The 12 Best Xero Add Ons and Integrations for 2025

Discover the 12 best Xero add ons and integrations to automate your accounting. Our guide details top tools for payments, payroll, expenses, and more.

Xero is a powerhouse accounting platform on its own, but its real strength is unlocked when you connect it with specialized tools. Think of Xero as your financial hub, and integrations as the spokes that connect every other part of your business, from sales and inventory to payroll and expenses. The right add-ons automate tedious tasks, eliminate manual data entry, and give you a crystal-clear, real-time view of your business's financial health.

But with over 1,000 apps available in the official marketplace, finding the perfect fit can feel overwhelming. How do you choose the ones that will actually make a difference without sinking hours into trial-and-error?

This guide cuts through the noise. We've done the heavy lifting to curate a definitive list of the best Xero add ons and integrations designed to solve specific, common business challenges. We go beyond simple descriptions, providing an in-depth analysis of what each tool does, who it’s best for, and the real-world problems it solves. Whether you're an accountant managing multiple clients, an e-commerce store owner drowning in sales data, or a startup looking to automate your entire financial workflow, you'll find a proven solution here.

Inside, you'll find a detailed breakdown for each recommended app, complete with:

- •Key feature analysis and practical use cases.

- •Honest assessments of potential limitations or considerations.

- •Screenshots to give you a feel for the user interface.

- •Direct links to get you started quickly.

Forget wading through endless options. This resource is your shortcut to finding the tools that will truly supercharge your Xero experience and help you build a more efficient, automated, and insightful accounting system. Let’s get started.

