Boost Efficiency with Accounting Workflow Management

Explore how accounting workflow management can streamline your firm’s operations. Improve efficiency and save time today!

Let's get straight to it. Accounting workflow management is simply how your firm gets work done. It’s the playbook you use to organize, track, and complete every single task, from the moment a new client walks in the door to when you deliver their final reports. A solid workflow ensures nothing ever gets lost in the shuffle.

What Is Modern Accounting Workflow Management?

Forget the old days of dusty file cabinets, endless email chains, and sticky notes covering every monitor. Modern accounting workflow management is your firm's digital command center. It’s the system that directs every task, client file, and team member, making sure work flows smoothly from one person to the next without you having to constantly chase people down for updates.

Think of it like a Michelin-star kitchen during a hectic dinner service. Every chef has a specific role, orders flow in a clear sequence, and each dish follows a precise, well-practiced path before it lands on the table. A great workflow brings that same level of smooth, predictable order to your firm’s operations, turning potential chaos into a reliable process.

Beyond Simple Checklists

This goes way beyond a glorified to-do list. A real workflow management system acts as the single source of truth for your entire team. It clearly defines who does what, and by when for every client engagement.

For instance, a standard tax preparation workflow could be set up to run on its own:

- •Client Onboarding: The system automatically sends a welcome email and a secure link for them to upload documents.

- •Preparation: Once all documents are in, the job is instantly assigned to the right accountant. No manual hand-off needed.

- •Review: As soon as the preparer finishes, the file is automatically sent to a senior manager for review.

- •Filing: After approval, the system handles getting the final client signatures and prompts the team to file.

This kind of structure takes all the guesswork out of the equation. Everyone can see exactly where every client's work is at any moment. All that time spent manually chasing people and information? Gone. That administrative headache is a real problem for many firms. In fact, one study found that before automating, 53.8% of firms spent over 5 hours a week just scheduling and assigning work. After bringing in automated tools, 75.8% of those firms cut that time down to 5 hours or less. You can dig into the numbers yourself in the full 2025 workflow automation report.

A great workflow system doesn’t just manage tasks; it liberates talent. By automating the administrative noise, you empower your team to shift from managing deadlines to delivering high-value advisory services that build client loyalty and drive firm growth.

The Shift From Manual to Automated

The difference between sticking with old-school manual methods and embracing a modern, automated system is night and day. Manual processes often rely on a messy combination of spreadsheets, disjointed email threads, and physical files. This creates information silos where it's easy for things to go wrong. An automated system, on the other hand, brings all these functions together under one roof.

To really see the difference, let’s compare the two approaches side-by-side.

Manual vs. Automated Workflow: A Quick Comparison

The table below breaks down the key distinctions between a traditional, manual setup and a modern, automated one. It highlights how automation transforms core aspects of running an accounting practice, from assigning tasks to communicating with clients.

| Feature | Manual Workflow (Spreadsheets & Email) | Automated Workflow (Management Software) |

|---|---|---|

| Task Assignment | Manual delegation via email or meetings | Automatic assignment based on pre-set rules |

| Progress Tracking | Requires constant follow-ups and status updates | Real-time dashboards showing progress for all jobs |

| Client Communication | Scattered across multiple email threads | Centralized client portal and communication logs |

| Document Storage | Disorganized folders on local drives or email | Secure, centralized, and version-controlled storage |

| Error Rate | High risk of data entry errors and missed steps | Significantly reduced through standardization and automation |

As you can see, an automated system isn't just a minor upgrade - it fundamentally changes how work gets managed, freeing up your team to focus on what truly matters.

The Real-World Payoffs of a Smart Workflow

Putting a structured system in place for accounting workflow management does a lot more than just clean up your dashboard. It delivers real, tangible results you can feel across your entire firm. The benefits aren't just about getting organized; they fundamentally change how your team works, how clients see your value, and how your business can grow. It’s about building a practice that’s more resilient, profitable, and ready for whatever comes next.

