A Guide to Download Stripe Invoices

Need to download Stripe invoices for your records? Our guide walks you through finding, exporting, and automating your Stripe invoice management.

If you're running your business on Stripe, you already know that messy financial records are a no-go. This isn't just about the drudgery of bookkeeping; it's about having a real-time pulse on your cash flow, making tax season a breeze, and keeping a clear paper trail for every transaction. That's why figuring out how to download Stripe invoices is one of those fundamental skills that sets up a well-run business for success.

So, Why Bother Managing Your Stripe Invoices?

Let's be honest, managing invoices feels like just another admin task on a never-ending to-do list. But it's actually a core business function that touches everything from your customer relationships to your financial planning. Having your Stripe invoices at your fingertips can be a real lifesaver.

Picture this: a client calls, questioning a charge from three months ago. Or maybe they just need a copy of an old payment for their own accounting. If you can pull up and send them that specific invoice in minutes, you look professional, build trust, and solve the problem instantly.

The Bedrock of Good Financial Health

Think of your invoices as the foundation of your company's financial health. When tax season rolls around, a complete, organized file of your Stripe invoices saves you (and your accountant) a world of stress. It’s the difference between a calm, orderly filing and a last-minute scramble for missing documents.

Beyond just taxes, these records are essential for day-to-day operations:

- •Account Reconciliation: Making sure the payouts from Stripe actually match the sales you've made.

- •Cash Flow Analysis: Getting a clear picture of your revenue trends week-to-week or month-to-month.

- •Proof of Transaction: Having undeniable proof of a sale when you need it most.

And this isn't a small-scale operation. Stripe processed a staggering $1.4 trillion in payment volume in a single year, which shows just how many businesses rely on this system every day.

Invoice management isn't just about looking backward. It's about creating a trustworthy financial history that helps you make smarter decisions for where your business is headed.

This whole process is so critical that many businesses eventually look for ways to make it more efficient. Once you've mastered the manual download, you might find yourself exploring the benefits of automated invoice processing. It’s often the next step for any growing company looking to get time back.

Finding Invoices in Your Stripe Dashboard

Diving into your Stripe Dashboard for the first time can feel like a lot to take in. There are menus and options everywhere, but finding your invoices is actually pretty simple once you know where to click. The main thing to remember is how Stripe separates different types of financial documents.

Most people’s first instinct is to check under the "Payments" tab, which seems logical. While you’ll see successful charges and basic receipts there, it’s not where the official, itemized invoices live. For those, especially if you’re dealing with subscriptions or recurring billing, you need to head over to the Billing section.

Think of the Billing section as the true home for all your invoicing history. It’s built to give you the full picture, not just a running list of recent payments.

Getting to Your Invoice History

Once you're in the Billing area, look for a tab labeled "Invoices." Clicking that will take you straight to a complete, organized list of every invoice you've ever created. This is your mission control for managing client billing.

You'll land on a page that looks something like this, giving you a quick overview of recent invoices, their status, and the amount.

This screen is great for getting a quick snapshot of what's going on - you can see what’s been paid, what's overdue, and even what’s still sitting in drafts. It’s an incredibly useful view for keeping your accounts receivable in check.

Now, here's the real time-saver: the filtering options. Instead of scrolling through pages of invoices, you can instantly zero in on exactly what you need.

You can slice and dice your invoice list by all sorts of criteria:

- •Date Range: Need to see everything from last quarter? Or maybe just last week? Easy.

- •Status: Instantly pull up a list of all paid, overdue, or unpaid invoices.

- •Customer: See the entire billing history for a specific client with a single click.

- •Payment Method: Filter for invoices paid by card versus those paid by bank transfer.

One crucial detail to keep in mind is permissions. Not everyone on your team will be able to see or download invoices. This is a good thing - it keeps sensitive financial data secure. To access this area, a user needs to have admin or owner permissions. If you’re handling tax reporting or audits, this security layer is essential. For a deeper dive into user roles, InvoiceRelay has a helpful guide.

Once you get comfortable with these filters, what used to be a long, tedious search can become a quick, two-minute task.

