Difference Between Invoice and Receipt: Key Differences Explained

Learn the difference between invoice and receipt, understand their uses, and discover why knowing these differences is important for your business.

Here’s the simplest way to think about it: an invoice is a request for payment, sent before a customer pays. A receipt, on the other hand, is the proof of payment you give them after the money has changed hands.

Think of it like a conversation. The invoice opens the discussion about what's owed, and the receipt officially closes it by confirming the deal is done.

Understanding These Core Financial Documents

While people often mix up the terms in casual conversation, these two documents play very different - and very critical - roles in any business transaction. Nailing the difference is key for accurate bookkeeping, clear communication with customers, and keeping your cash flow healthy.

An invoice is what you send when you've sold something on credit. It details what you provided and establishes a clear obligation for the buyer to pay you. A receipt is the document that confirms they've fulfilled that obligation. One tracks the money you're expecting, and the other confirms it has safely arrived.

Key Takeaway: An invoice creates a financial obligation (your accounts receivable), while a receipt cancels that obligation by confirming payment.

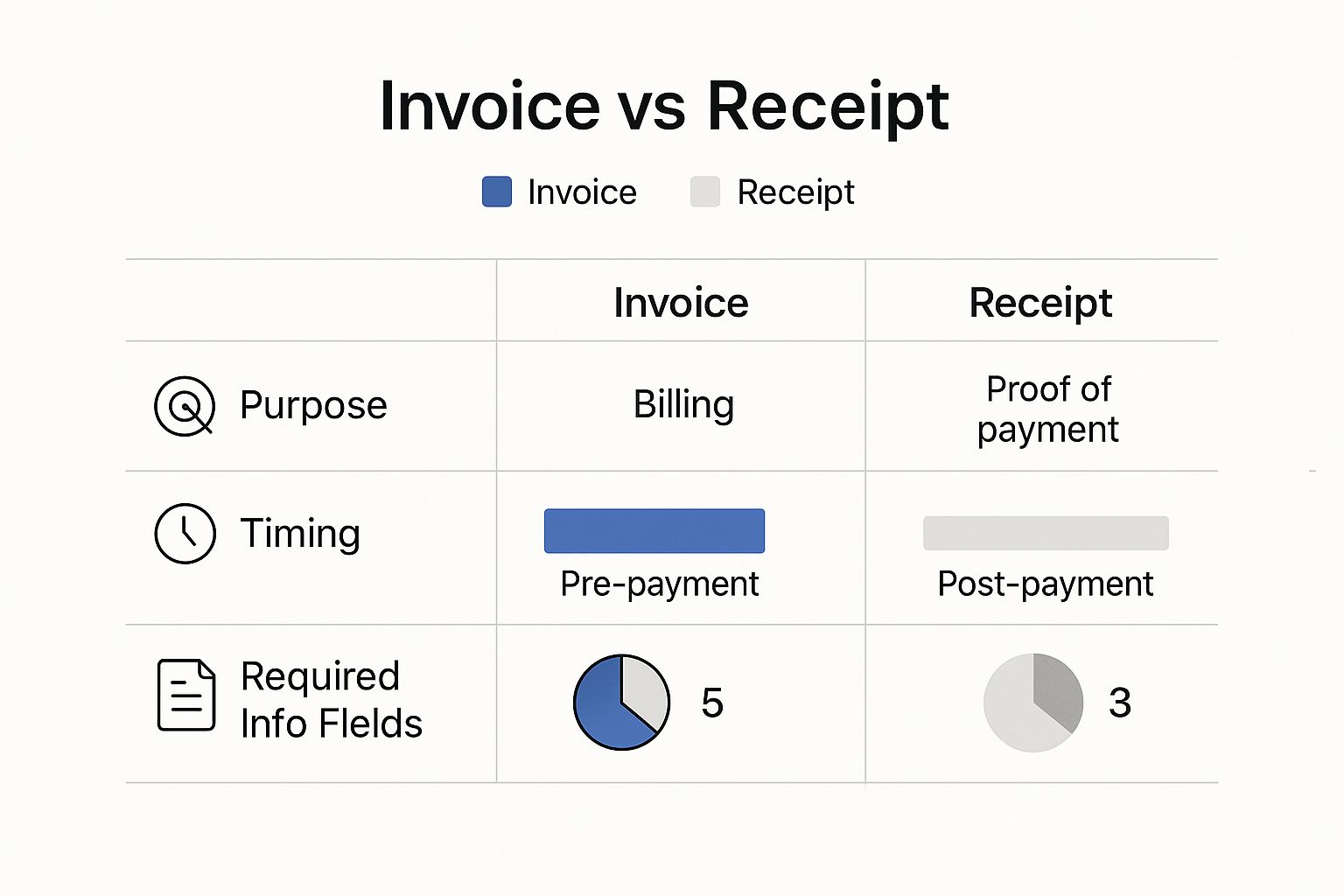

To make things even clearer, let's break down their main roles side-by-side.

Quick Guide Invoice vs Receipt at a Glance

This quick table cuts right to the chase, highlighting the essential differences between an invoice and a receipt.

| Attribute | Invoice | Receipt |

|---|---|---|

| Purpose | To request payment for goods or services rendered. | To provide proof that a payment has been made. |

| Timing | Issued before payment is made. | Issued after payment has been received. |

| Function | It shows what a customer owes your business. | It shows what a customer has already paid. |

In short, one is a "please pay me," and the other is a "thank you, you've paid." Both are crucial for keeping your financial records straight.

Why an Invoice Is Your Most Important Payment Tool

Think of an invoice as more than just a bill. It’s the official starting gun for getting paid and a surprisingly powerful tool for managing your business's cash flow. For anyone in a service-based business, from freelancers to B2B companies, this document is an absolute must-have. It solidifies your agreement with a client, creating a clear, legally recognized paper trail of what you delivered and what they owe you.

