Invoice Capture Software That Transforms Your AP

Discover how invoice capture software automates data entry, reduces errors, and saves time. Learn to choose the right solution for your business.

Invoice capture software is a game-changer for any business still wrestling with manual data entry. Think of it like this: it’s the difference between manually copying a book word-for-word and using a scanner to create an editable digital document in seconds. This technology is your ticket out from under the mountains of paper and PDF invoices that bury accounts payable teams.

Leave Manual Invoice Entry Behind

Picture your finance team slogging through their day, keying in details from dozens, or even hundreds, of invoices. Each entry is a tedious, repetitive task just begging for human error - a mistyped digit here, a wrong vendor name there. This old-school process isn't just slow; it's a huge drain on your team's time and a source of costly mistakes that can cause chaos in your financial records.

This is exactly the headache that modern invoice capture software was designed to cure. It essentially acts as a smart digital assistant for your AP department.

The concept is simple but incredibly powerful: the software automatically "reads" any invoice you throw at it - from a scanned paper document to a PDF in an email - and intelligently pulls out the critical information. It finds and extracts data points like vendor names, invoice numbers, line items, and total amounts with amazing accuracy.

Once captured, this data is double-checked and then sent directly into your accounting or ERP system. This creates a smooth, hands-off workflow from start to finish. It’s not just a minor upgrade; it's a completely new way to manage your payables, shifting your team's focus from mind-numbing data entry to valuable financial strategy.

The True Cost of Manual Processing

The trouble with manual invoice handling goes way beyond just wasted time. Here are a few common pain points that this software directly solves:

- •High Processing Costs: When you add up employee hours, manually processing a single invoice can be surprisingly expensive.

- •Error-Prone Data: Even with a stellar 99% accuracy rate, you're still looking at one error for every 100 invoices, which leads to payment delays and frustrating reconciliation issues.

- •Lack of Visibility: With stacks of paper, you have zero real-time insight into your cash flow or upcoming liabilities.

To really see the difference, let’s compare the two approaches side-by-side.

Manual vs Automated Invoice Capture at a Glance

| Aspect | Manual Processing | Invoice Capture Software |

|---|---|---|

| Process | Human employee reads invoice and types data into a system. | Software automatically scans, reads, and extracts data. |

| Speed | Slow; can take many minutes per invoice. | Extremely fast; processes invoices in seconds. |

| Accuracy | Prone to human error (typos, misinterpretations). | Highly accurate, often exceeding 99% with AI validation. |

| Cost | High cost per invoice due to labor. | Low cost per invoice, with a focus on a software subscription. |

| Scalability | Difficult to scale; requires hiring more staff. | Easily scales to handle thousands of invoices without more staff. |

| Visibility | Poor; data is siloed until manually entered. | Excellent; provides real-time data for financial dashboards. |

This table makes it clear: the move to automation isn't just about convenience - it's a strategic business decision.

By tackling these core issues, the software frees your team to focus on higher-value work like budget analysis, cash flow forecasting, and building better vendor relationships. To learn more about streamlining information input across your whole organization, check out this guide to automate data entry. Making this shift is a critical step for any business looking to boost efficiency and stay competitive.

