Simplify Workflow with Email Invoice Extraction to Google Sheets

Discover how email invoice extraction to Google Sheets automates data entry, saves time, and reduces errors. Improve your process today!

Let's face it, the process of email invoice extraction to Google Sheets sounds a bit technical. But really, it just means setting up a smart system that automatically scans your emails, finds invoices, grabs the important stuff - like who it's from and how much you owe - and neatly organizes it all in a spreadsheet.

No more copy-pasting. No more typos. Just a live, up-to-date ledger of your expenses.

Say Goodbye to Manual Invoice Entry for Good

We've all been there. You open your inbox, and it's a sea of invoices from suppliers, contractors, and software subscriptions. That sinking feeling kicks in because you know what's next: a long, soul-crushing session of manually entering every single detail into a spreadsheet.

It’s not just boring; it’s a recipe for disaster. A single misplaced decimal or a skipped invoice can throw your entire financial picture out of whack. The time you waste on this repetitive task is time you're not spending on what actually matters - growing your business. This manual grind is a serious bottleneck.

But there’s a much better way. In this guide, we'll build a simple workflow that automates the entire process of email invoice extraction to Google Sheets using Tailride. It's a set-it-and-forget-it system that finds invoice data in your emails (even in PDF attachments!) and zaps it directly into your Google Sheet.

Manual vs Automated Invoice Processing

See the core differences between sticking with manual entry and upgrading to an automated workflow for managing your invoices.

| Aspect | Manual Processing | Automated Extraction |

|---|---|---|

| Speed | Slow, hours per week | Instant, happens in seconds |

| Accuracy | Prone to typos & human error | Nearly 100% accurate |

| Visibility | Delayed, only updated in batches | Real-time, as invoices arrive |

| Effort | High-touch, tedious | Hands-off, runs in the background |

| Scalability | Breaks down as volume grows | Handles any volume effortlessly |

The table really says it all. Automation isn't just a minor improvement; it's a completely different (and better) way of working.

Why Automation Is a Game-Changer Now

Moving from a manual system to an automated one is more than just a time-saver. It's a strategic upgrade for your entire business operation.

Here’s what you stand to gain:

- •Slash Human Error to Near-Zero: An automated system doesn’t get tired, distracted, or accidentally hit the wrong key. Your financial data becomes far more reliable from the moment it enters your books.

- •Get Your Time Back: What could you do with an extra 5-10 hours every month? That's time you could spend talking to customers, refining your strategy, or just taking a well-deserved break.

- •See Your Finances in Real-Time: The moment an invoice hits your inbox, the data is in your spreadsheet. This gives you a crystal-clear, up-to-the-minute view of your cash flow, empowering you to make smarter, faster decisions.

This is about more than just efficiency. It’s about building a business that’s more resilient, scalable, and less dependent on your constant manual effort.

If you're new to this concept, it's worth taking a moment to understand what workflow automation is and how its principles can be applied to so much more than just invoices.

The goal here is simple: create a system that works for you, not the other way around. Let's get it set up.

The True Cost of Manual Invoice Processing

It’s easy to think of manually handling invoices as a "free" task, especially if you're not paying for a specific tool to do it. But that's a dangerous illusion. The hidden costs are very real, and they quietly eat away at your time, money, and even your team's morale.

Let's do some quick back-of-the-napkin math. If it takes you just 15 minutes to process a single invoice from start to finish - opening it, finding the data, keying it into a spreadsheet - and your time is worth, say, $50 an hour, that one invoice just cost you $12.50. Now, multiply that by all the invoices you handle in a month. The number gets big, fast.

And that's just the time component. The manual grind is a minefield for human error. A single typo in an invoice amount, a misplaced decimal point, or a forgotten due date can snowball into overpayments, late fees, and hours spent digging through records to figure out what went wrong.

More Than Just Time and Money

The damage from manual invoice entry goes way beyond the numbers on a balance sheet. It creates a kind of operational drag that can slow your entire business down.

- •Strained Vendor Relationships: Late payments from a slow, manual process can really sour the great relationships you've built with your suppliers. In business, reliable partners are everything.

- •Lack of Financial Clarity: When your expense data is only updated in big, infrequent batches, you're always looking in the rearview mirror. You can't make smart, agile decisions with stale information.

- •Reduced Employee Morale: Let's be honest, nobody enjoys mind-numbing data entry. Tasking talented people with copy-paste work is a fast track to burnout and disengagement.

The real problem with manual processing is that it traps you working in your business on low-value tasks, instead of on your business focusing on growth and strategy. This is exactly why finding a solid solution for email invoice extraction to Google Sheets is so important.

