Top 10 Best Document Management Software for Accountants in 2025

Discover the best document management software for accountants in 2025. Streamline your workflow with our top picks to boost productivity and security.

Welcome, accountants, bookkeepers, and financial pros! If you're tired of drowning in a sea of paperwork, chasing clients for documents, and wrestling with disorganized files, you've come to the right place. A robust document management system isn't just a 'nice-to-have' anymore; it's the backbone of a modern, efficient, and secure accounting practice. The right software can transform your workflows, slash administrative hours, and elevate your client service from good to exceptional.

But with so many options, how do you find the perfect fit? We've done the heavy lifting for you. This guide cuts through the marketing noise to provide an honest, in-depth look at the 12 best document management software for accountants. We'll explore everything from all-in-one practice management suites like Canopy and TaxDome to specialized client portal tools like SmartVault and Liscio, helping you make an informed decision that future-proofs your firm.

Understanding the value of a robust system begins with adhering to essential documentation best practices, which is why we’re focusing on tools that enhance compliance and security. Inside, you'll find detailed breakdowns of each platform's key features, integrations, pricing, and specific use cases, complete with screenshots and direct links to get you started. We’ll also give you our frank assessment of the pros and cons, so you can confidently choose the platform that aligns perfectly with your firm's unique needs, client base, and growth goals. Let's dive in and find the system that will reclaim your time and streamline your operations.