How Invoice Capture Software Really Works

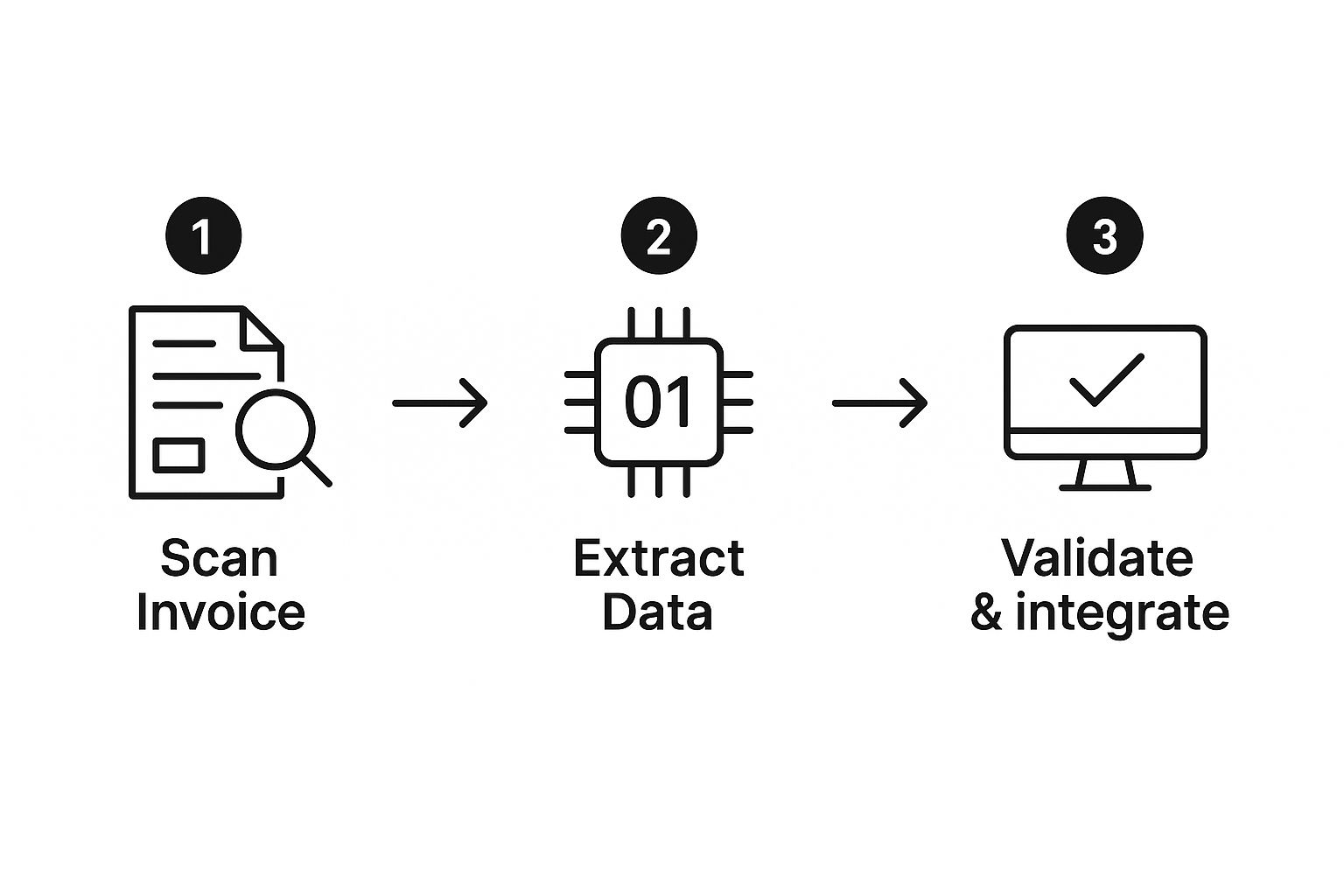

So, what's really going on behind the scenes with this kind of software? It might seem like magic, but it’s actually a surprisingly straightforward process that takes a jumble of different invoices and turns them into clean, usable data.

Let's break down exactly how an invoice goes from a PDF in your inbox to a paid entry in your accounting system.

Think of it like a smart, digital mailroom. The first step, ingestion, is just a fancy word for getting the invoices into the system. The software can automatically monitor a specific email address (like invoices@yourcompany.com), scan paper documents you feed into it, or even log into supplier portals to download new bills.

From Image to Text with OCR

Once the software has the document - whether it’s a PDF, a JPG photo, or another file type - the real work begins with Optical Character Recognition (OCR). This is the foundational technology that reads the document and converts the picture of text into actual text your computer can understand.

It's a bit like this: if you take a photo of a receipt, your computer just sees a grid of pixels. You can't copy the total amount or search for the vendor's name. OCR is the engine that analyzes those pixels, recognizes the shapes of letters and numbers, and turns them into editable text.

By breaking down the image into individual characters, the software gets the raw material it needs for the next, more intelligent step.

AI-Powered Data Extraction and Validation

Here’s where modern invoice capture software really pulls away from older, simpler tools. After OCR turns the invoice into text, Artificial Intelligence (AI) steps in to make sense of it all. The AI isn't just reading words; it's understanding them in context.

It’s smart enough to find the invoice number, due date, vendor name, and line-item details, no matter how weird or inconsistent the vendor's layout is. This is a huge deal, since no two suppliers seem to format their invoices the same way.