To really get why automation is a game-changer, it helps to understand the real cost of manual document filing and how it ripples through an entire organization. You’re not alone in this struggle. Shockingly, it's estimated that by 2025, about 68% of companies will still be manually keying in invoice data.

With processing costs hitting an average of $15 to $23 per invoice and taking more than eight days to complete, it's a massive bottleneck. Automating this workflow isn't just a nice-to-have; it's a strategic move toward a smarter, more scalable business.

Let's Build Your Automated Workflow in Tailride

Okay, enough with the theory. Let's roll up our sleeves and actually build this thing. I'm going to walk you through setting up a hands-free system for email invoice extraction to Google Sheets. We’ll be creating your first workflow - or a "Recipe," as Tailride calls them - that will become your new favorite data entry assistant.

First things first, we need to connect Tailride to where your invoices live: your email inbox. This is done with a secure authorization, so you're not handing over your password. You just grant permission and tell the system where to look. Is it your main inbox? A special folder you set up called "Invoices"? A specific Gmail label? You decide.

Think of this step as giving Tailride a key and a map. It’s the foundation for everything that follows.

Telling Your Assistant What to Grab

Once your email is connected, we get to the fun part: teaching your new assistant what information to pull from each invoice. Tailride has a really intuitive interface for this, so you can forget about writing complex code.

It’s honestly more like highlighting text on a document. You’ll just point and click on the key fields from a sample invoice. This usually includes things like:

- •Vendor Name: Who's billing you?

- •Invoice Number: That all-important unique ID.

- •Invoice Date: When it was sent.

- •Due Date: When you need to pay it by.

- •Total Amount: The bottom line.

You can get as granular as you want, capturing individual line items, tax details, or any other custom field that’s important for your business. You're basically creating a blueprint for what matters on an invoice.