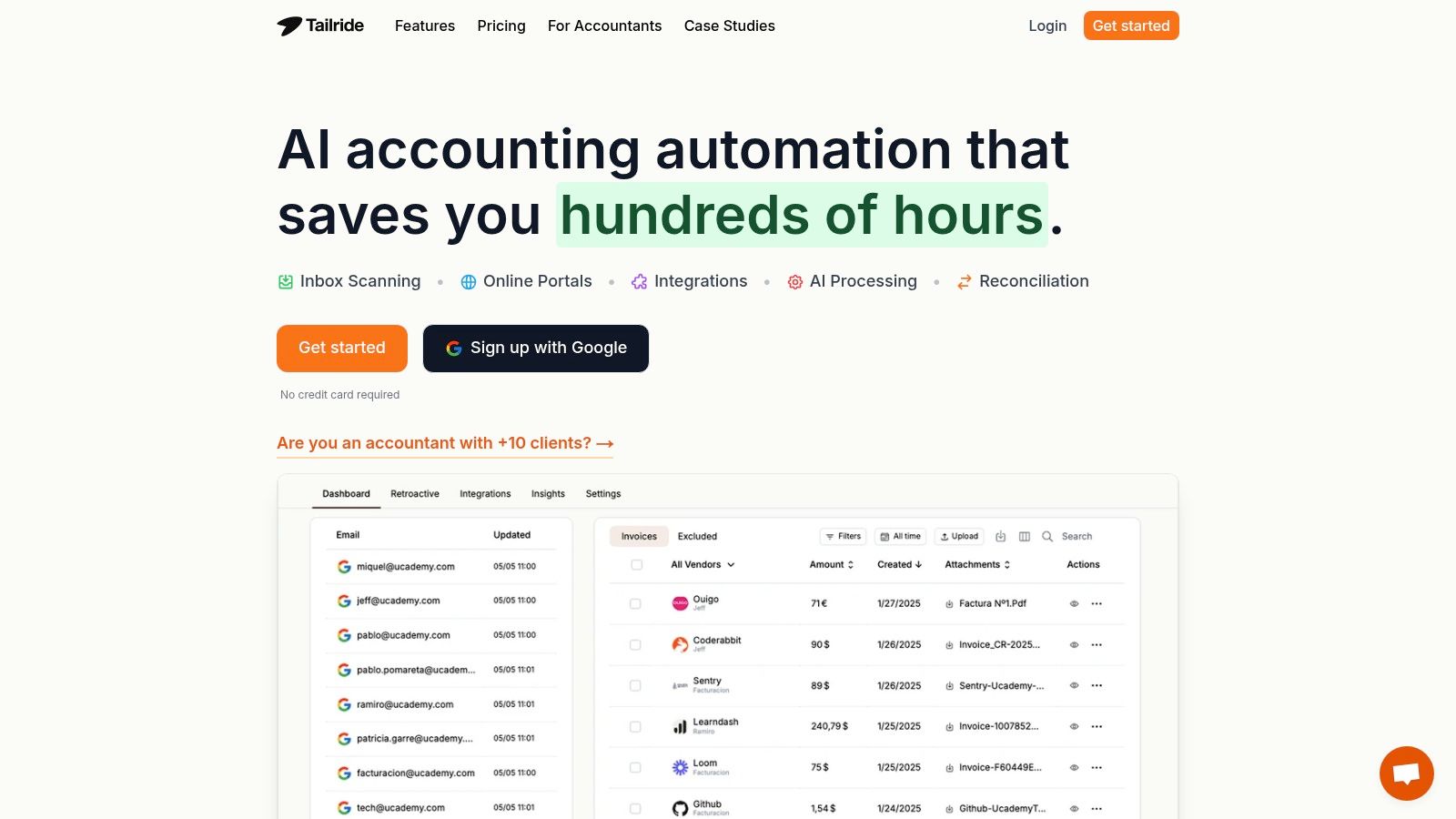

1. Tailride

Tailride emerges as a premier choice for the best document management software for accountants by focusing on a critical pain point: automated invoice and receipt management. It’s engineered to virtually eliminate manual data entry, saving finance teams hundreds of hours by intelligently capturing, classifying, and processing financial documents from nearly any source. The platform’s core strength lies in its powerful AI that learns and adapts to your firm's specific needs.

What truly sets Tailride apart is its multifaceted approach to document capture. It connects directly to email inboxes (Gmail, Outlook, IMAP) and over 20 major online portals to automatically pull invoices and receipts. This removes the need for clients to constantly forward documents, creating a seamless, "set it and forget it" workflow that accountants managing multiple clients will appreciate.

Key Features & Use Cases

- •AI-Powered Data Extraction: The intelligent AI captures data from PDFs, images, email bodies, and URLs with near-perfect accuracy. Accountants can set custom rules for precise GL coding, tagging, and categorization, ensuring every document is processed correctly from the start.

- •Secure Portal Connectivity: A unique Chrome extension allows you to fetch invoices directly from vendor portals like Amazon or Meta Ads without storing client login credentials. This enhances security and simplifies the collection of recurring bills.

- •Effortless Expense Reporting: Team members can submit paper receipts instantly by snapping a photo and sending it via dedicated Telegram or WhatsApp bots, making expense tracking simple and immediate.

- •Multi-Currency Reconciliation: Tailride matches invoices against bank transactions across different currencies, flagging missing entries and ensuring audit-ready financial records.

Pricing and Integration

Tailride offers a flexible pricing model designed to scale with your firm. It starts with a free plan for up to 10 invoices per month, making it accessible for solo practitioners or small businesses to test its capabilities. Paid plans are cost-effective, starting at $19 for 50 invoices.

The platform integrates seamlessly with essential accounting software like QuickBooks, Xero, and Business Central, plus cloud storage like Google Drive and Sheets, ensuring that your automated data flows directly into your existing ecosystem.

Pros & Cons

| Pros | Cons |

|---|---|

| Automates up to 99% of manual invoice data entry, saving significant time. | The free plan’s 10-invoice limit is restrictive for most active businesses. |

| Securely fetches invoices from vendor portals without needing client credentials. | Initial setup of custom AI rules and integrations may require a small time investment. |

| Handles paper receipts easily via popular messaging apps. | |

| Enterprise-grade security (GDPR, Tier-2 CASA certified) provides peace of mind. | |

| Direct integrations with major accounting software ensure smooth workflow continuity. |