But it doesn't stop there. The software then double-checks everything it found. It will:

- •Match the vendor name against the supplier list in your accounting system.

- •Run the math to make sure the subtotals, taxes, and grand total all add up correctly.

- •Flag any problems for a human to look at, like a missing purchase order number or a potential duplicate invoice.

This built-in sanity check is what prevents costly mistakes from ever entering your books. It's a major reason why the global market for this software is exploding, growing from an estimated $33.59 billion in 2024 to a projected $40.82 billion in 2025. That's a massive 21.5% jump in a single year, and you can dig into the full market research to see what's driving it.

Integration and Closing the Loop

The final piece of the puzzle is integration. Once the invoice data has been captured, read, and verified, the software sends it directly into your other business systems. This could be your QuickBooks or Xero account, or a larger Enterprise Resource Planning (ERP) platform.

This seamless handoff is what makes the whole process so powerful. Nobody on your team has to lift a finger to type in data. The information just shows up where it needs to be, ready for final approval and payment. The result is a perfect, traceable digital record from beginning to end.

What This All Means for Your Business

Alright, we've talked about the "what" and the "how," but the real question is "why?" Why should you actually care about invoice capture software? The answer isn't just about processing invoices a little faster; it's about the ripple effect it has across your entire business, delivering real, measurable value that you'll feel on your bottom line.

The most obvious win is the immediate drop in costs and time sinks. Just think about it: every hour your team spends keying in data from a PDF is an hour they're not spending on something more important. Automation practically erases that tedious work, letting your skilled finance pros focus on tasks that actually move the needle - like forecasting cash flow or digging into budget analysis.

Gaining Control Through Unbeatable Accuracy

Let’s be honest, manual data entry is a recipe for mistakes. A single misplaced decimal or a typo in an invoice number can spiral into overpayments, missed early payment discounts, or a compliance nightmare that takes days to sort out. Invoice capture automation puts a stop to that by dramatically improving your data quality right from the start.

The software acts like a hawk-eyed gatekeeper for your finances. It automatically checks invoice data against your existing records, flagging anything that looks off. This nips costly payment errors in the bud and keeps your books clean and ready for an audit at a moment's notice.

This level of accuracy gives you something every business leader craves: clarity and control. Instead of wondering what’s lurking in that pile of unprocessed invoices, you get a real-time view of your accounts payable. This empowers you to make sharp financial decisions and manage cash flow with genuine confidence. You can dive deeper into the full range of accounts payable automation benefits in our detailed guide.

Building Stronger Relationships and Security

The positive impact doesn't stop at your own walls. Paying your suppliers accurately and on time is the foundation of any good business relationship. When vendors know they can count on you, it builds trust and goodwill, which can often lead to better terms and a stronger partnership down the road.

On top of that, automation gives you a bulletproof digital audit trail. Every single step - from the moment an invoice is captured to when it's approved and paid - is logged and timestamped. This makes audit prep a simple matter of pulling a report instead of a desperate scramble through filing cabinets, adding a serious layer of security to your operations.

This isn't just a niche trend; it's where the market is heading. The global invoice processing software market is expected to reach $8.4 billion by 2033, as more and more companies realize these efficiencies are no longer optional. Adopting this technology isn't just about keeping up; it's about building a smarter, more resilient financial backbone for your business.

Essential Features of Top Invoice Capture Tools

Let's be honest, not all invoice capture software is created equal. While many tools can handle the basics, the really good ones are packed with features designed to deal with the messy reality of accounts payable. Choosing the right tool means looking past the flashy marketing claims.

Think of it like buying a car. Sure, almost any car will get you from point A to B. But you've got to look under the hood to see if it has the horsepower, reliability, and safety features you actually need for your daily drive. The same logic applies to the software that will handle your company’s financial lifeblood.

Core Data Handling Capabilities

First things first, any platform worth your time has to manage invoices in whatever format they arrive. Your vendors aren't all sending pristine PDFs. You're going to get JPEGs snapped on a phone, data buried in the body of an email, and even scans of old-school paper documents. A flexible tool takes them all in stride.

This is where high-accuracy AI comes in. Modern systems do much more than just read text; they learn from every single invoice, getting smarter and more precise over time. This is a massive leap from older systems that made you build manual templates for every new vendor. If you want to get into the nitty-gritty, our complete guide on invoice OCR software explains how this tech really works.