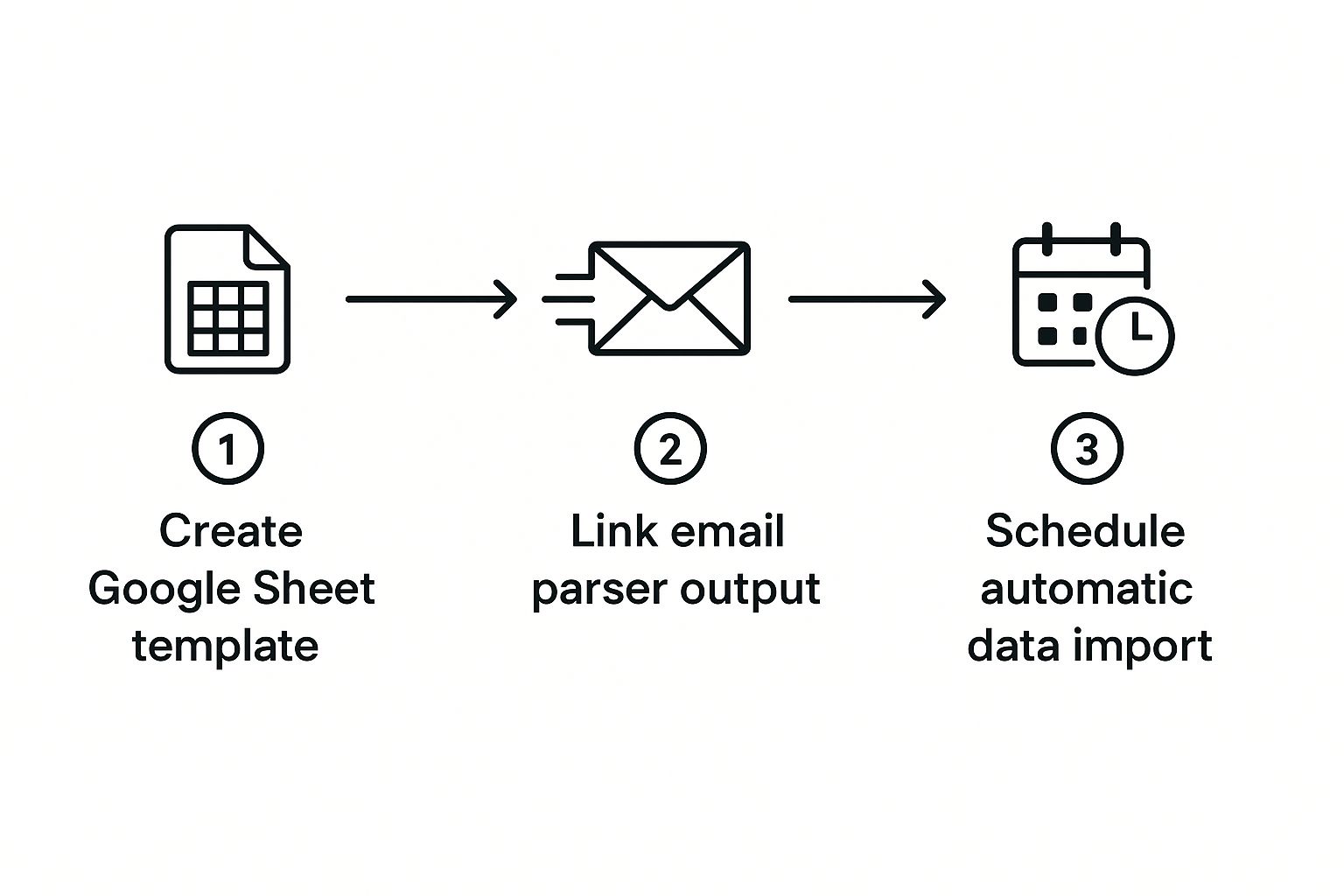

This little diagram gives you a great visual of the workflow we're putting together, from setting up the Google Sheet all the way to scheduling the automatic import.

You can see how each piece of the puzzle connects, creating a smooth, automated pipeline that sends data straight from your inbox to your spreadsheet.

Putting Your Email on Autopilot

For this automation to be truly set-it-and-forget-it, it has to run on its own. This is where Tailride's real-time monitoring comes into play. As soon as you activate your Recipe, the system starts keeping a constant eye on the email folder or label you pointed it to.

This is where the magic really kicks in. The second a new email with an invoice lands, your workflow springs into action. The system immediately scans the email and its attachments (like PDFs), finds the data points you defined earlier, and gets them ready for the next step. If you want to get into the nitty-gritty, you can learn more about how Tailride uses its powerful IMAP email monitor, which is compatible with pretty much any email provider out there.

The system is also incredibly smart. By 2025, automated invoice data extraction isn't just a nice-to-have; it's a necessity. With invoice volumes and complexity on the rise, modern tools are hitting accuracy rates of nearly 99%, which makes a huge difference in cutting down on vendor disputes and late payments.

Pro Tip: I always recommend creating a dedicated "Invoices" folder in your email client. Then, set up a simple rule to automatically filter emails from your vendors into that folder. This keeps your main inbox tidy and gives your workflow one clean, organized place to look for new bills.

With this setup, you’re not just processing invoices in batches at the end of the week. You’re capturing them the moment they arrive. Your Google Sheets ledger will always be up-to-date, giving you a real-time snapshot of your expenses without you having to lift a finger.

Getting Your Invoice Data into Google Sheets

Okay, so your workflow is now grabbing all that juicy invoice data from your emails. That's great, but the data needs a home. This is where we bridge the gap and send everything over to a Google Sheet, turning a simple spreadsheet into your command center for expenses.

Connecting Tailride to your Google account is straightforward and secure. You'll be prompted to log in to Google and grant permission - don't worry, you're not handing over your password. You're just giving Tailride the specific thumbs-up it needs to talk to your spreadsheets.

Once you've given the green light, you can point Tailride to the exact Google Sheet you want to use. You can either pick one you already have or just create a fresh one on the spot.

Mapping Your Data Fields: The Most Important Step

Now for the magic. We need to tell Tailride where to put each piece of information it finds. This is called field mapping, and it's less complicated than it sounds.

Think of it like sorting mail. You're just telling the system, "That 'Invoice Total' you found? It goes in my 'Amount' column. The 'Vendor Name' goes in the 'Vendor' column." It's a simple, visual matching game.

Here’s a little tip I’ve learned from setting this up countless times, and it makes a huge difference:

Prep your Google Sheet ahead of time. Before you even touch the mapping settings, open up Google Sheets and create your column headers. Think about what you need to track: 'Vendor Name', 'Invoice Date', 'Due Date', 'Invoice ID', 'Amount', etc. Having these columns ready makes the next part a breeze.

With your headers waiting, the mapping process becomes a simple point-and-click affair. You'll just match the fields Tailride gives you to the columns you created:

- •Tailride's 'Vendor Name' gets mapped to your 'Vendor Name' column.

- •Tailride's 'Invoice Total' gets mapped to your 'Amount' column.

- •Tailride's 'Invoice Number' gets mapped to your 'Invoice ID' column.

You just do this for every piece of data you want to capture. It only takes a couple of minutes, but it's the key to making sure every future invoice lands in the right spot, perfectly organized, without you lifting a finger. If you're curious about how this works with other tools, you can explore more on connecting a Google Workspace).

Watch Your Sheet Become a Live Dashboard

This isn't just about data entry. You're building a living, breathing financial tool. As soon as the connection is active, every single invoice Tailride processes will instantly appear as a new, perfectly formatted row in your Google Sheet. We're talking real-time updates.