How to Download Single or Bulk Invoices

Alright, so you’ve found your invoices in Stripe. Now, how do you actually get your hands on them? Most of the time, you'll be doing one of two things: grabbing a single invoice for a specific customer or exporting a whole batch for your accountant at the end of the month. Stripe’s dashboard handles both scenarios pretty well, but the workflow is a little different for each.

Let's start with the easy one. A client pings you asking for a copy of last month's invoice. No problem. From your main invoice list, just click on the one they need. This pulls up a detailed view with all the specifics - line items, customer details, and payment status.

Downloading a Single PDF Invoice

Once you're looking at the specific invoice, you'll see a button labeled "Download invoice" or "Download PDF" somewhere on the page. Give that a click, and Stripe will generate a professional-looking PDF you can save and send right over to your client. It’s a quick task that makes you look on top of your game.

This is perfect for those one-off requests. But when you need to pull records for dozens or even hundreds of transactions, clicking through them one by one is a non-starter. That’s when you need Stripe’s bulk export.

Exporting Invoices in Bulk

When it's time to do your books, you'll want to download Stripe invoices all at once. Head back to the main "Invoices" page and look for an "Export" button, which is usually tucked away in the top right corner. This is where those filtering tools we talked about become your best friend.

Before hitting export, you can dial in exactly what you need. For instance, you could set the date range to "Last quarter" and filter the status to only show "Paid" invoices. This way, your export file won't be cluttered with overdue or draft invoices - just the settled transactions you need for your records.

Pro Tip: Stripe's bulk export gives you a CSV file. This is fantastic because you can import it directly into accounting software like QuickBooks or Xero, which can save you a ton of manual data entry. The file breaks down everything into neat columns for gross amounts, fees, and customer info.

As your business grows, manually downloading and organizing these files every single month can really start to feel like a chore. If you're tired of the repetitive clicking, it might be time to look into a Stripe integration that automates invoice collection. These tools can automatically pull and sync your financial data for you, letting you focus on running your business instead of drowning in admin tasks.

Customizing Invoices Before You Download

Before you hit that download button, hold on a second. It's really worth taking a few minutes to make sure your invoices actually look like your business. A generic invoice is fine, but a branded one? That builds trust and makes you look polished every time a client gets a bill.

You might be surprised by how much control Stripe gives you over the look and feel of your invoices. This isn’t just about making things pretty; it’s about getting the right information in front of your clients to avoid confusion and questions down the road. Best of all, you only have to set it up once.

Fine-Tuning Your Invoice Template

Head over to your Stripe settings and you'll find the invoice template editor. This is your command center for making these documents your own. It's a simple step that pays off big time when you download Stripe invoices that are clear, complete, and professional.

Here are a few of the most impactful tweaks you can make:

- •Add Your Logo: This one’s a no-brainer. An invoice with your logo instantly looks more official and reinforces your brand.

- •Include Your Tax ID: Depending on where you operate, you might be legally required to show a VAT, GST, or other tax number. Get it on there to stay compliant.

- •Set a Default Memo: Have a standard message you always include? Maybe bank details for wire transfers or a project reference? Pop it in here so you don't have to type it out every time.

- •Customize the Footer: The footer is prime real estate. Use it for your payment terms (like "Net 30"), a simple "thank you," or even a link to your terms of service.

Seriously, spending 10 minutes on this now will save you from sending out bland, unprofessional-looking documents forever.

An invoice is more than just a request for money - it's a critical piece of communication. Make sure it clearly shows your business name and address, the client's info, a unique invoice number, issue date, due date, a breakdown of services, and the total amount due.

Getting these details right from the start ensures every invoice you create is already complete and ready to go.

Automating Your Invoice Management Workflow

Let's be honest, manually downloading invoices every month is a chore that just doesn't scale. As your business grows, that quick five-minute task quickly morphs into a soul-crushing time suck. This is exactly where a little bit of automation can completely change the game, turning a reactive headache into a proactive, hands-off system.

Stripe does offer some basic, but genuinely useful, automation right out of the box. For instance, you can set up your account to automatically email finalized invoices to a specific address. Think of your accountant's inbox or a dedicated finance@yourcompany.com email. It’s a simple but effective first step that ensures the right documents get where they need to go without you having to lift a finger.

