A Founder’s Guide to Bookkeeping for Startups

Master bookkeeping for startups with this guide. Learn to set up your finances, choose the right software, and automate tasks for sustainable growth.

Tags

Alright, founders, let's talk about bookkeeping. But forget the image of a dusty ledger and late-night tax prep. Instead, think of it as the real-time health dashboard for your business. It’s the only way to truly see your company's pulse (cash flow), its energy levels (revenue), and its overall fitness (profitability). Flying without this dashboard is one of the quickest ways to crash and burn.

Why Smart Bookkeeping Is Your Startup’s Secret Weapon

For too many new entrepreneurs, "bookkeeping" feels like a chore - something you begrudgingly tackle when taxes are due. But that's a dangerously shortsighted view. For a startup, keeping clean books isn't just about staying out of trouble with the IRS; it's about survival. It’s about having the financial clarity to make smart, data-backed decisions every single day.

Without a solid grip on your numbers, you’re basically running your business with a blindfold on. You can't confidently answer the most critical questions that will ultimately decide your startup's fate.

The Real Cost of Neglecting Your Books

Letting your financial records become a mess creates massive blind spots. Picture this: you're in a pitch meeting with your dream investor, and they ask about your burn rate or customer acquisition cost. Fumbling for an answer doesn't just look bad - it shatters their confidence in you. It happens more than you'd think.

Even worse, a surprise cash crunch can force you into terrible corners, like accepting a loan with awful terms or letting go of a key team member. These aren't just hypotheticals; they're the grim reality for many. In fact, roughly 50% of startups fail within five years, and running out of cash is a top culprit. Keeping your books in order from the start is how you avoid becoming a statistic.

A common mistake is viewing bookkeeping as a backward-looking task. In reality, it's a forward-looking compass. It tells you not just where you've been, but where you're headed and if you have enough fuel to get there.

Building a Resilient Company from Day One

This guide is here to help you turn that financial chaos into clarity. We’ll walk you through a clear, step-by-step roadmap to build a financial foundation that can withstand the pressures of growth. Getting this right empowers you to:

- •Make Smarter Decisions: Know exactly when you can afford to hire, when to double down on marketing, and how to price your products to actually make a profit.

- •Secure Funding with Confidence: Walk into investor meetings with clean, accurate financial statements that tell a powerful story of your company's potential.

- •Optimize Cash Flow: Quickly spot where money is being wasted and get paid faster on your invoices. Our guide on invoice management for startups has some great tips on this.

- •Build a Scalable Foundation: Set up systems that can grow with your business, so you aren't stuck with an expensive, time-sucking cleanup project down the road.

Building Your Financial Filing System

Before you record a single sale or expense, you need a place to put everything. Think of your bookkeeping system like a big digital filing cabinet. If you just shove every receipt and invoice into a drawer without any folders, you’ll have a chaotic mess on your hands come tax time.

That’s where your Chart of Accounts (COA) comes in. It’s the set of folders for that filing cabinet.

The COA is the absolute backbone of your financial records. It’s essentially a complete list of every category your startup’s money can possibly fall into. Its job is simple: to give every single dollar that flows in or out of your business a specific, logical home.

A well-thought-out COA brings instant clarity. It lets you see exactly where your money is coming from and where it's going, turning a confusing pile of numbers into a story you can actually read and act on.

The Five Core Account Types

Every transaction your business makes will fit into one of five basic categories. Getting a handle on these is the first step to building a COA that actually works for you. A critical part of this process is establishing a business bank account, which acts as the central hub for tracking these transactions.

Let's break down these five pillars.

- •

Assets: This is all the stuff your company owns that has value. Think computers, office furniture, and, most importantly, the cash in your bank account.

- •

Liabilities: This is simply what your company owes to other people. It could be a loan from the bank, your credit card balance, or bills from suppliers you haven't paid yet.

- •

Equity: This is the net worth of your company. If you sold all your assets and paid off all your liabilities, what's left over belongs to the owners. For a startup, this is where you’ll track founder contributions and investor capital.

- •

Revenue (or Income): This is the fun one - all the money your company earns from its business activities. For most startups, this is primarily from selling your product or service.