The best part? Now you can use all the cool features Google Sheets offers. Add a 'Running Total' column with a simple SUM formula. Use conditional formatting to make past-due invoices scream red. Create charts to visualize your spending by vendor.

You've successfully combined powerful automation with the flexibility of a spreadsheet. The result is a dynamic dashboard that gives you an accurate, up-to-the-minute view of your business finances.

Getting Your Extractor Dialed In for Better Accuracy

Alright, so you've got the basic automation running. That’s a huge first step, so pat yourself on the back. But as we all know, the real world of invoices is… well, chaotic.

What happens when one vendor calls their invoice ID "Invoice #" but another one uses "Ref No."? If you don't account for these little differences, your system is going to miss things. This is where we go from a decent setup to a bulletproof one. By fine-tuning your Tailride Recipe, you make sure your email invoice extraction to google sheets workflow is smart enough to handle the curveballs vendors will inevitably throw.

Dealing with Different Invoice Formats

The most common snag you'll hit is the sheer variety of terms used on invoices. One company’s “Total Due” is another’s “Amount Payable.” Your first pass at the setup might only be looking for one specific term.

The good news is, you can easily teach your Recipe to look for multiple keywords for the same piece of information. Just think of it like giving your data extractor a list of nicknames to look for.

- •For an invoice number, you could tell it to search for "Invoice #," "Inv No.," or "Reference."

- •For the total amount, it could look for "Total," "Balance Due," or "Amount."

This one little tweak makes your whole system so much more flexible and reliable. It ensures you get the right data, every single time, no matter who sent the invoice. If you want a deeper dive, we cover the basics of how to extract data from invoices in another guide.

The goal isn’t to force all your vendors to use one perfect invoice template. That’s a losing battle. The real win is building a system smart enough to understand all their imperfect ones.

Handling Tricky PDFs and Line Items

Another classic challenge is pulling information from multi-page PDFs or, even trickier, grabbing individual line items for super-detailed expense tracking. Tailride was built for this stuff. It reads the entire document, not just the first page.

You can set up your Recipe to spot a table of line items and pull out each product, its quantity, and price, then neatly drop them into separate rows in your Google Sheet. For any business that needs to see exactly where their money is going, this is a total game-changer.

This kind of detailed work is why the AI-driven invoice processing market is absolutely exploding. It’s expected to leap from $2.8 billion in 2024 to over $47 billion by 2034. Why? Because AI can slash processing time by more than 60%. By fine-tuning your system like this, you’re putting that power to work for your own business.

Common Questions About Invoice Extraction

Jumping into a new automated system always sparks a few questions. It’s smart to get the details sorted out before you dive in, so let’s walk through some of the most common things people ask when setting up their email invoice extraction to Google Sheets.

My goal is to clear up any lingering doubts you might have. Once you see how these common situations are handled, you’ll be ready to build your own system with confidence.

Can This Process Handle Invoices in PDF Attachments?

Absolutely. In fact, this is one of the biggest strengths of using a tool like Tailride. The whole system is built to automatically spot when an email has an attachment.

It then finds the invoice file - whether it's a PDF, JPG, or another common format - and uses Optical Character Recognition (OCR) to read the text inside. You can officially say goodbye to manually opening PDFs and copying data. You just tell your workflow to look for attachments, and the platform does the heavy lifting of turning that document into clean data for your Google Sheet.

The real magic here is that the system treats an invoice inside a PDF the same as one in the body of an email. It’s all just data to be captured, which makes your setup incredibly flexible.

What If My Invoices Come in Different Languages?

That’s a super common scenario for anyone working with international suppliers. Modern AI extraction tools are trained on massive global datasets, which means they can understand multiple languages and recognize different currency symbols and date formats right out of the box.

When you're setting up your extractor, you can usually point it toward specific regional formats or just let the AI figure out the language on its own. A good rule of thumb I always follow is to test the system with a few real-world international invoices. This lets you see exactly how it performs and tweak any parsing rules if needed, ensuring you get high accuracy from day one.

Is This Method Secure for Financial Information?

Security should always be priority number one with financial data, and this process is built with that in mind. Reputable platforms use secure protocols like OAuth 2.0 to connect to your email and Google accounts.

This is a critical point: OAuth means the platform never actually sees or stores your passwords. Instead, you grant specific, limited permissions that you can revoke at any time. All the data is sent over encrypted channels, and you always have full control. I always recommend going with a service that’s upfront about its security practices and compliance standards.

Ready to stop copy-pasting and build a smarter, automated workflow? With Tailride, you can set up your email invoice extraction to Google Sheets in minutes and get your first invoices processed automatically. Get started for free at Tailride.