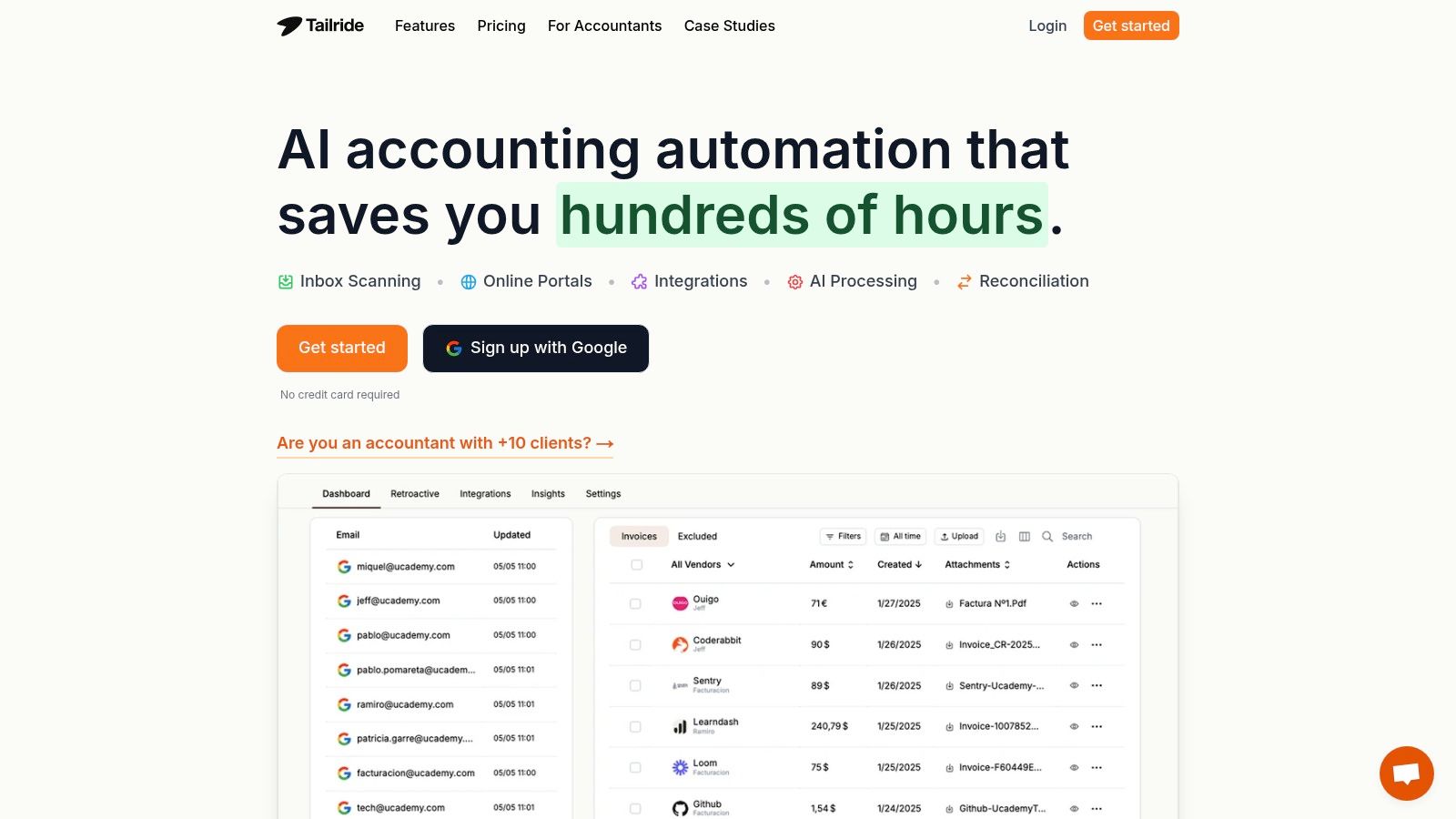

1. Tailride

Tailride emerges as a powerful and indispensable tool for any business looking to conquer invoice and receipt chaos. It's a cutting-edge automated data entry platform that stands out as one of the best Xero add ons and integrations for its sheer efficiency and intelligent design. It fundamentally eliminates the soul-crushing task of manual data entry by connecting directly to your financial information sources like email inboxes and supplier portals.

This platform isn't just about capturing data; it’s about making that data work for you. Tailride’s AI engine intelligently extracts information from PDFs, images, and even email bodies, then pushes it seamlessly into Xero, QuickBooks, or other systems. This ensures your financial records are always accurate and up-to-date without constant manual intervention.

Key Features and Use Cases

- •Automated Invoice Capture: Tailride connects to Gmail, Outlook, or any IMAP inbox. It can retroactively scan years of invoices or monitor your inbox in real-time, capturing new bills as they arrive. A practical use case involves setting it to scan a dedicated "invoices@" email address, ensuring every supplier bill is automatically processed and sent to Xero for payment approval.

- •AI-Powered Custom Rules: This is where Tailride truly shines. You can create rules to automatically tag invoices from specific suppliers, classify expenses to the correct chart of accounts in Xero, or flag exceptions for review. For example, you could set a rule to automatically assign all Adobe invoices to the "Software Subscriptions" expense account.

- •Paper Receipt Handling: Unlike many competitors, Tailride tackles paper receipts with unique bots for Telegram and WhatsApp. Simply snap a photo of a receipt, send it to the bot, and the data is captured, processed, and ready for your expense reports. This is a game-changer for teams with travel or field expenses.

- •Secure Portal Extraction: The platform offers a secure Chrome extension that uses your active browser session to download invoices from supplier portals. This clever approach means you never have to share sensitive login credentials, maintaining enterprise-grade security.

Practical Implementation

Setting up Tailride is remarkably fast, with most users extracting their first invoice in under a minute. The user experience is clean and intuitive, guiding you through connecting your email and Xero accounts. A crucial tip is to start by training the AI with a batch of historical invoices. This helps it learn your specific vendors and coding preferences, maximizing accuracy from day one.

While the free plan is limited to 10 invoices per month, it’s a great way to test the core functionality. Paid plans are accessibly priced, starting at $19/month for 50 invoices, making it a scalable solution for freelancers and growing businesses alike. Given its robust security features, including GDPR compliance and Tier-2 CASA validation, Tailride is a trusted choice for businesses that prioritize data privacy.

Website: https://tailride.so

2. Xero App Store (official marketplace)

When searching for the best Xero add-ons and integrations, the first and most logical place to start is Xero’s own official marketplace. The Xero App Store is a comprehensive directory hosting over 1,000 certified applications designed to extend Xero’s core functionality. It’s the most reliable and centralized source for finding, vetting, and connecting new tools to your accounting software.

The platform is incredibly user-friendly, allowing you to filter apps by function, industry, or region, ensuring you only see solutions relevant to your business needs. Each listing provides detailed descriptions, screenshots, and, most importantly, genuine user reviews and ratings, which are invaluable for assessing an app's quality and fit.