Visit Website: https://tailride.so

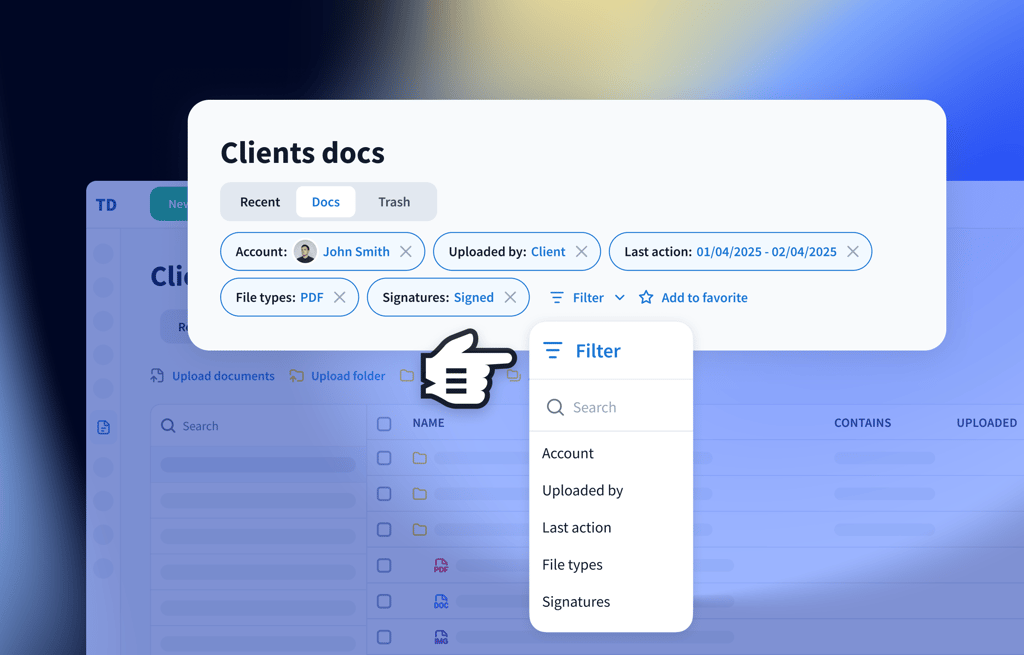

2. TaxDome (Document Management That Connects Every Part of Your Workflow)

Document management in TaxDome is designed around how accounting practices actually work - not as a standalone tool, but as part of a connected system. It includes essentials like unlimited secure storage and e-signatures (KBA available), folder templates and access rights, along with a built-in PDF editor, AI-powered document naming, customizable intake forms, the ability to lock documents to invoices, and more.

Rather than existing in isolation, document management connects with the broader workflow - from proposal to payment - with automations reducing manual steps and notifications keeping everyone aligned.

Why It Makes the List

TaxDome earns its spot as one of the best document management software platforms for accountants for its focus on consolidating firm operations and client collaboration in one place. It's widely used across the industry and recognized with seven 2025 CPA Practice Advisor Readers' Choice Awards, including categories for document automation and practice management. When everything runs on one platform, firms see faster client responses and greater internal efficiency.

Best For: Firms that are growing and need a unified platform to manage operations and deliver a consistent, high-quality client experience at scale.

| Feature Highlights | Our Take |

|---|---|

| AI-Driven Document Management | Combines everyday tasks like renaming and tagging with deeper functionality, which extracts data and sends it into connected tax software |

| Advanced Automation | Supports even the most complex workflows with automation tools designed to take manual admin off your plate |

| Client Portal | Gives clients a simple, mobile-friendly way to upload documents, e-sign, and approve, making intake faster and delivery more reliable |

Pros & Cons

- •Pro: Everything you need is built in - no add-ons required

- •Pro: Clients send what you need faster thanks to an easy and intuitive experience

- •Con: Learning curve for teams adopting end-to-end workflow tools

- •Con: Customizing automations and forms may require some upfront setup

Website: https://taxdome.com/

3. Wolters Kluwer - CCH Axcess Document

For accounting firms already invested in the Wolters Kluwer ecosystem, CCH Axcess Document is less a choice and more a natural extension of their existing workflow. This platform is designed from the ground up specifically for the rigorous demands of tax and audit professionals. Its standout feature is the native integration with the broader CCH Axcess suite, which creates a unified command center for client work, from tax preparation to document storage and secure client portal delivery.

Why It Makes the List

CCH Axcess Document excels in governance and compliance, making it one of the best document management software for accountants who prioritize security. It offers robust, role-based security permissions and granular retention policies that help firms meet regulatory requirements automatically. The ability to publish documents directly to the CCH Axcess Portal for clients streamlines communication and eliminates the need for insecure email attachments. This tight coupling of services is a powerful advantage; you can learn more about the importance of accounting software integration here.