- •

Expenses: This is the money you spend to keep the lights on and generate revenue. Everything from employee salaries and software subscriptions to marketing ads falls under this umbrella.

By sorting every single transaction into these five buckets, you're laying the groundwork for all three major financial statements: the Balance Sheet, the Income Statement, and the Cash Flow Statement.

A Startup-Friendly Chart of Accounts Template

Okay, let's make this real. A startup's COA looks a little different than a corner bakery's. It needs to reflect a modern business. Below is a simple, practical template showing the kinds of sub-accounts you might set up under each of the five main types.

1. Assets

- •Current Assets:

- •

1010 - Business Checking Account - •

1020 - Business Savings Account - •

1200 - Accounts Receivable(customer invoices you're waiting on)

- •

- •Fixed Assets:

- •

1500 - Computer Equipment - •

1600 - Office Furniture

- •

2. Liabilities

- •Current Liabilities:

- •

2010 - Accounts Payable(bills you need to pay) - •

2100 - Business Credit Card

- •

- •Long-Term Liabilities:

- •

2500 - Small Business Loan

- •

3. Equity

- •

3010 - Founder's Contribution - •

3020 - Venture Capital Investment - •

3900 - Retained Earnings(profits you've reinvested)

4. Revenue

- •

4010 - SaaS Subscription Revenue - •

4020 - One-Time Service Fees

5. Expenses

- •

5010 - Salaries and Wages - •

5020 - Software Subscriptions (SaaS) - •

5030 - Marketing and Advertising - •

5040 - Office Rent - •

5050 - Bank Fees

Taking the time to set up your COA this way from day one is one of the smartest things you can do for your company's financial health. It’s what turns the often-dreaded subject of bookkeeping for startups from a confusing jumble of numbers into an organized system that helps you make better decisions.

Choosing The Right Bookkeeping Software

Let's be honest: picking bookkeeping software can feel like you’re staring at a wall of TVs at an electronics store. They all look shiny, and they all promise to make your financial life easier. For a startup, though, the right tool isn’t about the flashiest features - it's about finding a solid foundation that can actually support your growth.

Think of it like this: you wouldn't use a scooter for a cross-country road trip. Sure, it’s great for zipping around town, but it’s not built for the long haul. A simple spreadsheet is your scooter; it might work for your first handful of transactions, but it'll break down fast once your business starts picking up speed. You need software built for the journey ahead.

So, how do you cut through the marketing noise? Focus on the three things that really matter for a growing company: scalability, integration, and ease of use. This simple framework will help you find a solution that empowers your financial management, not one that just adds another task to your plate.

Core Criteria For Startup Bookkeeping Software

Your software choice isn’t just another subscription - it’s a strategic decision that directly impacts your ability to grow, raise money, and make smart moves.

Here's what to look for:

- •

Scalability: Can this software grow with you? A tool that’s perfect for a solo founder working out of a coffee shop will crumble under the weight of a Series A company with multiple revenue streams and international customers. Your software has to handle more transactions without getting bogged down.

- •

Integration: Does it play nice with your other tools? Your startup is an ecosystem of different apps - Stripe for payments, your bank, maybe a payroll provider. The best bookkeeping software plugs right into these systems, automatically pulling data and saving you from hours of soul-crushing manual entry.

- •

Ease of Use: Can you figure it out without being a CPA? As a founder, your time is everything. You need an intuitive interface that makes it easy to categorize transactions, pull up a report, and get a quick snapshot of your financial health.

This is why cloud-based software is non-negotiable for any modern startup. It gives you real-time access to your financials from anywhere, which is a lifesaver for remote teams and founders who are always on the move. You always have an up-to-the-minute, accurate picture of your company's finances.

Your accounting software should be your co-pilot, not a passenger you have to drag along. It should provide real-time insights that help you steer, not just a historical log of where you've been.