Beyond Built-In Features

The real magic happens when you start connecting Stripe to the other tools you rely on every day. Platforms like Zapier or Make are fantastic for this, acting as a bridge to build some seriously powerful workflows.

Imagine this: you could create a rule so that every time an invoice is paid in Stripe, the PDF is instantly and automatically saved to a specific folder in Google Drive or Dropbox. Just like that, you have a perfectly organized, real-time archive of all your financial records. No more frantic searching at tax time.

For businesses that are really cranking out transactions, it’s worth exploring how you can achieve even greater unlocking efficiency with invoice processing automation. Dedicated tools can take this to a whole new level. For example, a specialized tool like the Stripe Invoice Extractor can pull all the detailed data and sync it directly with your accounting software, completely wiping out the need for manual data entry.

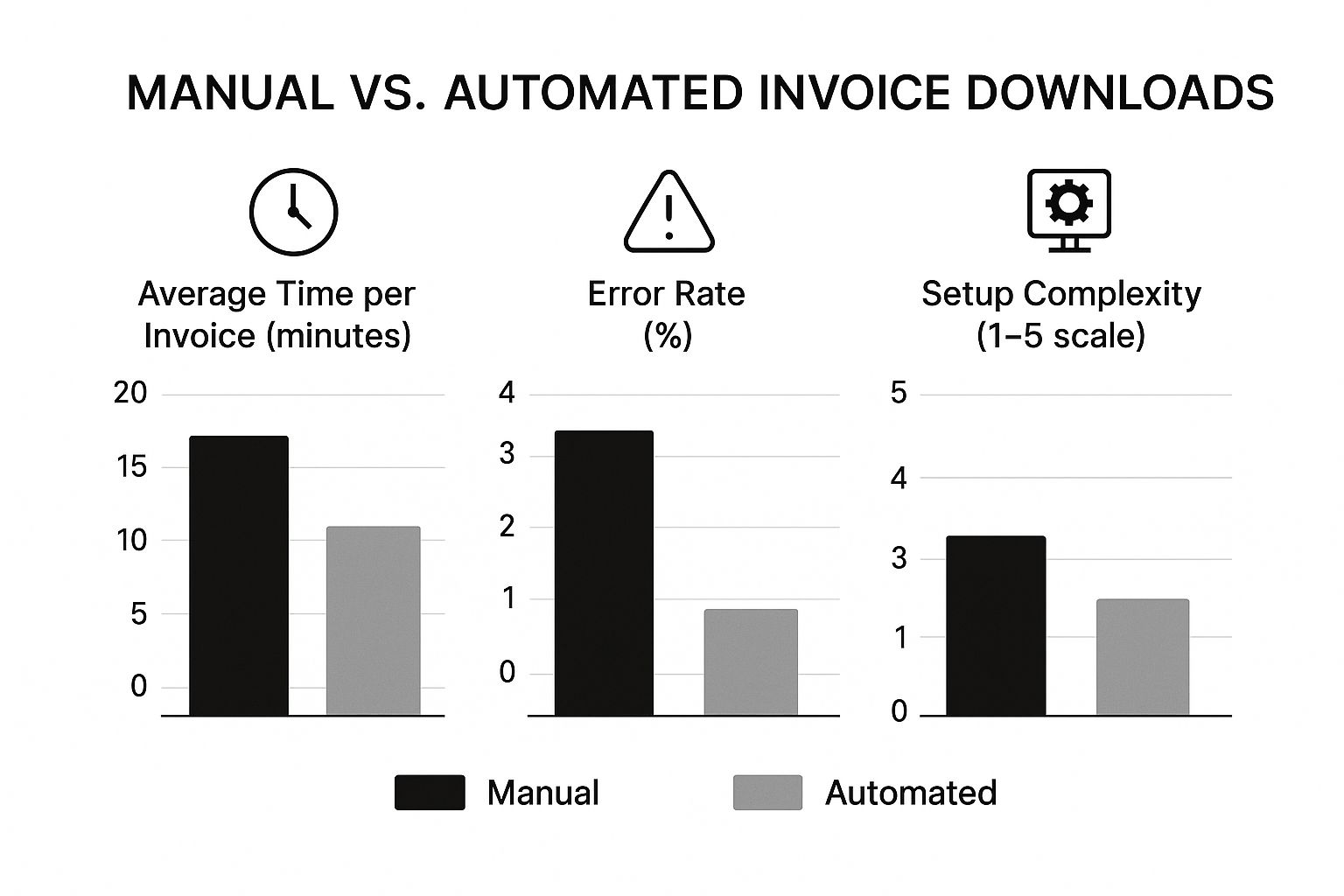

Stripe Invoice Automation Methods Compared

Choosing the right automation method really depends on your business's volume and complexity. A simple email forward might be enough for a small side project, but a growing company will need something more robust.

Here’s a quick comparison to help you figure out what makes the most sense for you:

| Method | Best For | Setup Effort | Cost |

|---|---|---|---|

| Manual Download | Very low volume, occasional invoices | None | Free (time cost) |

| Stripe's Built-in Email Forwarding | Solo entrepreneurs and small businesses | Low | Free |

| Integration Platforms (Zapier/Make) | Growing businesses needing multi-app connections | Medium | Varies (Free to $$) |

| Dedicated Extractor Tools (e.g., Tailride) | High-volume businesses needing accounting sync | Low to Medium | Subscription fee |

Ultimately, the goal is to find a system that saves you time and reduces errors without overcomplicating your process. For most, moving beyond manual downloads is a clear win.

The following chart really drives home the difference between manual and automated invoice management.

As you can see, while automation might take a little more effort to set up initially, it absolutely crushes manual work when it comes to time saved per invoice and nearly eliminates the risk of human error.

This shift isn't just a niche trend. Stripe's payment volume has soared past the $1 trillion mark, with over 1.22 million live websites using its services. All those businesses need their invoices for compliance, accounting, and clear financial records, making automation a critical strategy for anyone serious about growth.

