting approval times from weeks down to days or even hours.

- •A Shift to Strategic Work: With data entry handled, your finance pros can finally dedicate their brainpower to things that matter, like forecasting cash flow, analyzing budgets, and negotiating better terms with vendors.

- •Happier, More Engaged Employees: Let's be honest, nobody enjoys tedious, repetitive work. Taking that off their plate leads to much higher job satisfaction. Your team feels more valued when they’re solving complex problems instead of just typing in numbers.

This newfound speed allows your business to be more agile and make smarter decisions based on up-to-the-minute data. To see how this fits into the bigger picture, check out our guide to automate accounts payable.

Achieving Rock-Solid Data Accuracy

No matter how careful we are, human error is just a fact of life in any manual process. A single typo, a misplaced decimal point, or the wrong vendor code can cause overpayments, create compliance headaches, and waste hours of detective work to fix. Automated extraction brings a level of precision that people simply can’t maintain all day, every day.

Modern AI systems can hit accuracy rates of over 99%, and thanks to machine learning, they actually get smarter with every invoice they process. This kind of reliability is a game-changer. It means you can trust your financial reports, which is essential for making smart business decisions. It also improves your relationships with suppliers because they get paid correctly and on time, which cuts down on frustrating back-and-forth disputes.

At the end of the day, that accuracy creates a dependable foundation you can build your entire financial operations on.

Choosing the Right Invoice Extraction Tool

Picking the right tool for invoice data extraction is a lot more than just buying software - it’s about finding a reliable partner for your financial operations. The market is flooded with options, and they are definitely not all created equal.

Some tools are little more than basic scanners with a sprinkle of AI, while others are powerful, intelligent platforms built to scale with you. To make the right call, you need to know exactly what to look for under the hood.

A great tool doesn’t just blindly pull data. It understands context, organizes information logically, and seamlessly passes it along to other systems without needing constant hand-holding. Let's break down the essential features that deliver real-world value.

Multi-Format Support

Let’s be honest, your vendors send invoices in every format imaginable. You’ll get pristine PDFs from one, a blurry JPEG from another, and some will just type the details straight into an email. A tool that chokes on anything but a perfect PDF is going to cause more headaches than it solves.

True flexibility means the system can handle whatever you throw at it:

- •PDFs: This is a given, but it must handle both text-based and scanned (image-only) versions.

- •Image Files: It should easily read common formats like JPG, PNG, and TIFF.

- •Email Bodies: The best tools can pull data directly from the text of an email, no attachments needed.

This all-format capability creates a single, unified workflow. It stops you from becoming the "exception handler," which is exactly the manual work you're trying to eliminate.

Line-Item Detail Extraction

Grabbing the invoice total, date, and vendor name is table stakes. That’s the easy part. But for deep financial analysis, smart inventory management, or accurate job costing, you need to go deeper. The ability to extract detailed line-item data is what separates the basic tools from the professional-grade solutions.

This means the software can read and understand the individual products, quantities, unit prices, and SKUs buried in the invoice table. Without this level of detail, you're only getting a vague, high-level summary of your expenses.

A tool that can’t see beyond the invoice header is only doing half the job. True invoice data extraction gives you the granular detail needed for sharp financial oversight and strategic decision-making.

Seamless System Integration

What good is an extraction tool if it doesn't talk to your other software? It's like having a car with no wheels - it might look impressive, but it’s not going to get you anywhere. The data it captures is only powerful if it flows automatically into the systems you already use every day.

Look for robust, pre-built integrations with your existing:

- •Accounting Software: Think QuickBooks, Xero, or NetSuite.

- •ERP Systems: Crucial for connecting with platforms like SAP or Oracle.

- •Cloud Storage: A simple link to Google Drive or Dropbox can make archiving a breeze.

This connectivity is what creates a truly touchless process, from the moment an invoice lands in your inbox to the final payment approval. To get a better sense of how this technology works, you can explore our guide on invoice capture software.

The Human-in-the-Loop Workflow

Let's get one thing straight: even the smartest AI isn't perfect 100% of the time. It might get tripped up by a brand-new invoice format or a poorly scanned document. That’s why a human-in-the-loop (HITL) validation feature is non-negotiable.

This isn't a flaw in the AI; it’s a sign of a well-designed, practical system. A smart HITL workflow flags only the invoices where the AI has low confidence. It then queues them up for a team member to quickly review and approve in a simple interface. This gives you the best of both worlds: the incredible speed of AI paired with the final assurance of human judgment.

With so many variables to consider, it helps to have a checklist. The table below outlines the core features you should be asking about when vetting potential software partners.