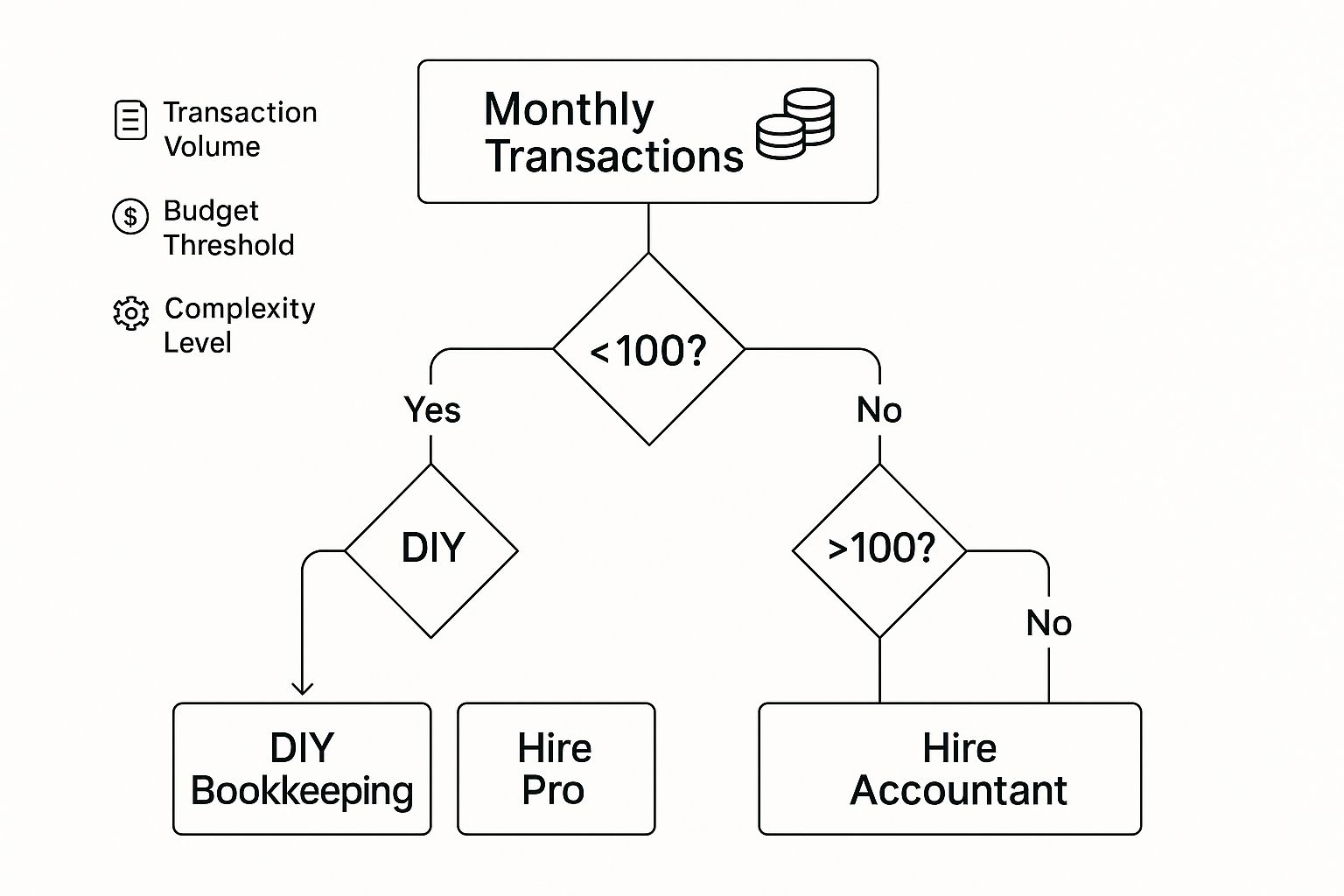

This isn't a decision you want to make on gut feeling alone. This decision tree can help you visualize which path makes the most sense for your startup's current stage.

As you can see, you might get away with a manual approach when you're just starting out, but as soon as you start growing, dedicated software becomes essential for keeping your records accurate and timely.

Startup Bookkeeping Software Comparison Framework

Your startup’s financial needs will change as it evolves. What works for a pre-seed company is worlds away from what a business needs as it scales past Series A.