The first thing you’ll notice is a huge drop in wasted time. Just think about all those hours spent chasing down missing documents, untangling endless email chains, or manually nudging staff about deadlines. A solid workflow automates these nagging admin tasks, giving those hours right back to your team.

This newfound time isn't just for playing catch-up. It's a golden opportunity to point your most valuable asset - your team's brainpower - toward work that's more engaging and, frankly, more profitable.

Boost Team Morale and Focus

Nothing burns out a good accountant faster than constantly switching gears, drowning in repetitive admin, and fighting disorganized information. When processes are clear and predictable, your team can finally dig into the core accounting work they were actually hired to do. This simple shift is a massive boost for job satisfaction and morale.

They stop being task-jugglers and become true accounting professionals again. Empowering them like this is the secret to keeping top talent and building a strong, motivated culture. With clear priorities and automated reminders, everyone knows exactly what's on their plate, which cuts down on stress and improves the quality of their work.

By standardizing the mundane, you unlock the exceptional. An effective workflow doesn't just manage processes; it frees your talented accountants to deliver the strategic insights that clients truly value, transforming your firm from a compliance shop into an indispensable advisory partner.

Enhance Accuracy and Minimize Risk

Let's be honest: manual data entry and disjointed communication are breeding grounds for errors. A misplaced decimal, an outdated spreadsheet, or a misread email can spiral into costly mistakes, compliance headaches, and broken client trust. A centralized workflow system slashes these risks.

By using standard templates and checklists for every service, you create a safety net so no step ever gets missed. When data moves automatically from one place to another - say, from an invoice capture tool straight into your accounting software - the chance of human error plummets. You can even explore specific tactics to improve accounts payable efficiency, which is a huge piece of the accuracy puzzle.

Elevate Client Satisfaction and Growth

Your clients feel the impact of your internal processes, whether you realize it or not. Faster turnarounds, clear communication, and consistent service build incredible trust and keep them happy. A well-managed workflow means clients aren't left in the dark, wondering about the status of their work.

This operational excellence is also the foundation for real growth. It’s what lets you scale your firm without the wheels falling off. As you bring on more clients, a defined workflow ensures you can handle the extra volume without sacrificing quality. This efficiency is absolutely crucial for firms looking to expand into high-value client advisory services (CAS).

The global accounting services market is expected to hit $735.94 billion in 2025, and the firms expanding their CAS offerings are seeing massive growth. In fact, these firms reported a median revenue jump of 17% in 2023 and expect that to nearly double by 2025.

Beyond these general perks, applying specific strategies for operational efficiency improvement for fund managers and other niche financial areas can unlock even bigger gains, showing just how powerful these principles are across the board.

Building Your Workflow on a Solid Foundation

A truly great workflow system isn't just about the software you buy - it's about the strategic thinking you put in before you even start shopping. You need to build a rock-solid foundation first. Skipping this step is like trying to build a house on a shaky frame; no matter how fancy the windows are, the whole structure is at risk.

This foundation ensures that when you do bring in technology, it makes your firm genuinely better, not just faster at doing the wrong things.

Let's walk through the essential pillars you need to put in place to build a workflow that’s not only efficient but can grow right along with your firm.

Standardize Everything You Can

The very first pillar, and arguably the most important, is standardization. You need to create clear, repeatable roadmaps for every single service you offer, whether it's routine monthly bookkeeping or complex annual tax prep. When every job is treated like a one-off custom project, you're just inviting chaos, inconsistency, and wasted hours.

Think about it. A standardized bookkeeping process might look like this:

- •A go-to checklist for all required client documents.

- •A set, non-negotiable procedure for how transactions are categorized.

- •A branded template for the monthly financial report you send out.

This level of consistency guarantees every client gets the same stellar service. It also makes bringing on new team members a breeze. You’re not just training people; you’re handing them a proven playbook.