Essential Features of Modern Invoice Extraction Software

| Feature | Why It's Important | Evaluation Question |

|---|---|---|

| Multi-Format Support | Ensures all incoming invoices (PDFs, JPEGs, emails) are processed in one unified workflow. | "Can your system extract data directly from email bodies and scanned image files, not just text-based PDFs?" |

| Line-Item Extraction | Provides granular data needed for detailed expense tracking, inventory management, and job costing. | "Does your AI capture individual line items, including quantities, unit prices, and SKUs?" |

| Integration Capabilities | Creates a touchless workflow by automatically syncing data with your existing accounting/ERP systems. | "Do you offer a pre-built integration for our specific ERP/accounting software?" |

| Human-in-the-Loop (HITL) | Guarantees data accuracy by flagging low-confidence extractions for quick human review. | "What does your validation workflow look like for invoices the AI can't read with high confidence?" |

| Security & Compliance | Protects sensitive financial data and ensures you meet regulatory standards. | "Is your platform SOC 2 compliant and GDPR-ready?" |

| Scalability | The tool should be able to grow with your business without a massive increase in cost or decrease in performance. | "How does your pricing and performance scale as our invoice volume grows from 500 to 5,000 per month?" |

Ultimately, choosing wisely means looking past the sales pitch. Focus on finding a secure, intelligent, and scalable platform that can truly support your finance team for the long haul.

Your Step-by-Step Implementation Roadmap

https://www.youtube.com/embed/n7OsOyTJ6CY

Making the switch to an automated invoice extraction system is a big move, but it doesn't have to be a headache. If you break the process down into a clear, logical roadmap, you can make a smooth transition that delivers value right away and sets your team up for success down the road.

Think of it like getting a new set of high-tech tools for your workshop. You wouldn't just hand them to your crew and walk away. You'd start with a blueprint, run a small test project, and show everyone how to use them safely and effectively. Let’s walk through that blueprint, phase by phase.

Phase 1: Define Your Goals and Pick a Partner

Every journey starts with a destination. Before you do anything else, you need to get crystal clear on what you’re trying to fix. Are you drowning in late payment fees? Is month-end closing a nightmare? Or are you just trying to rescue your team from the soul-crushing boredom of manual data entry? Setting clear, measurable goals is the first, most important step.

Once you know what you need, you can find the right partner to help you get there. Don't just look at a features list - not all vendors are created equal. You need a solution that fits your specific goals, plays nicely with your current accounting software, and has a support team that actually feels like they're on your side.

Choosing a vendor isn't just a software purchase; it's a strategic partnership. The right one won't just sell you a tool - they'll provide guidance and support to make sure your automation project is a success.

Phase 2: Run a Pilot Program

It’s tempting to go all-in, but jumping into a full-scale rollout without testing the waters is a recipe for disaster. A much smarter move is to run a small, controlled pilot program first. This is your chance to prove the concept works and see the technology handle your actual invoices and workflows.

For this test, pick a specific slice of your AP process. For example, you could start with invoices from just one or two of your highest-volume suppliers. This approach gives you a few big wins:

- •Low-Risk Validation: You can confirm the tool does what it promises without blowing up your entire operation.

- •Discover Your Quirks: The pilot will quickly shine a light on any unique invoice formats or workflow oddities that need special attention.

- •Build Internal Momentum: Nothing gets people on board like a successful test run. It creates real excitement and makes getting buy-in from the rest of the company a whole lot easier.

Think of the pilot as a dress rehearsal. It’s your chance to work out all the kinks before the main performance.

Phase 3: Integrate and Go Live

With a successful pilot in the bag, you’re ready for the full rollout. This phase is all about plugging the new tool into your existing financial systems. A good solution should offer simple, out-of-the-box integrations with popular platforms like QuickBooks or Xero, which makes this part surprisingly smooth.

The "go-live" moment is when you officially flip the switch. This is where clear communication is everything. Make sure everyone on the finance team knows exactly what the new process looks like, what their role is, and who to call if they get stuck.

Phase 4: Train Your Team for Success

The last, and arguably most important, step is training. Modern tools are built to be intuitive, but great training ensures your team can unlock the platform's full power from day one. This isn't just about showing them which buttons to click; it’s about helping them understand the "why" behind the new way of working.

A solid training plan should cover three key areas:

- •The New Workflow: A step-by-step walkthrough of how invoices now move from receipt to processing to approval.

- •Handling Exceptions: Clear instructions on how to use the "human-in-the-loop" feature to review and fix any invoices the AI flags for review.

- •Accessing Data: How to find and use all the clean, structured data for better reporting and analysis.

A well-trained team is an empowered team. They’ll be ready to leave manual entry in the dust and step into a more strategic role, focused on the company's financial health.

The Future of Invoice Processing

Automating invoice data extraction isn't the end goal. Think of it more as a launchpad for a much smarter, more intuitive way to manage your company's finances. The tools you put in place today are really the building blocks for a future where accounts payable is predictive, secure, and practically runs itself. When you see it this way, you realize the investment isn't just about cutting costs - it's about staying ahead of the curve.

