How to Organise Receipts Easily | Expert Tips & Tricks

Learn how to organise receipts effectively with practical methods, digital tools, and automation tips. Get started today for a clutter-free approach!

Let's be honest - staring at a shoebox overflowing with crumpled receipts or an inbox clogged with digital ones is a special kind of nightmare. We've all been there. The best way to organize receipts isn't some magic trick; it's simply about choosing a consistent system and actually sticking to it.

This guide is your battle plan to go from paperwork chaos to financial clarity. We'll walk through three solid approaches to get you started.

Finally End Your Receipt Overwhelm

The real secret here is that there's no single "perfect" method. It’s all about finding the right system for you. We're going to cover three practical ways to tackle the mess: a straightforward manual setup, an easy-to-manage digital system, and some seriously smart automation tools. The goal? To turn this dreaded chore into a simple habit that makes budgeting, returns, and even tax season feel genuinely stress-free.

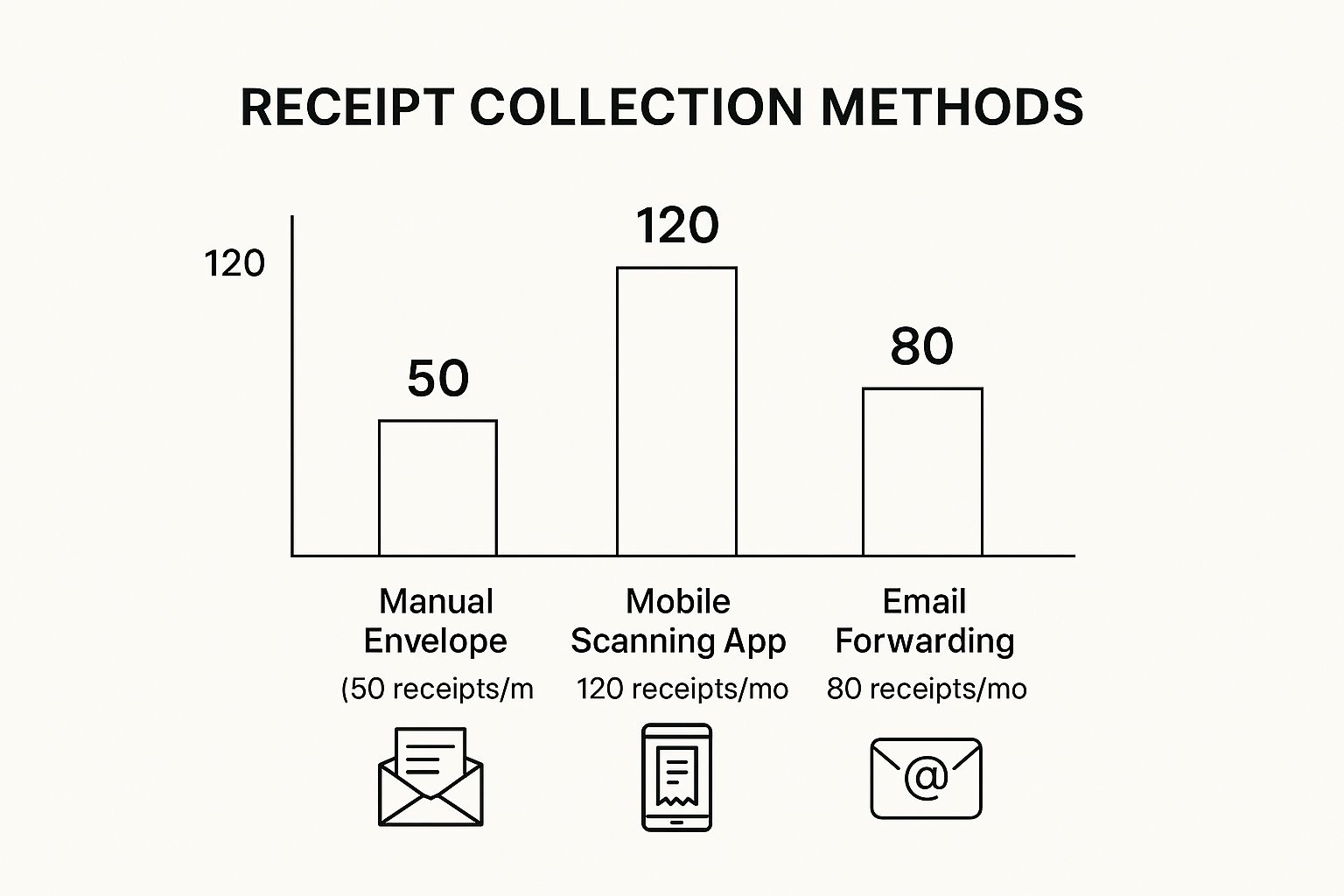

So, where do you start? The sheer volume of receipts you handle is often the biggest factor. This chart gives you a great visual of what each method can realistically handle each month.

As you can see, once you start dealing with more than a handful of receipts, mobile scanning apps pull way ahead of manual entry or basic email forwarding. They’re a game-changer for managing higher volumes without pulling your hair out.

Why a System Matters So Much

Without a reliable process, you’re basically leaving money on the table. You risk losing out on valuable tax deductions, scrambling to find proof of purchase for a return, and flying blind when it comes to your own spending habits. A good system gives you:

- •Financial Clarity: You’ll finally know exactly where your money is going, which is the first step to better budgeting.

- •Tax-Time Readiness: Imagine having all your documents ready to go for tax filings or, heaven forbid, an audit. No more frantic searching.

- •Simplified Returns: Need to return that gadget or use a warranty? You can pull up the proof of purchase in seconds.

To help you get a clearer picture of which path might be best, take a look at this quick comparison.

Which Receipt System Is Right for You?

A quick look at the three core methods for organizing receipts to help you find the best starting point for your needs and style.

| Method | Best For | Key Benefit |

|---|---|---|

| Manual System | Individuals or small businesses with very few monthly transactions. | Simple, low-tech, and requires no special software. |