Another must-have is automated validation rules. You should be able to set up your system to automatically flag invoices that are missing a PO number, have calculation errors, or look like a duplicate. This kind of proactive checking catches problems before they ever pollute your accounting system.

Seamless Integration and Workflow

Here’s the thing: invoice capture software can't be an island. Its whole purpose is to feed clean, verified data into the rest of your financial world. Because of that, seamless integration isn't just nice to have - it's essential.

Look for a solution that offers solid, pre-built connectors to popular accounting software like QuickBooks and Xero, and major ERPs like NetSuite or Dynamics 365. This ensures a smooth, two-way street for your data, saving you from the headache of custom development work.

The real goal here is "touchless" processing. An invoice should be able to arrive, get captured, validated, and pushed into your general ledger for approval - all without a single person having to lift a finger. That's the level of automation that truly changes the game for an AP team.

Finally, don’t forget about the people who will be using it every day. A quality tool should provide:

- •A User-Friendly Dashboard: A clean, simple dashboard that gives you a real-time view of all your invoices, their status, and any potential roadblocks.

- •Customizable Approval Workflows: The software needs to bend to your company's processes, not force you into its box. You need the flexibility to set up multi-step approval chains that match how your business actually works.

As you look at these platforms, it can be helpful to see how they compare to the broader world of data extraction. The core principles behind the best web scraping tools - accuracy, flexibility, and reliability - are exactly what you should demand from your invoice solution.

Seeing Invoice Capture in Action

Theory is great, but let's be honest - it’s seeing the software solve real problems that makes it all click. The benefits of invoice capture software aren't just a generic list; they look different depending on the industry and its unique headaches. Let’s walk through a few real-world scenarios to see what this actually looks like on the ground.

Taming Supply Chain Complexity in Manufacturing

Picture a busy manufacturing plant. Their biggest accounts payable nightmare is the three-way match. Every single invoice has to be manually checked against its corresponding purchase order and the goods received note. It’s tedious, slow, and a breeding ground for human error, especially when you’re juggling hundreds of suppliers.

This is where automation flips the script. When an invoice arrives, the software instantly captures it, extracts the PO number, and checks it against the purchase order and receiving documents in your system. If everything lines up, the invoice gets a green light for payment. No waiting, no manual checks.

But what if there's a problem, like a price difference or a quantity that doesn't match? The system immediately flags it and sends it to the right person for review. This simple step prevents you from paying an incorrect bill before it ever becomes a real problem.

Centralizing Retail Operations

Now, think about a retail chain with stores scattered all over the country. Each location gets its own invoices for local services - cleaning, marketing, you name it. Without a central system, the head office AP team is basically flying blind, drowning in mailbags of paper with zero real-time insight into what the company actually owes.

Invoice capture software acts as a central command center. A store manager can just snap a photo of an invoice with their phone or forward an email. The system instantly reads, sorts, and codes it, feeding the data directly into a live dashboard at headquarters. Suddenly, the finance team can see every single payable from every single store.

This centralized view is a massive win for managing cash flow. Finance leaders get a complete, up-to-the-minute picture of their financial obligations, allowing them to make smarter strategic decisions instead of just reacting to chaos.

This kind of efficiency is more important than ever. While finance team workloads jumped by about 8% last year, their staffing levels actually dipped slightly. Doing more with less isn't just a goal; it's a necessity.

Streamlining Professional Services Billing

Finally, let's look at a professional services firm, like a marketing agency or an IT consultancy. For them, the name of the game is tracking project expenses with surgical precision. Every single cost, whether it's a freelance photographer's invoice or a new software subscription, has to be tied to the correct client project. Get this wrong, and you risk under-billing clients and tanking your profitability.

With invoice capture software, this process becomes practically foolproof. As vendor invoices arrive, the AI can read project codes or other unique identifiers right off the document. It then automatically assigns the cost to the right project in your accounting system.

This doesn't just clean up the internal AP workflow. It ensures every single expense is accounted for and billed back to the client correctly, protecting your profit margins and building trust with more accurate invoicing.

Choosing the Right Software for Your Business

Picking the right invoice capture software can feel like a huge task, but it doesn't have to be. The trick is to approach it methodically. Don't think of it as just buying software; think of it as hiring a new digital employee for your finance team. You need to make sure they have the right skills, can handle your workload, and fit in with how your company operates (and, of course, your budget).