To help you think through this, here’s a simple framework for evaluating software based on your current stage.

| Feature/Consideration | Pre-Seed/Bootstrapped | Seed Stage | Series A and Beyond |

|---|---|---|---|

| Primary Goal | Simplicity and cost-effectiveness | Scalability and basic investor reporting | Advanced reporting, compliance, and multi-entity support |

| Must-Have Features | Bank feeds, expense tracking, simple invoicing | Customizable chart of accounts, P&L, and Balance Sheet | Revenue recognition, advanced analytics, and audit trails |

| Integration Needs | Bank account and credit card connections | Payment processors (e.g., Stripe), payroll systems | CRM, inventory management, and international banking |

| Typical Budget | Low-cost monthly subscription ($30-$70/mo) | Mid-tier plans with more features ($70-$200/mo) | Enterprise-level plans or custom pricing ($200+/mo) |

This framework should give you a good starting point for your own research.

Using these tools is now the standard, not the exception. By 2025, about 64.4% of U.S. small and medium-sized businesses are expected to be using accounting software to manage their books. In fact, 64% of company owners now handle their own bookkeeping, a shift made possible by cloud software that automates transaction entry straight from their bank accounts. This turns a tedious manual chore into a simple, automated workflow. You can discover more about the impact of bookkeeping providers and see how this trend has fueled growth.

Ultimately, choosing the right software is an investment in your startup’s future. Taking the time now to pick a scalable, integrated, and user-friendly platform will pay you back tenfold in time saved, mistakes avoided, and opportunities seized. It's a critical step in building a rock-solid financial system for the exciting journey of bookkeeping for startups.

Designing a Bookkeeping Workflow That Actually Works

Having the right software and a perfect Chart of Accounts is like owning a high-performance race car. It looks amazing and has incredible potential, but it won't go anywhere if you don't know how to drive it. That's what a bookkeeping workflow is: your race plan. It's a simple, repeatable system that keeps your financial engine running without a hitch.

Without a routine, bookkeeping quickly becomes a frantic, month-end fire drill. You’re stuck wrestling with a mountain of uncategorized transactions and chasing down receipts, all while trying to actually run your business. That kind of stress is completely avoidable.

The goal isn't to turn you into a full-time bookkeeper. It's to build small, consistent habits that take bookkeeping for startups from a chaotic mess to a calm, predictable process. This gives you a crystal-clear, real-time view of your financial health, not just a blurry snapshot once a month.

Your Weekly Bookkeeping Sprint

Think of this as your 30-minute financial check-in. It’s not about closing the books - it's just about keeping things tidy so your monthly close is quick and painless. Block it out on your calendar for the same time every week, maybe Friday afternoon, and it’ll become a powerful habit before you know it.

Your 3-Step Weekly Checklist:

- •Categorize Transactions: Hop into your accounting software and deal with the transactions that have pulled in from your bank feeds. Since it’s only been a week, the details of each purchase will still be fresh in your mind.

- •Attach Digital Receipts: Got any receipts for major purchases this week? Snap a picture or upload the file and attach it to the transaction right away. This simple step prevents the dreaded "shoebox of receipts" from ever becoming a problem.

- •Review Open Invoices: Take a quick peek at your accounts receivable. See any invoices that just became overdue? A gentle follow-up now is so much more effective than a panicked one a month from now.

This little weekly sprint stops the small stuff from piling up. According to a U.S. Bank study, a staggering 82% of startup failures are tied to cash flow problems. A consistent weekly routine helps you spot potential cash flow issues way before they spiral into a crisis.

Your weekly workflow is your early warning system. It's where you catch small discrepancies before they become big, expensive problems and maintain a real-time pulse on your cash position.

The Monthly Financial Close

Now for the main event. Your monthly close is more thorough. This is when you finalize the previous month’s activity and pull together the reports that tell the financial story of your business. The best time to do this is within the first 5-10 days of the new month.

Here's a breakdown of your month-end review:

- •Bank Reconciliation: This is non-negotiable. It involves matching every single transaction in your bookkeeping software to the corresponding entry on your bank and credit card statements. This is how you confirm your records are 100% accurate.