Centralize Communication and Collaboration

Next up: centralized communication. We've all been there - critical information gets lost in a black hole of scattered emails, random texts, and notes from hallway chats. Putting an end to this by shifting all client and team communication onto a single, shared platform is an absolute game-changer.

Imagine a world where every conversation, every question, and every file related to a client's work lives in one place. The frantic hunt for context is over. Your team can see the entire history of a project at a glance, which means less time spent asking "Hey, did you get that file?" and more time actually doing the work.

A centralized workflow becomes your firm's single source of truth. It stops the endless loop of "Did anyone get that file from the client?" and replaces it with a clear, auditable trail of every action taken and every message sent.

This isn't just a nice-to-have; it's what modern firms are actively seeking. Research shows the most sought-after software features are all about consolidating information, including centralized dashboards (73.9%), automated client reminders (69.3%), and secure client portals (60.6%).

Automate Repetitive and Recurring Tasks

Once you've standardized your processes, you can unlock the magic of automation. This is all about pinpointing those low-value, mind-numbing tasks that eat up your team's day and handing them over to your new robot assistant. Take a moment to think about all the manual clicks and repetitive work that happens daily.

Automation is perfect for things like:

- •Recurring Tasks: Automatically creating jobs for monthly bookkeeping or quarterly tax filings right on schedule.

- •Client Reminders: Sending polite, automated nudges for missing documents or approvals.

- •Data Entry: Using tools to instantly pull data from invoices and sync it with your accounting software.

This isn't about replacing your talented accountants; it's about freeing them from the administrative grind so they can focus on high-value advisory work. It's no wonder that a recent report found 66.1% of firms measure their success by how smoothly their systems operate - a direct payoff of smart automation. To get this right, you might consider professional accounting technology transformation services to help integrate the best tools for your firm.

Achieve Real-Time Visibility

Finally, a strong workflow foundation gives you what every firm leader craves: complete visibility. A real-time dashboard is your mission control, giving you a bird's-eye view of every job's status, who's working on what, and where potential logjams are starting to form.

This kind of transparency lets you manage your team's capacity effectively, shuffle tasks to prevent burnout, and give clients accurate, up-to-the-minute updates without having to chase anyone down. You're no longer managing by guesswork. You're making smart, data-driven decisions that keep your entire operation humming along smoothly.

Your Step-By-Step Implementation Roadmap

Switching to a new system for accounting workflow management can feel like a huge project, but breaking it down with a clear roadmap makes all the difference. This isn't about a disruptive overhaul; think of it as a controlled, strategic upgrade to your firm's operational engine. A step-by-step approach removes the guesswork and sets your team up for a smooth, successful transition.

The goal is to move from where you are now to a more efficient future with as little friction as possible. Having a solid plan is critical for any financial undertaking. For instance, a structured loan application process is a perfect example of how a methodical, step-by-step approach delivers reliable results. We'll use that same principle here.

Step 1: Map Your Current Processes

Before you even glance at any software, you need a crystal-clear picture of how work gets done right now. This is your diagnostic phase. Get in front of a whiteboard or open a spreadsheet and start tracing the journey of a common task, like monthly bookkeeping or processing accounts payable.

At each stage, ask the tough questions:

- •Who handles this task?

- •Where are the documents kept?

- •How do we get approvals?

- •Where are things always getting stuck?

This exercise is incredibly revealing. It will immediately highlight your biggest bottlenecks and hidden time-wasters. You might find that chasing down invoices eats up 25% of a junior accountant's week or that waiting on approvals is your single biggest hold-up. This map gives you a concrete target for improvement.