Key Features and User Experience

The in-product installation flow is a major advantage. You can initiate a trial or connect an app directly from the listing page, significantly reducing setup friction. This streamlined process makes it easy for business owners and accountants to experiment with new tools without a complex onboarding process. While pricing information sometimes links out to the vendor’s site, the direct access to vetted tools is unparalleled.

- •Pros:

- •Most comprehensive and trusted source for Xero apps.

- •Direct, in-product installation simplifies setup.

- •User reviews provide authentic social proof and quality benchmarks.

- •Cons:

- •Listing quality and detail can vary between vendors.

- •You may need to visit external sites for complete pricing details.

For those looking to dive deeper into the technical side, you can find more information about how to integrate with the Xero App Store.

Website: https://apps.xero.com/us

3. Stripe for Xero

Stripe is a must-have integration for any business that needs to accept online payments seamlessly. It allows you to add a one-click ‘Pay now’ button directly to your Xero invoices, making it incredibly simple for customers to pay you using a credit card, Apple Pay, or Google Pay. This direct integration significantly accelerates your cash flow by removing common payment friction points for your clients.

What makes Stripe one of the best Xero add-ons is its automated reconciliation. Once a payment is made, Stripe automatically marks the invoice as paid in Xero and matches the transaction in your bank feed, saving you hours of manual data entry. For US-based users, the integration even extends to Xero’s mobile app with a ‘Tap to Pay’ feature, perfect for in-person transactions.

Key Features and User Experience

Setting up Stripe with Xero is straightforward, and its pay-per-transaction model means there are no monthly or setup fees to worry about. The user experience is designed for simplicity, from creating Payment Links for recurring invoices to ensuring PCI Level 1 compliance for secure transactions. While standard card processing fees apply and the initial payout can take a week, the reduction in accounts receivable headaches is a massive win for any business.

- •Pros:

- •No monthly fees, only pay-per-transaction pricing.

- •Automated reconciliation streamlines bookkeeping and saves time.

- •Widely trusted and secure payment platform.

- •Cons:

- •Standard card processing fees apply to each transaction.

- •The first payout can take 7–10 business days to process.

- •Surcharging rules can be complex and vary by state in the US.

Website: https://apps.xero.com/us/app/stripe

4. Square + Xero (via Amaka)

For businesses in retail, hospitality, or services that rely on Square for point-of-sale (POS) and payment processing, this integration is an absolute game-changer. Officially supported and built by Amaka, it automates the tedious process of manually entering daily sales data into Xero, making it one of the most essential Xero add-ons for brick-and-mortar and mobile businesses. The integration ensures your sales, taxes, tips, and payment fees are accurately reflected in your accounting records without daily manual effort.

This tool shines by creating a daily summarized sales invoice in Xero that matches your Square deposits, including a detailed breakdown of processing fees. This makes bank reconciliation incredibly straightforward. It supports multi-location businesses, allowing you to track performance across different sites, and can even back-sync up to a year of historical transaction data to clean up your books.

Key Features and User Experience

Setting up the integration is remarkably fast, thanks to an express wizard that guides you through the mapping process. While the core daily sync is free for Square users, Amaka offers paid plans for more advanced needs, like line-item detail syncs or specialized configurations. Management happens within the Amaka dashboard, which is separate from Xero but provides clear control over your sync settings.

- •Pros:

- •The core daily sales sync integration is free for all Square users.

- •Extremely fast and simple setup process with the express wizard.

- •Officially recognized partner integration, ensuring reliability and support.

- •Cons:

- •More advanced features require a subscription to a paid Amaka plan.

- •Integration is managed through the Amaka dashboard, not directly within Xero.

Website: https://apps.xero.com/us/app/square

5. PayPal for Xero

For businesses seeking to offer customers flexible and widely recognized payment options, the official PayPal for Xero integration is an essential tool. This add-on embeds a "Pay Now" button directly onto your Xero invoices, allowing clients to pay instantly using their PayPal account, credit/debit card via PayPal Guest Checkout, or even Venmo in the US. This familiarity and trust in the PayPal brand often lead to faster payments and improved cash flow.