This single piece of paper (or email) is what fuels your accounts receivable. It's how you keep track of who owes you money, gently nudge clients about overdue payments, and get a realistic picture of your future income. The scale is massive, too - globally, an estimated 550 billion invoices are sent out each year, which shows just how fundamental they are to business.

Key Components of a Legally Sound Invoice

For an invoice to do its job properly, it needs a few key pieces of information to protect both you and your client. It’s basically a mini-contract for payment.

- •Unique Invoice Number: Essential for your records and makes it easy for everyone to reference a specific bill.

- •Clear Payment Terms: Spell out exactly when you expect to be paid (e.g., Net 30, Due on Receipt) and what payment methods you accept.

- •Itemized List of Services: Break down everything you provided, including quantities, rates, and the total for each line item.

- •Business and Client Information: Include the full names, addresses, and contact info for both you and your client.

Having a detailed invoice is your first line of defense if a payment goes overdue. It serves as the primary evidence of what's owed when you have to start a debt collection process.

Example in Action: Imagine a marketing agency just wrapped up a three-month social media campaign. They’d send an invoice that breaks down the management fee for each month, the ad spend they covered, and the costs for content creation. The document clearly states the $5,000 total owed, gives a "Net 15" payment term, and has a unique invoice number, which keeps the whole process professional and straightforward.

The Essential Role of a Receipt in Every Transaction

Once a customer pays, the conversation changes. It's no longer about what they owe you; it's about what they've paid. This is where the receipt comes in. A receipt is your official confirmation that a transaction is done and dusted - the financial obligation is settled. Think of it as the handshake that closes the deal.

This little piece of paper (or email) is the ultimate proof of purchase, and it’s critical for both sides of the counter. For your business, it’s a non-negotiable part of your sales records, confirming revenue has hit your account. For your customer, it's their golden ticket for returns, warranty claims, or just proving they own something.

What Makes a Receipt Official

For a receipt to be legitimate, it needs to have a few key pieces of information. It’s basically a snapshot of the finished transaction that keeps everyone on the same page.

Here’s what every good receipt should include:

- •Payment Date: The exact day the money was received.

- •Amount Paid: The total sum that was handed over.