The demand for these tools is exploding as businesses everywhere push for smarter digital operations. The global invoice processing software market is expected to reach a massive $87.95 billion by 2029, all thanks to big leaps in OCR and intelligent document recognition. This isn't just a fleeting trend; it’s a clear signal that integrated, intelligent financial systems are the new standard. You can dig into some detailed market projections for invoice processing software on ResearchAndMarkets.com if you want to see the numbers.

Predictive Analytics and Cash Flow Forecasting

Imagine your invoice data doing more than just showing you where money went. What if it could tell you where it’s going? Soon, advanced AI will be able to analyze invoice data as it comes in, giving you powerful predictions about what's next. By spotting patterns in payment terms, vendor habits, and spending trends, the system can give you a surprisingly accurate cash flow forecast weeks, or even months, out.

This completely changes the game for your finance team, moving them from a reactive, backward-looking role to a proactive, forward-looking one. Instead of just closing the books on last month, they can see a potential cash crunch coming, spot opportunities to invest surplus funds, and make smart decisions that steer the entire business.

The future of financial data isn't just about accuracy; it's about clairvoyance. AI will turn your AP department into a strategic forecasting engine that anticipates financial needs before they arise.

Blockchain for Unbreakable Trust

While AI is making invoice processing smarter, other technologies like blockchain are poised to make it fundamentally more secure and transparent. A blockchain-based system creates a permanent, shared record of every transaction that both you and your supplier can see.

This brings a whole new level of trust to the table and helps get rid of those all-too-common disputes.

- •Immutable Records: Once an invoice hits the blockchain, it’s there for good. It can’t be changed or deleted, which creates a perfect, tamper-proof audit trail.

- •Instant Verification: Both you and your supplier can confirm an invoice's status instantly, cutting out the need for all that back-and-forth communication.

- •Reduced Fraud: The very nature of blockchain - decentralized and totally transparent - makes it nearly impossible for a phony invoice to sneak into the system.

The Rise of the Autonomous Workflow

When you put all these pieces together, you start to see the outline of a fully autonomous financial workflow. Invoice data extraction is just the first step. The real vision is a system where an invoice arrives, its data is instantly pulled and checked, matched against purchase orders, approved based on rules you’ve set, and scheduled for payment - all without a single person having to lift a finger.

This hands-off process frees up your team to stop chasing paperwork and start focusing on what truly matters: strategic financial planning, handling the rare exceptions, and building stronger relationships with suppliers. The ultimate goal is to build a self-driving financial engine that runs with speed, precision, and intelligence, setting your business up to thrive no matter what the future holds.

Have a Few Questions?

Jumping into any new technology brings up a lot of questions, and when it involves your company's financials, you need solid answers. Let's walk through some of the most common questions we hear about AI-powered invoice extraction and get you the information you need.

How Accurate Is This AI Stuff, Really?

This is usually the first thing people ask, and for good reason. The short answer? Really accurate. Top-tier AI platforms can hit accuracy rates well over 99%.

Now, a brand-new system might start out in the low 90s, but here's where the magic happens. The AI learns. Every time a person makes a small correction, the system gets smarter. It remembers that vendor's quirky layout for next time. So, the accuracy isn't just a fixed number - it's a living, breathing thing that gets sharper and more reliable with every invoice it sees.

What About Invoices in Different Languages or Weird Formats?

No problem at all. Modern businesses operate globally, and these tools are built for that reality. They can handle dozens of languages, often detecting the language automatically without you having to lift a finger.

The same goes for formats. Whether you get a perfect PDF, a scanned paper invoice, or just the details copied into an email, a good system can process it. This flexibility is what lets you create one simple workflow instead of juggling different processes for different types of documents.

Is My Financial Data Actually Safe?

Security is everything, and any provider worth their salt makes it their top priority. The leading invoice data extraction platforms are built with serious, enterprise-level security to keep your financial information locked down tight.

Here’s what to look for as a baseline:

- •SOC 2 Compliance: This is a big one. It's a rigorous audit that proves a provider is handling your data responsibly and securely.

- •GDPR Compliance: If you do business in Europe, this is a must. It shows a deep commitment to data privacy standards recognized worldwide.

- •Data Encryption: Your data should be encrypted both in transit (as it's being uploaded) and at rest (when it's stored on their servers).

Handing over financial data requires a ton of trust. Always do your homework and check a provider’s security credentials and certifications before you commit. It’s the only way to be sure your information is in good hands.

How Does This Plug Into My Existing Accounting Software?

This is the key to making it all work - the data has to flow smoothly into the systems you already use. The whole point is to avoid manual data entry, so a clunky integration would defeat the purpose.

Most top platforms have pre-built, one-click connections for popular accounting software like QuickBooks, Xero, and NetSuite. If you’re using a custom-built ERP or something more complex, they’ll almost always have a robust API. This just means your tech team can easily build a direct bridge, ensuring all that perfectly extracted data lands exactly where it needs to in your financial records, automatically.

Ready to stop wasting hours on manual data entry? Tailride connects directly to your inboxes and portals, using AI to automatically extract and organize all your invoice data. See how you can get your first invoices processed in seconds.