The integration’s core strength lies in its automation. It automatically imports and helps reconcile your PayPal transactions on a daily basis, including sales, fees, and transfers. This saves considerable time on manual data entry and reduces the risk of reconciliation errors. By connecting directly within Xero, setup is straightforward, especially for US-based businesses, making it one of the more accessible payment integrations available.

Key Features and User Experience

The primary benefit is the expanded payment flexibility offered to your customers. With support for global currencies and broad consumer adoption, PayPal removes payment friction for a diverse client base. The automatic daily sync ensures your financial records in Xero remain accurate and up-to-date without constant manual intervention, a key feature for busy business owners.

- •Pros:

- •Significantly expands consumer payment options, including Venmo.

- •Strong buyer trust and familiarity can accelerate invoice payments.

- •Easy setup directly within Xero and automatic daily transaction reconciliation.

- •Cons:

- •Merchant fees can be higher than other payment gateways and vary by transaction.

- •PayPal's support and pricing policies can change frequently, requiring users to stay informed.

Website: https://apps.xero.com/app/paypal

6. Gusto (US Payroll + HR for Xero)

For US-based small businesses, Gusto is a top-tier payroll and HR platform that offers one of the best Xero add-ons and integrations available. It transforms complex tasks like payroll, tax filings, and benefits administration into a streamlined, automated process. Gusto’s native connection with Xero ensures that all payroll data, including wages, taxes, and reimbursements, syncs perfectly with your general ledger.

What truly makes Gusto stand out is its commitment to a modern, user-friendly experience designed for business owners, not just accountants. The platform handles everything from employee onboarding and time tracking to benefits and compliance across all 50 states, making it a comprehensive solution for managing your team. Its granular integration even allows you to map payroll expenses to Xero tracking categories like departments or projects, providing deeper financial insights.

Key Features and User Experience

Gusto’s integration is exceptionally smooth, automatically creating detailed journal entries in Xero after each pay run, which eliminates manual data entry and reduces the risk of errors. The setup is straightforward, guiding you through connecting accounts and mapping payroll items correctly. Beyond payroll, the platform’s HR tools, such as offer letters and document management, centralize employee administration in one place.

- •Pros:

- •Strong, user-friendly experience tailored for US small businesses.

- •Granular and native integration syncs with Xero tracking categories.

- •Often offers discounts and extended trials for new users.

- •Cons:

- •Pricing can become high for advanced HR features and larger teams.

- •Customer support quality can vary depending on your subscription plan.