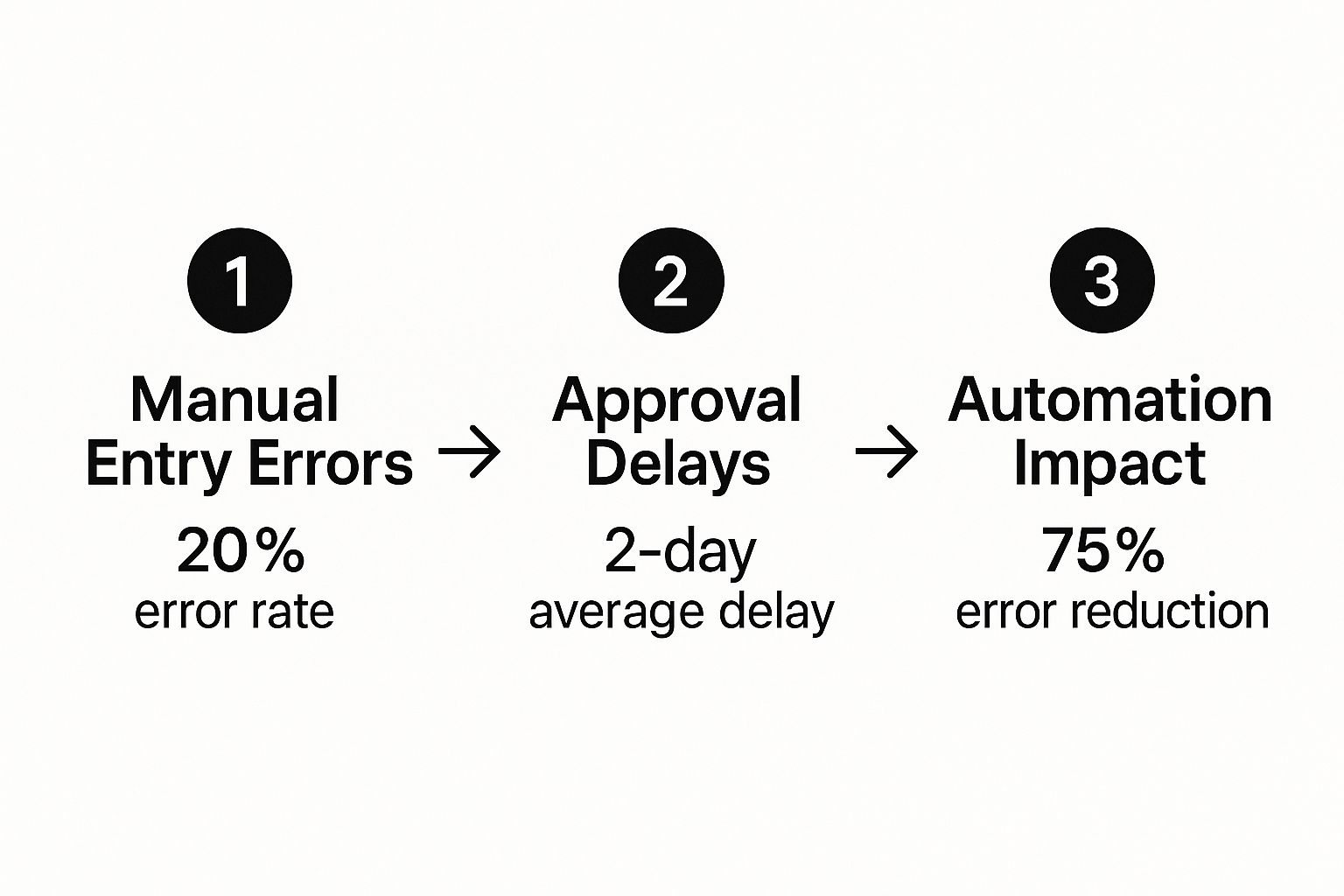

The infographic below shows some of the common pain points this mapping process uncovers and how automation can solve them.

As you can see, the shift from manual work to an automated system is huge. It has the potential to slash errors by as much as 75%.

Step 2: Select the Right Tools

Now that you know exactly what problems you need to solve, you can start looking for the right tools. Don’t get distracted by flashy features. The key is to find technology that directly targets the bottlenecks you just identified.