| Digital Scanning | Anyone who wants to go paperless and has a moderate volume of receipts. | Creates a searchable digital archive and reduces physical clutter. |

| Automated Software | Freelancers, business owners, or anyone managing a high volume of expenses. | Saves significant time by automatically extracting and categorizing data. |

Each of these methods has its place, but the trend is clearly moving toward smarter, digital solutions.

The move to digital isn't just a convenience anymore; it's becoming a necessity. I've seen firsthand how messy receipt habits hold people and businesses back. Adopting modern tools cuts down on human error and turns a mind-numbing task into an automated process that's crucial for real financial control. If you're curious about the bigger picture, a detailed report on the growth of expense management software shows just how widespread this shift is.

Alright, let's get your receipts sorted for good.

Build a Simple and Solid Manual System

Before you dive headfirst into apps and software, it pays to master the basics with a physical system. Honestly, it’s a low-cost, surprisingly effective way to learn how to organize receipts and build good habits that will stick with you, no matter which method you eventually choose.

So, let's officially retire that old shoebox overflowing with crumpled papers. It's time for something that actually works.

The very first thing you need is a dedicated "collection point." This could be a simple tray on your desk, a specific folder, or even a designated kitchen drawer. The rule is simple: every single paper receipt goes straight here. No exceptions. This one small habit stops those pesky slips of paper from disappearing into coat pockets or getting lost in the black hole under your car seat.

Think of this spot as your temporary inbox. Setting aside time once a week to process everything inside keeps the task manageable and prevents it from turning into a mountain of paper later.

Create Your Filing Structure

With a collection point sorted, you need a long-term home for those processed receipts. The classic accordion folder is a favourite for a reason - it’s simple, cheap, and it just works. You can label the tabs by month or by expense category, depending on what makes the most sense for you.

For personal finances, I find that categories usually work best:

- •Groceries: Get a real, hard look at where your food budget is going.

- •Utilities: Keep all your energy, water, and internet bills in one tidy spot.

- •Auto: Easily track what you're spending on fuel, maintenance, and insurance.