Best For: Firms deeply embedded in the Wolters Kluwer software suite.

| Feature Highlights | Our Take |

|---|---|

| Native CCH Axcess Integration | Unmatched workflow efficiency for existing Wolters Kluwer users. |

| Strict Governance Controls | Strong audit trails, version control, and retention policies. |

| Direct-to-Portal Publishing | Simplifies secure client collaboration and document sharing. |

Pros & Cons

- •Pro: Purpose-built for the specific needs of modern CPA firms.

- •Pro: Powerful security and compliance features are baked in.

- •Con: Pricing is opaque and requires a custom quote, making it hard to budget upfront.

- •Con: Some users report occasional system slowdowns during peak tax season.

Website: https://www.wolterskluwer.com/en/solutions/cch-axcess/document

4. Thomson Reuters - GoFileRoom

For accounting professionals operating within the Thomson Reuters ecosystem, GoFileRoom is a well-established and powerful document management solution. It's a mature, web-based platform designed specifically for the complex workflows of tax and accounting firms. Its key strength lies in its deep integration with the Thomson Reuters suite of tax products, creating a cohesive environment where documents flow seamlessly from preparation to storage and retrieval.

Why It Makes the List

GoFileRoom earns its spot as one of the best document management software for accountants through its robust indexing and search capabilities. The platform allows for user-defined indices, making it incredibly fast to locate specific client files or engagement documents, even within massive archives. It also supports essential security features like multi-factor authentication (MFA) and provides an open API for custom integrations, offering a level of flexibility not always seen in enterprise-grade accounting software. The extensive documentation and onboarding resources ensure firms can get up and running effectively.

Best For: Accounting firms heavily invested in the Thomson Reuters software ecosystem.

| Feature Highlights | Our Take |

|---|---|

| User-Defined Indices | Offers highly customizable and rapid search functionality. |

| Deep Thomson Reuters Integration | Creates a seamless workflow for firms using products like UltraTax CS. |

| API Access for Integrations | Provides the flexibility to connect with other essential business tools. |

Pros & Cons

- •Pro: Mature, CPA-focused feature set built for professional firm workflows.

- •Pro: Extensive product documentation and onboarding support for new users.

- •Con: Officially limited to Chrome browser support, which might not suit all firms.

- •Con: Some add-ins and integrations are Windows-centric, potentially limiting Mac users.