For example, if your process map showed that manual invoice entry is a massive time-sink, then you need a dedicated tool for that. Our guide on invoice automation software is a great resource for weighing your options. Integrating specialized software like GetInvoice can automatically capture, pull, and categorize invoice data, wiping out the manual work that leads to mistakes and delays. The goal is to build a tech stack where every tool has a clear, powerful purpose.

The best software doesn't just automate tasks; it enforces best practices. Choose tools that guide your team toward the standardized, efficient processes you've designed, making the "right way" the easiest way to work.

Step 3: Design and Build Your Templates

This is where you bring your ideal workflow to life inside the software. You’re essentially creating digital blueprints for all your core services, like client onboarding, tax prep, or monthly closes.

Each template needs to include:

- •A sequence of tasks: Every single step, laid out from start to finish.

- •Assigned roles: No confusion about who is responsible for what.

- •Deadlines: Realistic timelines with built-in dependencies.

- •Automated triggers: Set up the system to send reminders or move tasks along automatically when a step is completed.

Start simple. Just build out one or two of your most important workflow templates first. You can always add more complexity and fine-tune them later as your team gets the hang of the new system.

Step 4: Train Your Team and Run a Pilot Program

Great technology is useless if your team doesn't know how to use it. A successful launch depends entirely on good training and getting everyone on board. Don't just throw a new tool at your team and hope for the best.

First, explain the "why." Show them how this change will cut down on their tedious administrative work and free them up for more meaningful, high-value tasks. Then, run hands-on training sessions using the very templates you just built.

Next, kick off a pilot program with a small, hand-picked group of clients. This controlled test run lets you find and fix any problems in a low-stakes environment. You’ll get real-world feedback from both your team and a few trusted clients, allowing you to iron out any kinks before a firm-wide rollout. This phased approach makes for a much, much smoother transition for everyone involved.

Alright, you’ve launched your new accounting workflow management system. Congratulations! That's a huge step, but I'll be honest with you - it’s the starting line, not the finish. The real magic happens when you treat your new workflow not as a static tool, but as a living, breathing part of your firm that needs to grow and adapt right alongside you.

Think of it like a high-performance engine. You wouldn't just drop it into a car and expect it to run perfectly forever without any maintenance, right? Of course not. You’d need to perform regular tune-ups, check the oil, and maybe even upgrade a few parts down the road. Your workflow is no different. If you want to keep reaping the benefits, you have to give it consistent attention.

Conduct Regular Workflow Audits

To keep your system running in top condition, you've got to pop the hood and take a look around every so often. I recommend setting up a regular schedule - maybe quarterly or twice a year - to do a formal workflow audit. This isn't about pointing fingers or finding fault; it's about spotting opportunities for improvement.

Get your team together and have an open conversation about what's working beautifully and what's causing headaches.

Ask some direct questions:

- •Where are the bottlenecks? Are tasks still getting stuck somewhere?

- •Are there any new, mind-numbing repetitive tasks that we could automate?

- •Is our team communication still happening in the right channels, or have old habits snuck back in?

The answers you get from these check-ins are pure gold. They give you a clear roadmap for making small tweaks that can lead to massive gains in productivity.

Focus on Continuous Team Training

Your workflow system is powered by your team. As your firm evolves and you add new services or tools, you need to make sure everyone feels confident and up-to-speed. This doesn't mean you have to schedule boring, all-day training sessions.

Keep it simple. You could build a small internal knowledge base with quick how-to videos or checklists. When you roll out a new process, just hold a quick 15-minute huddle to walk everyone through it. Creating this culture of continuous learning is key. It empowers your team and helps you get the absolute most out of your tech stack. If you want to dive deeper, exploring the bigger picture of accounting process automation can reveal even more areas ripe for improvement.