- •Payment Method: How they paid you - cash, credit card, bank transfer, etc.

- •Remaining Balance: This should always be $0.00. A zero balance is the whole point!

Getting this right is crucial for clean bookkeeping. If your shoebox of receipts is overflowing, it might be a good time to learn how to organize receipts to keep your records straight and audit-proof.

Example in Action: Let's say a customer buys a new laptop from your online store for $1,200. The moment their credit card payment goes through, they get an automated email receipt. That email confirms their purchase, shows which card they used, and notes the transaction date. It gives them peace of mind, serves as proof for any warranty issues, and officially closes the loop on the sale for your business. That single document turns a pending order into recorded revenue.

Comparing an Invoice and a Receipt Side by Side

On the surface, invoices and receipts both seem like simple transaction records. But in reality, they play completely different roles. Think of it this way: an invoice is a request for payment, creating a financial obligation. A receipt is the proof of payment, which closes that loop.

Getting this distinction right is more than just semantics; it’s fundamental to clean bookkeeping, accurate financial reporting, and maintaining a professional relationship with your clients.

Let's break down the key differences to see how they function at opposite ends of a transaction.

As you can see, these documents are not interchangeable. One asks for money, and the other confirms it’s been received. Using the right one at the right time is crucial for keeping your financial workflow running smoothly.

Legal and Accounting Distinctions

From an accounting standpoint, an invoice and a receipt live in two different worlds. Invoices are logged under accounts receivable - money you're owed and expect to come in. This is future income.

Receipts, on the other hand, confirm that the cash is officially in the bank. They are proof that a transaction is settled and are used to record actual income. This separation is what keeps your books clean and gives you a clear picture of your financial health.

Information Breakdown: Invoice vs. Receipt

The details on each document are tailored to its job. An invoice needs to be rich with information to make sure your client knows exactly what they’re paying for, how to pay, and when it’s due. It’s all about clarity and providing a call to action.

A receipt is much simpler. Its only job is to confirm the payment details and close the transaction.

An invoice typically requires:

- •A unique invoice number for easy tracking.

- •An itemized breakdown of all products or services delivered.

- •Clear payment terms, instructions, and a specific due date.

- •Full contact information for both you and your client.

A receipt, in contrast, must include:

- •The exact amount paid.

- •The date the payment was successfully processed.

- •The method of payment used (e.g., credit card, bank transfer, cash).

- •A confirmation that the outstanding balance is now $0.00.

To help you see these differences at a glance, here’s a simple table comparing their core features.

Detailed Breakdown Comparing Invoice and Receipt Features

| Feature | Invoice | Receipt |

|---|---|---|

| Primary Purpose | To request payment for goods or services rendered. | To confirm that a payment has been received. |

| Timing of Issuance | Before the payment is made. | After the payment is made. |

| Accounting Role | Creates an Accounts Receivable entry (money owed). | Records revenue/cash received, closing the receivable. |

| Key Information | Itemized list, due date, payment terms, invoice number. | Amount paid, date of payment, payment method, zero balance. |

| Legal Status | A legally binding request for payment. | Proof of a completed financial transaction. |

This side-by-side view makes it clear: these are two distinct documents, each with a critical role in your business's financial operations.

An invoice tells the story of what’s owed, while a receipt provides the ending by confirming what’s been paid. Mastering both is a cornerstone of professional financial management. To take it a step further, check out our guide on invoice processing best practices and learn how to optimize your entire workflow.

When to Use an Invoice vs. a Receipt

Knowing the difference between an invoice and a receipt is a good start, but understanding the right time to use each one is what truly keeps your business finances in order. It all boils down to one simple question: when is the payment happening?

Think of it this way: an invoice is a request for a payment that will happen later. A receipt is a confirmation of a payment that just happened now.

Let's walk through a couple of real-world scenarios to see this in action.

For Service-Based Businesses

If you're a consultant, freelance designer, or run a digital marketing agency, the invoice is your best friend. You typically provide your expertise first and then bill for it afterward.