Website: https://tax.thomsonreuters.com/gofileroom

5. SmartVault (Document Management + Client Portal)

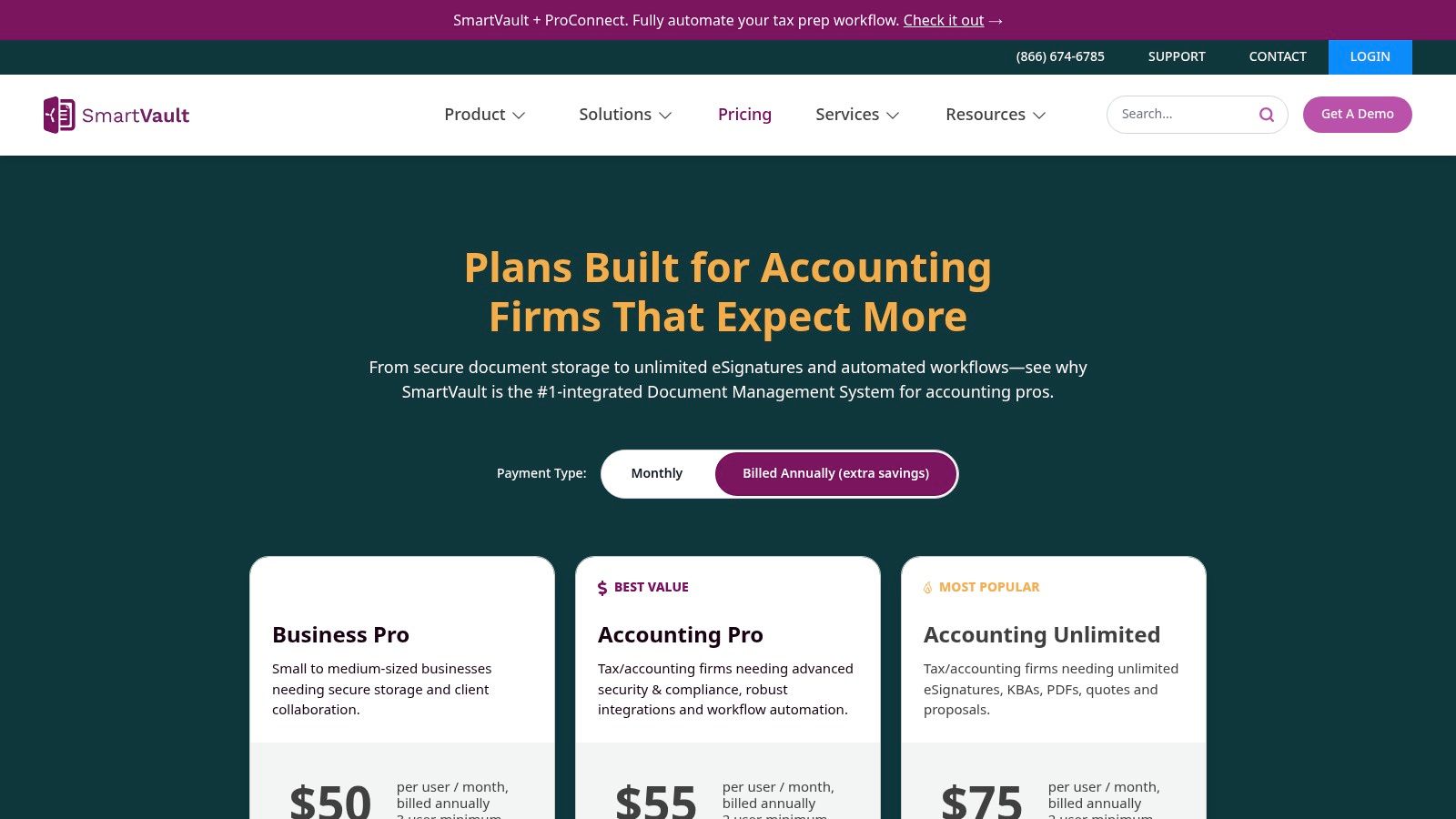

SmartVault carves out its niche by offering a powerful combination of cloud document management and a secure, branded client portal, built specifically for accounting professionals. Its major differentiator is the deep, proven integration with the Intuit ecosystem, particularly QuickBooks Desktop and Online. This allows accountants to attach, view, and manage source documents directly within their bookkeeping software, dramatically reducing app-switching and streamlining workflows from a single interface.

Why It Makes the List

SmartVault is a top contender for the best document management software for accountants who live and breathe QuickBooks. The platform comes loaded with accounting-centric templates for folder structures, which automates setup and ensures consistency across all clients. Its transparent pricing, unlimited cloud storage on all plans, and US-based support make it an accessible yet powerful choice. The combination of document storage, a client portal, and workflow automation makes it a comprehensive solution, which you can explore further in our guide to accounting document management software.

Best For: Accounting firms heavily reliant on QuickBooks and other Intuit tax products.

| Feature Highlights | Our Take |

|---|---|

| Deep QuickBooks Integration | A QBO browser extension and Desktop toolbar make this feel native. |

| Unlimited Cloud Storage | No need to worry about data caps as your firm and client base grow. |

| Integrated Client Portal | Provides a secure, professional way to exchange files and collaborate. |

Pros & Cons

- •Pro: Transparent pricing and highly regarded US-based customer support.

- •Pro: Proven, reliable integration with major Intuit tax and accounting products.

- •Con: Some plans have minimum user requirements, which may not suit sole practitioners.

- •Con: Access to advanced features like workflow automation requires higher-tier plans.