Website: https://apps.xero.com/us/app/gusto

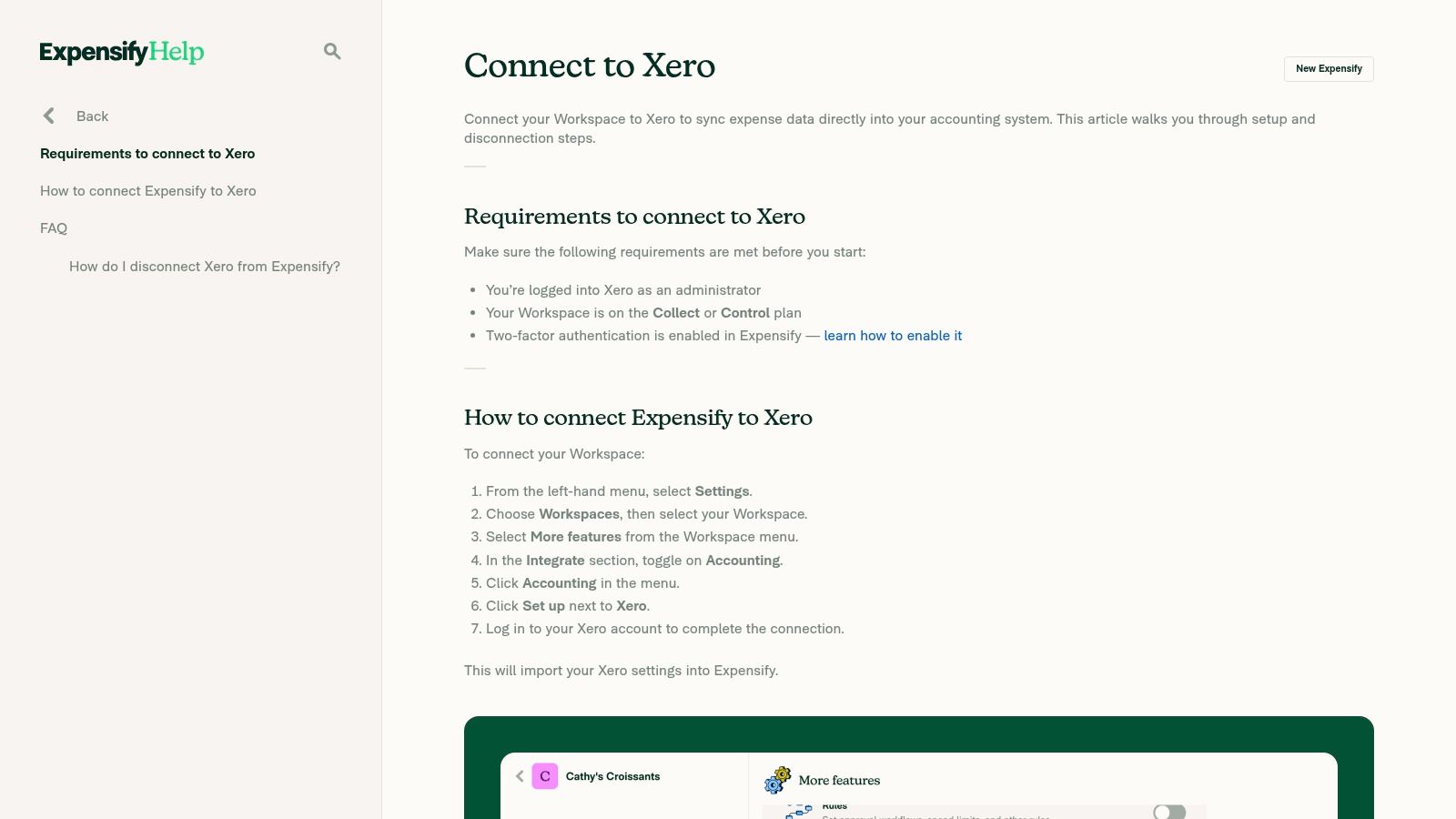

7. Expensify

Expensify is a powerhouse in the expense management world, making it one of the best Xero add-ons for businesses tired of chasing receipts and processing manual reimbursements. It automates the entire pre-accounting process, from receipt scanning and expense report submission to approvals and syncing data directly into Xero. This integration removes the tedious data entry that plagues many finance teams.

The platform’s strength lies in its SmartScan technology, which accurately captures receipt details with a simple photo. Users can then build expense reports on the go via a mobile app, track mileage, and submit for approval. For managers, custom approval workflows ensure that spending stays within policy before it's ever recorded in your accounting ledger, giving you granular control.

Key Features and User Experience

The integration with Xero is mature and robust, allowing you to sync expenses as bills, invoices, or even credit card charges, mapping them to the correct accounts in your chart of accounts. This flexibility is a significant advantage for businesses with complex spending categories. While the platform offers a wide range of features, including corporate cards and travel booking, its core expense management system is intuitive enough for any team member to adopt quickly. While Expensify is renowned for its deep integrations across various platforms, you can learn more about its capabilities by reading guides on integrating with other accounting software.

- •Pros:

- •Mature and well-documented Xero integration.

- •Affordable pricing plans suitable for small to medium-sized businesses.

- •Scales well from simple receipt capture to full policy control and corporate card management.

- •Cons:

- •The best pricing tiers often require an annual commitment and use of their corporate card.

- •The user interface can feel complex when combining travel, cards, and advanced approval rules.

Website: https://help.expensify.com/articles/new-expensify/connections/xero/Connect-to-Xero.html

8. Dext Prepare

For businesses drowning in a sea of paper receipts, invoices, and bank statements, Dext Prepare (formerly Receipt Bank) is a lifesaver. This AI-powered platform excels at high-accuracy data extraction, automating one of the most tedious parts of bookkeeping. It scans and pulls key information from documents, then publishes it directly to Xero, significantly reducing manual entry and the risk of human error.