Got Questions About Your Stripe Invoices? Let's Clear Them Up.

Even after you've pulled a few invoices from Stripe, some common questions always seem to come up. It's easy to get tripped up by the different document types or file formats. Let's walk through some of the most frequent sticking points so you can grab exactly what you need without the headache.

A lot of people ask about the difference between a receipt and an invoice. It’s a great question, and Stripe actually separates them for a good reason.

Can I Get a Receipt Instead of an Invoice?

Yep, you sure can. Think of it this way: invoices are the detailed bills you send before or when payment is due, which is why you find them under the Billing section. They’re perfect for B2B clients or subscriptions.

Receipts, on the other hand, are simple confirmations that a payment has cleared. You'll find these under the Payments section of your dashboard.

Just click into any successful payment, and you'll see options to "View receipt" or "Send receipt." One is a request for money, the other is proof it was paid. Simple as that.

What File Formats Can I Download?

For a single invoice, Stripe gives you a PDF. This is the gold standard for financial documents. PDFs look professional, they’re secure, and the formatting is locked, which is exactly what you want for client records or your own bookkeeping.

When you're exporting a whole batch of invoices, though, Stripe provides a CSV file. This is a lifesaver for anyone doing serious accounting. You can upload a CSV directly into tools like QuickBooks or Xero, which saves a ton of time on manual data entry and helps avoid costly mistakes.

How Do I Resend an Invoice to a Customer?

We've all been there. A client can't find the original email, or their finance team needs a copy for their records. Thankfully, resending an invoice from Stripe is a piece of cake.

It only takes a few clicks:

- •Head back over to the Billing section and click on "Invoices."

- •Find the invoice you need and click it to open up the details.

- •Just look for the "Send invoice" button.

You can double-check the email address, add a quick personal note, and fire it off. It’s a small touch that keeps things moving and helps you get paid faster, all while looking professional.

Tired of digging through dashboards and manually downloading documents? Tailride plugs right into Stripe and other tools, automatically fetching and organizing every single invoice and receipt for you. Get started for free at tailride.so and get your time back.