- •Review Financial Statements: Once everything is reconciled, generate your three core reports: the Profit & Loss (P&L), the Balance Sheet, and the Cash Flow Statement. Don't just file them away! Look for trends. Did your software costs suddenly jump? Is your revenue growing faster than your expenses?

- •Update Your Forecast: Compare how you actually did against the financial goals you set for the month. This is where your bookkeeping data stops being a history lesson and becomes a strategic tool, helping you make smarter decisions for the next quarter.

Embracing Automation to Save Time

The secret to a workflow you can actually stick with is letting technology do the heavy lifting. Modern accounting software is designed to automate all the repetitive stuff, freeing you up to focus on the bigger picture.

For instance, you can set up rules to automatically categorize recurring expenses, like your monthly software subscriptions or rent payments. The software learns as you go, and pretty soon, a huge chunk of your transactions will be sorted without you lifting a finger. This kind of automation is what makes a weekly check-in manageable and a monthly close efficient. It’s the key to building a workflow that truly works for a busy founder.

Getting Paid Faster with Invoice Automation

For any new business, cash is oxygen. You can have a world-changing product, but if your cash flow dries up, your business simply can't breathe. This is why getting paid on time isn’t just a nice goal - it's a core survival skill.

And yet, so many founders unintentionally choke their own cash flow with clunky, manual invoicing.

Think about the old way of doing things: manually creating PDFs, attaching them to emails, tracking who paid in a spreadsheet, and then sending those awkward "just following up" emails. It's a massive time suck. Worse, it creates a dangerous lag between finishing the work and actually having the money in your bank. That administrative drag is a luxury no startup can afford.

Thankfully, modern tools have completely changed the game. By automating invoice creation, sending out polite payment reminders, and letting clients pay directly from the invoice, you can seriously shrink your payment cycles. This turns your accounts receivable from a list of anxieties into a predictable, reliable source of cash.

The True Cost of Manual Invoicing

The problem with doing invoices by hand goes way beyond the time you spend on them. It injects friction and uncertainty into every single step of getting paid. Each manual touchpoint is another opportunity for a delay or an error to sneak in, which can strain your finances and even your client relationships.

Just look at the common pitfalls:

- •Delayed Sending: You wrap up a project on Tuesday but don't actually create and send the invoice until Friday afternoon. Boom. You've just lost three days of payment time right there.

- •Human Error: It’s so easy to mistype a due date, an amount, or even the client’s email. These tiny mistakes can trigger a whole chain of back-and-forth emails and drag out the payment process.

- •Inconsistent Follow-Up: Let's be honest, chasing late payments is uncomfortable. Without a system, it's tempting to let overdue invoices slide, which subtly tells clients that paying you on time isn't a huge deal.

- •Zero Visibility: When your invoices are just files scattered across emails and spreadsheets, you have no real-time view of your outstanding revenue. It makes trying to forecast your cash flow feel more like guesswork than a strategy.

These little inefficiencies snowball, creating a constant hum of financial uncertainty. Good bookkeeping for startups is all about eliminating that uncertainty, and invoice automation is one of the most powerful ways to do it.

A Real-World Automation Scenario

Let's walk through an example. Imagine you run a B2B SaaS company and a new client just signed up for your top-tier annual plan. Instead of you manually drafting an invoice, your system kicks into gear.

- •Instant Creation: The second that deal is marked "won" in your CRM, your accounting software automatically generates a professional, branded invoice with all the right details pulled in.

- •Automated Delivery: That invoice is immediately emailed to the client. It includes a secure link where they can pay right away with a credit card or bank transfer.

- •Smart Reminders: Your system sends a friendly heads-up a few days before the payment is due. If the due date passes, it automatically follows up with a series of polite but firm reminders on a schedule you've set.

- •Seamless Reconciliation: As soon as the client pays, the payment is automatically recorded and reconciled in your books. Your accounts receivable is updated in real-time, no data entry required.

This entire chain of events happens without you lifting a finger. It doesn't just get you paid faster - it frees up your time, makes your cash flow predictable, and makes your small startup look incredibly professional and organized.