Dext Prepare is particularly powerful for accountants and bookkeepers managing multiple clients, as well as businesses with high transaction volumes. It offers multiple capture methods, including a mobile app, email-in, and bulk uploads, making it easy to digitize paperwork on the go. The platform syncs seamlessly with Xero, mapping data to your existing chart of accounts, suppliers, and tracking categories for clean, consistent records.

Key Features and User Experience

Dext's standout feature is its advanced OCR technology, which can even extract line-item details from invoices, providing a level of granularity that many competitors lack. The integration with Xero is deep and reliable, making it an award-winning partner in the ecosystem. While its feature set can sometimes overlap with Xero’s own Hubdoc, Dext often provides a more robust and automated experience for complex needs.

- •Pros:

- •Slashes manual data entry and coding errors with high-accuracy OCR.

- •Deep Xero integration syncs suppliers, COA, and tracking categories.

- •Flexible document capture methods (mobile, email, upload).

- •Cons:

- •Pricing isn't fully transparent on the website, typically starting around $30/month.

- •Feature overlap with Hubdoc may require an evaluation to see which tool fits best.

Website: https://dext.com/us/business/product/integrate-with-accounting-software/xero

9. Hubdoc

As a Xero-owned tool, Hubdoc offers one of the most tightly integrated solutions for document capture and data extraction. It is included for free with most US-based Xero Business Edition plans (Starter, Standard, and Premium), making it an incredibly accessible starting point for businesses looking to automate their accounts payable process and go paperless. The platform streamlines the collection of bills and receipts, fetching them from emails, mobile app uploads, or direct scans.

Hubdoc’s core function is to extract key data like supplier name, date, and amount, and then publish the transaction directly into Xero as a bill, complete with the source document attached. This creates a clean, verifiable audit trail right within your accounting ledger, eliminating the need to chase down physical paperwork during reconciliation or tax season.

Key Features and User Experience

The primary advantage of Hubdoc is its seamless connection to the Xero billing workflow. Once a document is published, it appears in Xero ready for approval and payment, drastically reducing manual data entry and potential errors. While the OCR technology and feature set are more basic compared to advanced competitors, its no-cost inclusion and simplicity make it an unbeatable value proposition for small businesses just starting with automation. For those interested in the underlying mechanics, you can discover more about how email invoice extraction works.

- •Pros:

- •Included at no extra cost with most US Xero plans.

- •Deep, native integration with Xero's billing and reconciliation workflow.

- •Creates a clear and accessible audit trail by attaching documents to transactions.

- •Cons:

- •OCR accuracy and feature depth are less advanced than paid alternatives.

- •The mobile app experience, particularly on iOS, has received user feedback for performance issues.

Website: https://apps.xero.com/us/function/documents/app/hubdoc

10. A2X

For any business selling on ecommerce platforms like Shopify, Amazon, eBay, or Etsy, A2X is an essential tool for maintaining accurate financials. It solves a major headache for online sellers: reconciling bulk payouts from marketplaces. Instead of receiving thousands of individual transactions, Xero gets a single deposit, making it impossible to match sales, fees, shipping costs, and taxes manually. A2X bridges this gap by automatically summarizing each payout and creating a corresponding journal entry in Xero.

This process ensures that every line item in your Xero bank feed matches perfectly, giving you accrual-based financials that are both accurate and audit-ready. The platform is widely regarded as one of the best Xero add-ons for ecommerce because it eliminates tedious manual data entry, saving hours of work each month and preventing costly reconciliation errors. It also correctly accounts for Cost of Goods Sold (COGS), providing a true picture of your profitability.

Key Features and User Experience

A2X is renowned for its reliability and set-it-and-forget-it nature. Once configured, it runs quietly in the background, fetching payout data and posting tidy summaries to Xero. It supports multi-channel and multi-currency selling, making it scalable for growing businesses. The ability to backfill historical data is also a huge advantage for getting your books in order from day one.

- •Pros:

- •Saves countless hours by automating marketplace payout reconciliation.

- •Ensures ecommerce financials are accurate and reliable.

- •Highly recommended by ecommerce accountants and bookkeepers.

- •Cons:

- •Pricing is based on order volume and the number of connected channels, which can become costly for high-volume sellers.

- •Initial setup for complex stores might require some guidance.