- •

You send an invoice after finishing a project or hitting a specific milestone you've agreed on. This document lists all the work you did and tells the client exactly what they owe.

- •

You issue a receipt the moment that payment hits your account. This is the crucial follow-up step that confirms you've been paid, officially closing the loop on that transaction for both you and your client.

For Retail and E-commerce Stores

In retail, things are much more immediate. A customer finds something they like, brings it to the counter (or checkout page), and pays for it right then and there. Because the payment is instant, there's no need to ask for it with an invoice.

The process is straightforward:

- •A customer decides to buy a product.

- •They pay instantly with a card, cash, or a mobile payment app.

- •You immediately hand them (or email them) a receipt as their proof of purchase.

A receipt is the final word in any retail transaction. It’s the customer's confirmation of ownership and their key to making returns or warranty claims.

Getting this document flow right is essential for a healthy cash flow. And while you're busy managing the money coming in, don't forget about the money going out to your own suppliers. You can learn how to automate accounts payable to get a better handle on that side of your finances, too. Mastering both your receivables and payables is the secret to a stable, predictable business.

How Digital Tools Are Changing Invoices and Receipts

Let's be honest, the days of stuffed filing cabinets and paper trails are fading fast. Technology has completely changed the game for how we manage financial documents like invoices and receipts, and it’s for the better.

Switching to electronic invoicing (e-invoicing) and digital receipts makes everything run smoother. You get paid faster, make fewer mistakes, and your record-keeping becomes practically foolproof. This isn't just a minor upgrade; it's turning mundane paperwork into a real business advantage.

Modern invoicing software can handle the entire process for you, from generating the invoice to sending out polite payment nudges. On the other side of the transaction, smart receipts are no longer just proof of purchase. They've become a goldmine of data, offering insights into what your customers love and how they shop. A lot of this progress is thanks to the powerful capabilities and benefits of ERP systems that tie all these financial tools together.

This digital shift really shines a light on the different jobs invoices and receipts do. The global e-invoicing market is expected to rocket to $36.72 billion by 2032, which shows just how vital it is for managing what you're owed.

In contrast, the market for smart receipt analytics, valued at $2.7 billion, highlights how receipts are now all about analyzing what happened after the sale. You can dig into more details about this growing market on market.us.

While their fundamental roles haven't changed, both documents have grown into powerful tools for running a sharp, modern business.

Common Questions About Invoices and Receipts

Let's clear up some of the questions that often come up when you're sorting out invoices and receipts. Getting these details right can save you a lot of headaches later.

Can I Just Mark an Invoice "Paid" Instead of Sending a Receipt?

You could, but it’s not the cleanest way to handle your books. Think of a "Paid" stamp on an invoice as a quick confirmation, but a formal receipt is the official handshake that closes the deal.

Issuing a separate receipt leaves no room for doubt. It gives both you and your client a crystal-clear document showing the transaction is complete, which is always the most professional route.

For Tax Time, Do I Really Need to Keep Both?

Yes, absolutely. Holding onto both is non-negotiable for anyone serious about their finances, especially when the taxman comes knocking. Each document tells a different part of the story.

- •If you're the seller: Your invoices track what people owe you (accounts receivable), while receipts confirm the income you've actually received.

- •If you're the buyer: Invoices show what you owe (accounts payable), and receipts are your proof of payment for business expenses you want to claim.

What Happens If a Client Pays and I Forget the Receipt?

Forgetting to send a receipt can cause more trouble than you'd think. Your client is left hanging without proof of payment, which can lead to them chasing you up, causing confusion, or even sparking a dispute. It just looks unprofessional.

A timely receipt is more than just a piece of paper; it’s a sign of good business. It reassures your client, strengthens the relationship, and keeps your own financial records accurate from the get-go.

Make it a habit to send a receipt the moment a payment clears. It’s a small step that wraps up the transaction neatly and keeps your bookkeeping pristine.

Stop drowning in paperwork. Tailride plugs into your inbox and business portals, pulls the data from invoices and receipts automatically, and syncs it right to your accounting software. Get started for free at Tailride.