The magic happens when you connect your invoicing tools directly to your accounting software. A whopping 91% of startups that use real-time bookkeeping say they feel more prepared for audits and tax season precisely because this constant data sync gets rid of errors. And this trend is only growing - 72% of finance leaders are already planning to invest more in AI and automation.

Beyond just getting paid on time, a smarter invoicing process can uncover other financial wins, including potential savings on invoicing and payment fees. It’s about building a system that is both fast and efficient. To get a complete picture, take a look at our guide on https://tailride.so/blog/accounts-payable-best-practices to see how you can manage your outgoing cash just as effectively.

Common Questions About Startup Bookkeeping

Even with the best game plan, jumping into the world of bookkeeping can feel a little disorienting. As a founder, you're wearing a dozen hats at once, and it’s completely normal to have questions when it comes to managing the money side of things.

Think of this section as your personal cheat sheet. We’re going to tackle the most common questions we hear from founders, with straightforward answers to help you move forward with confidence.

When Should I Switch from Spreadsheets to Software?

The short answer? Yesterday. Or, more realistically, from day one. It might seem like overkill when you've only got a handful of transactions, but starting with real accounting software builds good habits right out of the gate. Your records will be clean, scalable, and ready for growth.

The absolute latest you should hold out is before you hit 10 transactions or take on any outside investment. Spreadsheets are just too prone to human error - a single typo in a formula can throw everything off. Plus, they can't give you the real-time financial picture you need to actually steer the ship.

Waiting until you're drowning in transactions just sets you up for a painful and expensive data migration project down the road. Starting with software makes bookkeeping for startups a manageable weekly task, not a dreaded quarterly cleanup.

Think of it like this: You wouldn't build a house on a shaky foundation, planning to fix it later. Your accounting software is that foundation. Start strong.

What Is the Difference Between Cash and Accrual Accounting?

Getting this right is a big deal, because it completely changes how you see your company’s financial health.

- •Cash Accounting: This is the simple one. You record money only when it actually hits or leaves your bank account. You send an invoice in May but don't get paid until June? With cash accounting, that revenue belongs to June.

- •Accrual Accounting: This method records revenue when you earn it and expenses when you incur them, no matter when the cash actually changes hands. In that same scenario, you’d record the revenue in May, when you did the work and earned the money.

While cash accounting feels easier, it can paint a misleading picture of how your business is actually performing. Accrual gives you a far more accurate view, which is why most investors and lenders demand it. If you have any plans to seek funding, this is the way to go.

How Often Should I Really Do My Bookkeeping?

Consistency is king. Letting your financial tasks pile up until the end of the month is a recipe for chaos and costly mistakes. For an early-stage startup, a simple, regular routine is your best friend.

A weekly check-in is the sweet spot. Just set aside an hour or two each week to hop into your software, categorize new transactions that have come through, and get a quick pulse on your cash position. This keeps the task from becoming a monster and the details are still fresh in your mind.

Then, at the end of each month, you can do a full bank reconciliation and pull your key reports (like your Profit & Loss and Balance Sheet). This simple rhythm ensures you always have an up-to-date financial snapshot to guide your decisions. You can find more advice in our guide to small business bookkeeping tips.

Do I Need to Hire a Bookkeeper Right Away?

Not necessarily. In the very early days, when your transaction volume is low, a founder can absolutely handle the books with good, user-friendly accounting software. The trick is just getting a solid system in place from the start.

But as your startup grows, so does the financial complexity. You’ll have more transactions, different revenue streams, maybe even payroll to manage. At that point, bringing in a professional bookkeeper or a fractional CFO becomes an incredibly smart investment.

A good rule of thumb? When you find yourself spending more than five hours a month on bookkeeping, it’s time to consider getting help. That’s valuable time you could be pouring back into growing your business. A pro doesn't just save you time - they bring strategic expertise, keep you compliant, and help you dodge expensive mistakes that could put your company at risk.

Ready to stop wasting hours on manual data entry? Tailride automates your invoice and receipt management by connecting directly to your inbox, saving you time and ensuring your books are always accurate. Learn how Tailride can transform your bookkeeping workflow.