If you're a freelancer or small business owner, organizing by month is often a lifesaver for bookkeeping and tax prep. If your business has more complex spending, our guide on organizing business receipts has some great category ideas to get you started.

Pro Tip: Before you file away a receipt for any important purchase, grab a pen and jot a quick note right on it. Something like, “Warranty for new office printer” or “Client lunch with ABC Corp re: Project Zebra.” This simple habit provides crucial context months - or even years - down the line, turning a generic receipt into a truly valuable record.

Going manual like this builds the discipline you need for any organizational method. It forces you to be intentional about what you keep and how you file it. By creating a clear, straightforward process for handling paper, you lay a solid foundation of order that makes switching to a digital or automated system a whole lot smoother when you're ready.

Taking Your Receipts Digital (Without Creating a Mess)

Ready to finally ditch that overflowing shoebox of paper receipts? Going digital is the way to go, but it’s easy to trade a physical mess for a digital one. The last thing you want is a chaotic folder on your computer that’s just as impossible to sort through. A good system needs to be searchable, secure, and - most importantly - simple enough that you'll actually stick with it.

The easiest way to get started is with something you already own: your phone. Grab a free scanner app like Adobe Scan or Microsoft Lens. They turn your phone’s camera into a surprisingly powerful scanner. Just make a habit of scanning receipts right when you get them. It takes 10 seconds and stops the paper from ever piling up.

Build Your Digital Filing Cabinet

Once a receipt is scanned, it needs a home. This is where cloud storage like Google Drive, Dropbox, or OneDrive becomes your best friend. But here’s the secret: you have to be disciplined about your folder structure and how you name your files.

I’ve found a simple chronological system works best. I create a main "Receipts" folder, and inside that, I make a new folder for each month. It looks like this:

- •Main Folder:

Receipts- •Subfolder:

2024-07 Receipts - •Subfolder:

2024-08 Receipts

- •Subfolder:

Then, every single file gets named with the same consistent format. This is non-negotiable if you want a system that actually works.

- •My Go-To Naming Format:

YYYY-MM-DD_Vendor_Amount.pdf - •A Real-World Example:

2024-07-26_OfficeDepot_45.99.pdf

It might seem tedious at first, but this consistency is what turns a messy folder into a searchable database. When tax time rolls around, or you need to find that one specific warranty receipt, you'll be thanking yourself.

Going digital doesn't just clear up desk space; it also means your important records are backed up and safe from fires or floods. Plus, sharing them with your accountant is as easy as sending a link. For more on this, check out this great A Guide to Paperless Office Solutions.

This shift is bigger than just personal organization. The market for cloud-based receipt management is expected to explode, reaching an estimated $11.36 billion by 2034. It’s clear that businesses and individuals are moving this way for better accuracy and efficiency.

If the manual scanning and filing feel like too much, there are tools designed to automate a lot of this work. We've actually put together a deep dive on this topic - you can find our picks for https://tailride.so/blog/receipt-scanning-software right here.

Ready to stop shuffling papers and wrestling with spreadsheets? Let's talk about putting your receipt workflow on autopilot.

Put Your Receipt Workflow on Autopilot

While manual and digital methods are a great first step, this is where you can truly get your time back. Automated tools can completely take over how you organize receipts by using smart tech like Optical Character Recognition (OCR) to do all the tedious work for you.

Think about it: you just snap a photo of a receipt. The software instantly reads it, pulling out the vendor's name, the date, and the total amount. You don’t have to type a single thing. This simple act eliminates the mind-numbing, error-filled task of manual data entry.

How Automation Works in Real Life

For a freelancer, this is a total game-changer. Imagine you just wrapped up a client meeting and grabbed a coffee on the way out. You take a quick picture of the receipt with an app on your phone. Before you've even left the coffee shop, the software has already pulled the data, flagged it as a business expense, and sent it straight to your accounting software like QuickBooks.

Suddenly, expense tracking goes from a dreaded weekend chore to a two-second habit. The time you save adds up fast, especially if you're dealing with a lot of transactions every month.