Website: https://www.a2xaccounting.com/pricing

11. Cin7 Core / Cin7 Omni

For product-based businesses that have outgrown Xero’s native inventory capabilities, Cin7 offers a powerful, dedicated solution for operational control. It provides comprehensive inventory, manufacturing, and order management, making it one of the best Xero add-ons for scaling e-commerce, wholesale, and manufacturing companies. Cin7 centralizes operations by syncing sales, purchases, and stock movements directly into Xero.

This integration ensures your financial records, such as sales invoices, cost of goods sold (COGS), and inventory asset values, are always accurate without manual data entry. It’s a significant upgrade for businesses that need advanced features like bill of materials (BOM), manufacturing resource planning (MRP), and multi-channel fulfillment through connectors for marketplaces, shipping carriers, and 3PLs.

Key Features and User Experience

Cin7 Core and Omni are robust platforms designed to handle complex operational workflows, from production to fulfillment. The native Xero integration automates crucial financial postings, providing real-time visibility into profitability and stock valuation. While the platform is powerful, its complexity means it requires a dedicated implementation process and ongoing management, which is a key consideration for smaller teams. The pricing, starting at $349/month, reflects its position as an enterprise-grade solution.

- •Pros:

- •Powerful solution for scaling manufacturers and wholesalers.

- •Provides robust operational features not available in Xero alone.

- •An industry-recognized upgrade path for product businesses.

- •Cons:

- •High starting price point may be prohibitive for smaller businesses.

- •Requires significant implementation effort and change management.

Website: https://www.cin7.com/pricing/

12. Zapier

When a direct Xero integration doesn't exist, Zapier steps in as the ultimate no-code connector. It acts as a powerful bridge, linking Xero to over 8,000 other web applications to automate just about any workflow imaginable. This makes it one of the most versatile and best Xero add ons and integrations for businesses that rely on a diverse stack of digital tools.

Zapier allows you to create automated workflows called "Zaps" that trigger actions between apps. For instance, you can automatically create a new Xero invoice whenever a deal is marked as "won" in your CRM, or add a new sales contact to Xero when someone fills out a form on your website. This automation eliminates tedious manual data entry, reduces errors, and ensures your financial records are always in sync with your operational activities.

Key Features and User Experience

The platform’s strength lies in its "if this, then that" logic, which is simple enough for non-developers to master. You select a trigger from one app (like a new payment in Stripe) and an action in another (like creating a payment record in Xero). Multi-step Zaps can even include filters and conditional logic for more complex, customized automations. While a paid Zapier plan is required since Xero is a premium app, the time saved often provides a significant return on investment.

- •Pros:

- •Connects Xero to thousands of apps that lack a native integration.

- •Extremely flexible, allowing for multi-step and conditional workflows.

- •No coding knowledge is needed to build powerful automations.

- •Cons:

- •Costs can escalate based on the number of tasks and Zaps you run.

- •Requires a paid Zapier subscription to connect with Xero.

Website: https://zapier.com/apps/xero/integrations

Top 12 Xero Add-Ons Feature Comparison

| Product | Core Features/Capabilities | User Experience & Quality ★ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points & Highlights ✨ |

|---|---|---|---|---|---|

| 🏆 Tailride | AI-driven multi-format invoice capture & reconciliation | ★★★★★ Intuitive & fast setup | Free plan (10 invoices); paid from $19/mo | Accountants, finance teams, SMBs | Paper receipt bots; secure Chrome extension; GDPR & Tier-2 CASA compliant |

| Xero App Store (official) | Centralized Xero app marketplace with 1000+ apps | ★★★★ User reviews & curated listings | Varies by app; free to access marketplace | Xero users seeking add-ons | In-product installs; US category filters |

| Stripe for Xero | Card payments & Tap to Pay, auto reconciliation | ★★★★ Fast reconciliation | No fees; pay-per-transaction | US businesses accepting payments | Tap to Pay in Xero app; PCI Level 1 compliant |

| Square + Xero (Amaka) | Daily sales sync, fee breakdowns, multi-location | ★★★★ Easy setup; official support | Free core for Square users; paid Amaka plans | US retailers & POS users | Supports location/categories; back-sync 1 year |

| PayPal for Xero | PayPal & Venmo payments with auto reconciliation | ★★★★ Trusted payment options | Merchant fees apply | US businesses & online sellers | PayPal guest checkout; multi-currency support |