First things first, get a handle on your current process. How many invoices are you actually dealing with each month? Are they straightforward, single-page bills, or are you wrestling with complex, multi-page documents packed with line items? Knowing your invoice volume and complexity is the foundation for everything else. A small business processing 50 simple invoices a month has completely different needs than a larger company juggling 5,000 complicated ones.

Distinguishing Must-Haves From Nice-to-Haves

Once you have a clear picture of your workload, it's time to make a checklist. This is where you need to be honest about what's an absolute deal-breaker versus what's just a nice bonus.

Your must-have list will likely include:

- •Rock-Solid Integration: The software has to play nicely with your existing accounting system. If your team lives in Xero, for example, you need a tool that connects to it without a hitch. You can learn more about how to deepen your Xero integration with automated tools.

- •High-Accuracy Data Extraction: The whole point is to stop manual entry, so the platform must be able to read all sorts of invoice layouts accurately. The less you have to correct, the better.

- •Top-Notch Security: You’re handing over sensitive financial data. Look for vendors who take security seriously - things like SOC 2 certification are a good sign they've got their act together.

This space is booming. The invoice automation market is expected to more than double, jumping from $3.54 billion in 2025 to a whopping $8.6 billion by 2032. All that growth means more choices for you, which makes having a clear checklist more important than ever.

Evaluating Scalability and Support

Finally, think about where your business is headed. The perfect solution for you today might feel cramped in two years. Can the software scale as your business grows? Dig into the pricing models with potential vendors. Is a pay-per-invoice plan better for you, or does a flat monthly subscription make more sense for your cash flow?

Don't forget to kick the tires on customer support. When you run into a problem - and you will - you need a support team that’s responsive and genuinely helpful. Check out reviews and ask them directly about their service-level agreements (SLAs).

Successfully rolling out an invoice capture software solution is about more than just the tech; it’s about smart planning. When you're bringing in a tool that handles so much data, applying proven strategies for data science project management can help ensure everything goes smoothly.

By taking the time to carefully map out your needs, prioritize features, and vet vendors on scalability and support, you’ll find a partner that genuinely saves you time and money for years to come.

Frequently Asked Questions About Invoice Capture

Even after seeing all the benefits, it's completely normal to have a few practical questions pop up before you dive into a new tool. I've heard them all over the years. This section tackles the most common things people ask about invoice capture software, giving you clear, honest answers to help you feel confident about your next move.

Let's get those last few questions answered.

How Long Does It Really Take to Get Set Up?

This is probably the number one concern I hear. People imagine months of disruptive, complicated setup, but that’s an outdated picture of how this technology works.

Modern, cloud-based tools are built for speed. For most businesses, you can be up and running in just a few days. The process typically involves linking your email and accounting software, which today's best platforms have turned into a simple, guided workflow. You could be capturing invoices automatically a lot faster than you think.

The whole point of modern automation is to deliver value right away. You shouldn't have to wait a quarter to see a return; you should feel the relief almost immediately.

Is This Technology Actually Affordable for a Small Business?

Yes, absolutely. The old myth that powerful automation is only for giant corporations is just that - a myth. The market has completely changed to make these tools accessible for businesses of all sizes.

Many providers offer flexible, subscription-based pricing. This means you can pay per invoice or find a flat monthly fee that aligns with your cash flow. When you consider the cost of manual errors and the hundreds of hours you'll save, invoice capture software often becomes one of the smartest, most cost-effective investments a small business can make.

Will It Work With My Existing Accounting Software?

This is a make-or-break question, and the answer is almost always a resounding "yes." The leading invoice capture tools are designed to integrate smoothly, not cause more headaches.

They offer reliable, pre-built connections for the major accounting systems that most businesses rely on, including:

- •QuickBooks (both Online and Desktop versions)

- •Xero

- •NetSuite

- •Microsoft Dynamics 365 Business Central

This seamless integration ensures all your captured invoice data flows right into your general ledger, no friction involved. It's always smart to double-check compatibility with any vendor you're considering, but you'll find that broad integration is now a standard feature, not a luxury.

Ready to stop wasting time on manual data entry? Tailride connects directly to your email and accounting software, using AI to capture and process invoices automatically. Start your free trial and see how much time you can save. Learn more and get started in seconds with Tailride.