Automation isn't just about moving faster; it's about accuracy and having peace of mind. When you take the human element out of data entry, you dramatically cut down on mistakes, which means your financial records are always correct and ready for tax time.

Tools like GetInvoice push this even further. A ton of your most important receipts - from software subscriptions to online purchases - land in your email inbox. Instead of having to find them, download them, and upload them, you can just forward those emails to a unique address. The system takes it from there, processing them instantly.

Here's a quick look at how you can pull receipts from different places into one central hub.

As you can see, modern tools let you capture receipts from your email, your phone, or even directly from supplier websites. It creates a smooth, unbroken flow of information.

For a more detailed look at various strategies, check out our complete guide on how to organize receipts. This kind of workflow completely removes the friction between getting a receipt and having it perfectly filed away.

Make Your New System a Lasting Habit

Let's be honest - the most brilliant receipt organization system in the world is completely useless if you don't stick with it. The real secret here isn't about picking the perfect tool; it's about building a solid routine around it. This is what truly separates lasting financial clarity from a temporary cleanup.

The best way I’ve found to make it stick is to treat it like any other important appointment. Block out just 10-15 minutes on your calendar every single Friday afternoon. Make this your dedicated time to tackle the week's receipts, whether that means filing paper slips into a folder or quickly scanning digital ones into the cloud. When it's on the calendar, it's real.

Build a Resilient Process

Even with the best intentions, simple missteps can derail a good habit. To make sure your system can withstand the chaos of real life, you need to build in a few safeguards. I’ve seen it happen countless times: someone's hard drive crashes, and years of digital records vanish because they didn't have a backup.

- •Create Redundancy: Always, always back up your digital receipts. A secondary cloud storage account, different from your main one, is a simple and effective way to protect yourself from losing everything.

- •Know the Rules: It's also vital to know your local tax authority's rules for record-keeping. For many, you'll need to hold onto records for three to seven years, but it's always smart to double-check the specific requirements where you live.

A system fails the moment it becomes overwhelming. The goal is to prevent the pile-up, whether it’s a physical stack of paper or a folder of unsorted JPEGs. Consistency will always beat intensity.

Think of it this way: a little effort each week is far more effective than a frantic, stressful cleanup marathon right before tax season. By avoiding common mistakes like inconsistent file naming or just letting things pile up, you're not just tidying up - you're creating a durable habit.

This small routine can transform a dreaded chore into a satisfying weekly checkpoint, giving you peace of mind that your financial records are always accurate and in order.

Have Questions About Organizing Receipts? Let's Answer Them.

Even with the best system in place, you're bound to have some questions pop up. It's totally normal. Here are a few of the most common ones I hear from people just starting to get their receipts in order.

How Long Do I Really Need to Keep Receipts for Taxes?

This is the big one, right? For most people and small businesses, you’ll want to hang onto your records for 3 to 7 years. The exact timing can vary, so it's a good idea to check the official tax record keeping guidelines for the nitty-gritty details.

Focus on keeping anything that backs up your income, deductions, and major purchases like equipment or property. Holding onto these ensures you're ready if the tax authorities ever come knocking with questions.

Once I Scan a Receipt, Can I Toss the Paper Copy?

For the most part, yes! This is one of the best things about going digital. Tax agencies are usually perfectly fine with high-quality digital scans as proof of purchase.

My personal rule of thumb? I always keep the original paper receipts for really significant purchases - think vehicles, expensive equipment, or anything with a long-term warranty. It might feel like overkill, but that little bit of extra caution can be a real lifesaver down the road.

What's the Easiest Way to Deal with All Those Email Receipts?

The simplest trick is to create a dedicated 'Receipts' folder right in your email account. Then, you can set up a filter to automatically catch any emails with words like "receipt," "invoice," or "order confirmation" and send them straight there.

This keeps them from cluttering up your main inbox and gathers them all in one spot, making it much easier to process them later.

Tired of manually forwarding emails and scanning stacks of paper? GetInvoice can automate your entire receipt workflow by connecting to your inbox and pulling all the important data for you. See how much time you could get back by visiting https://getinvoice.so.