| Gusto (US Payroll + HR) | Payroll, tax filing, onboarding with Xero sync | ★★★★ Strong SMB focus | Higher pricing; discounts available | US SMBs needing payroll & HR | Native Xero payroll integration; tax automation |

| Expensify | Receipt capture, reimbursements, corporate cards | ★★★★ Affordable & scalable | SMB-friendly plans, annual preferred | SMBs managing expenses | SmartScan AI; integrated travel booking |

| Dext Prepare | High-accuracy OCR, direct Xero publishing | ★★★★ Award-winning partner | From ~$30/month (not fully transparent) | Accountants processing bills | Line-item extraction; long-term document storage |

| Hubdoc | Basic document capture included with Xero plans | ★★★ Easy & simple | Included with US Xero plans | US Xero users needing entry basic | Free with Xero; audit trail maintained |

| A2X | Ecommerce payouts reconciliation for marketplaces | ★★★★ Highly rated by ecommerce pros | Scales with volume & channels | Ecommerce sellers & accountants | Supports Amazon, Shopify, multi-channel |

| Cin7 Core / Cin7 Omni | Inventory, MRP, order management with Xero integration | ★★★★ Robust for scaling manufacturers | Starts at $349/month | Product manufacturers & wholesalers | Advanced ops beyond Xero; BOM and multi-3PL support |

| Zapier | No-code automation across 8,000+ apps including Xero | ★★★★ Flexible but requires learning | Paid plans; cost scales with usage | Businesses needing custom automations | Multi-step Zaps; connects disparate apps |

Building Your Perfect Xero Tech Stack

Navigating the vast ecosystem of Xero integrations can feel like an overwhelming task, but as we've explored, the potential rewards are immense. The journey from a standalone accounting platform to a fully integrated, automated business hub starts with a clear understanding of your unique operational bottlenecks. The power of Xero isn't just in its core bookkeeping features; it’s in its ability to become the central nervous system of your entire business through strategic connections.

We've covered a lot of ground, from streamlining invoice data entry with tools like Tailride and Dext Prepare to simplifying complex e-commerce accounting with A2X. We've seen how payment gateways like Stripe and Square can close the gap between sale and settlement, and how payroll specialists like Gusto can eliminate compliance headaches. Each of these tools solves a specific, often time-consuming, problem.

Key Takeaways for Building Your Stack

The central theme is this: automation frees up your most valuable resource: time. By strategically selecting the best Xero add ons and integrations, you're not just buying software; you're buying back hours that can be reinvested into client relationships, strategic planning, and business growth.

Remember, the goal is not to adopt every shiny new tool. A bloated tech stack can be just as inefficient as a manual one. The key is to be deliberate and methodical in your choices. Start by identifying the single biggest friction point in your current workflow. Is it manual receipt entry? Is it reconciling thousands of Shopify transactions? Is it chasing overdue invoices? Pinpoint that pain, and you've found your starting point.

Your Actionable Next Steps

Before you commit to any new software, follow this simple framework to ensure you're making the right choice for your business or your clients:

- •Define the Problem: Clearly articulate the specific challenge you need to solve. Don't just say "I need to be more efficient." Instead, say "I spend 10 hours a month manually keying in supplier invoices."

- •Start Small: Choose one or two integrations that address your most critical needs. Don't try to overhaul your entire system at once. A phased approach allows you to manage the change, train your team effectively, and measure the impact of each new tool.

- •Leverage Free Trials: Almost every app in the Xero App Store offers a free trial period. Use this time to its fullest. Process real transactions, test the user interface, and evaluate the quality of their customer support. This is your chance to see if the tool truly fits your workflow before you invest.

- •Consider Scalability: Think about where your business will be in one, three, or five years. Will the tool you choose today grow with you? Look for flexible pricing plans and features that can support a larger, more complex operation down the line.

By treating your Xero setup as a dynamic, evolving tech stack, you position your business for sustained efficiency and growth. The right integrations act as a force multiplier, amplifying the value you get from Xero and empowering you to focus on what truly matters.

Ready to eliminate the most time-consuming data entry task in your workflow? Start your automation journey with Tailride, the tool designed to get your invoice and bill data into Xero flawlessly and instantly. See for yourself how much time you can save by visiting Tailride and starting your free trial today.