Your workflow is only as strong as the team that uses it. Consistent training and open feedback loops turn your staff into active participants in the firm's efficiency, not just passive users of a tool.

Gather and Act on Client Feedback

Don't forget that your clients are on the receiving end of your workflow. Every interaction they have with your firm is a direct reflection of your internal processes. Their feedback is one of the most valuable, and often overlooked, resources you have. Is the client portal a breeze to use? Are your communications clear and prompt?

Make it incredibly easy for them to share their thoughts. A simple, automated survey sent after a big project wraps up can give you amazing insights. And when you act on that feedback - and let your clients know you did - it does more than just improve your workflow. It builds incredible loyalty.

Adapt and Scale Your Processes

As your firm grows, your workflows have to be able to handle the extra load. A process that was perfect for 20 clients might completely fall apart when you hit 200. This is where having standardized templates becomes your secret weapon for growth.

When you onboard a new client or add a new service, resist the urge to just "wing it." Pull from your existing templates to build out a solid, repeatable process from day one. This proactive approach isn't just a good idea; it's quickly becoming the standard. In fact, by mid-2025, 36% of organizations have already implemented software to automate their business processes, with half of all business leaders planning to expand their use of automation soon. You can read more about these workflow automation trends to see just how critical this is for modern firms.

Got Questions About Accounting Workflow Management? We’ve Got Answers.

Jumping into accounting workflow management can feel like a big step, and it's natural to have questions. You might be wondering, "How does this even apply to my small firm?" or "What's the very first thing I should actually do?" Let's clear up the confusion with some straight-to-the-point answers to help you get started.

What Is the Best First Step to Improve Our Accounting Workflow?

Before you even glance at a software demo, the single best thing you can do is map out how you work right now. Seriously. Grab a whiteboard or a notebook and trace one of your core services, like monthly bookkeeping, from start to finish.

Document every single step. Who does what? Where are the files stored? How do you get approvals? And most importantly, where do things always seem to get stuck? This simple exercise creates a visual blueprint of your process, instantly highlighting the bottlenecks and messy parts. Suddenly, that vague feeling of being overwhelmed turns into a specific, solvable problem.

How Can a Solo Practitioner Benefit?

For a solo practitioner, your time is literally your most valuable asset, which makes workflow management even more critical. This isn't about setting up some massive, corporate system. It's about creating simple, repeatable checklists and templates for your services.

Think of it as building a reliable operational playbook. It ensures every client gets the same high-quality service, and it frees you from the mental heavy lifting of remembering every little detail. Even simple automations, like recurring task reminders, can claw back hours each week.

And you're not alone in this. The need for better workflows is huge for smaller firms. In fact, firms with 2 to 5 employees are the largest group (37.5%) tackling this, with solo practitioners right on their heels at 34.2%. The path to success for many of them? Starting with well-defined processes (65.2%) and investing in the right software (64.3%). You can dive deeper into these findings on accounting workflow trends.

The most powerful workflow for a solo practitioner is one that acts as a second brain. It remembers the small steps, automates the reminders, and organizes the files so you can focus entirely on delivering expert advice and building client relationships.

What Are the Biggest Mistakes to Avoid During Implementation?

The #1 mistake we see is trying to automate a broken process. If your current workflow is a tangled, inefficient mess, throwing software at it will just make the mess happen faster. You'll end up with a faster, more confusing system. Always map out and simplify your process first.

Another common pitfall is failing to get your team on board. Don't just pick a new tool and expect everyone to magically start using it. Involve them from the very beginning. Show them how it makes their lives easier - less chasing down information, more meaningful work. Proper training and clear communication are key. A successful rollout happens when your team sees the new system as a helpful tool, not just another chore.

Ready to eliminate manual data entry and reclaim your time? Tailride automatically captures invoices from emails and portals, extracts the data with AI, and syncs it directly with your accounting software. Stop chasing paperwork and start focusing on what matters. Get your first invoices extracted in seconds at Tailride.