Website: https://www.smartvault.com/pricing/

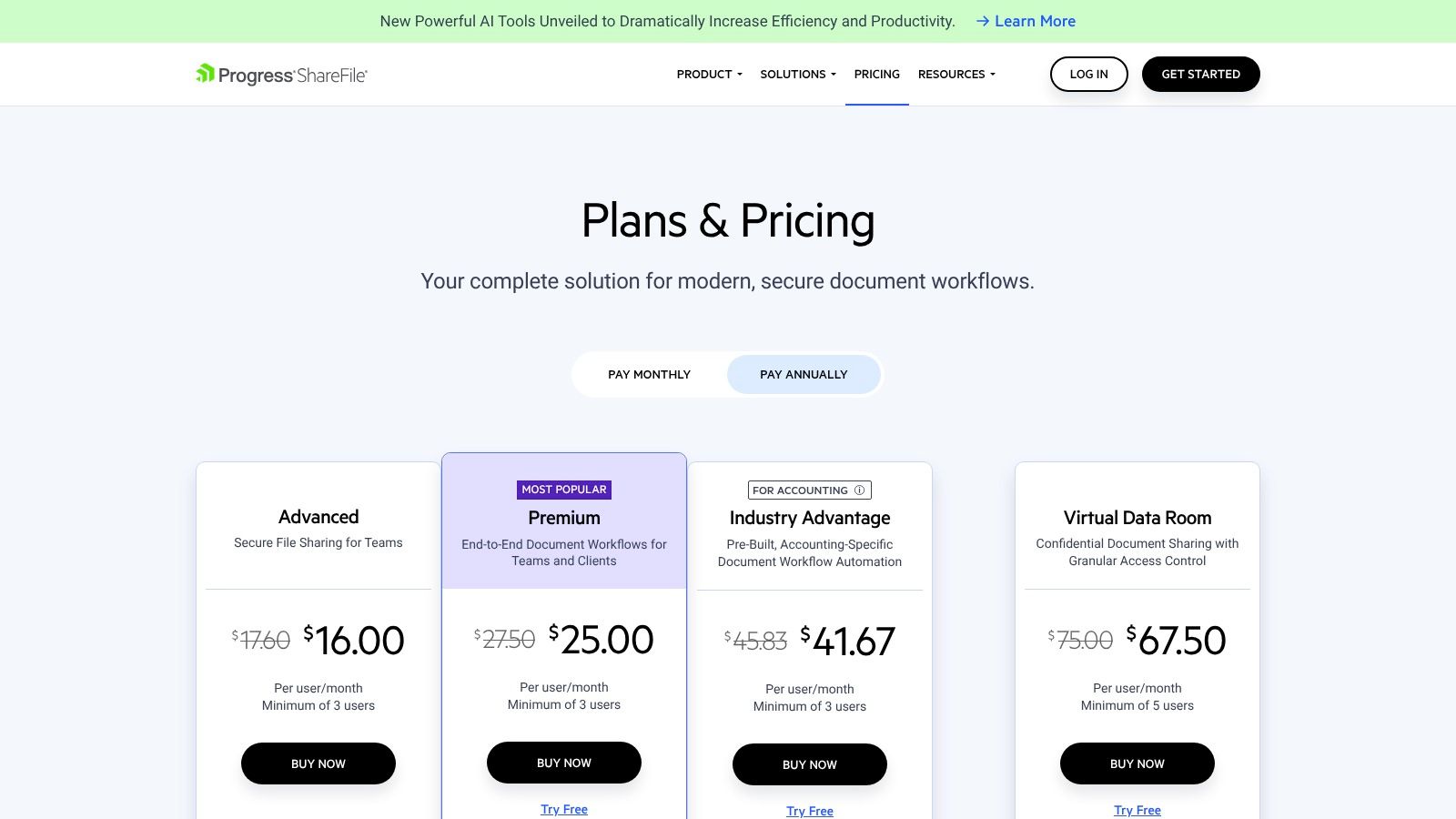

6. ShareFile (formerly Citrix ShareFile)

ShareFile has carved out a niche as a premier solution for secure client collaboration and document exchange. While it serves many industries, its features are particularly well-suited for accountants who need a branded, professional, and secure way to interact with clients. Its strength lies in combining a robust client portal with advanced features like e-signatures and automated request lists, making it a comprehensive tool for managing the entire client engagement lifecycle from a single, secure platform.

Why It Makes the List

ShareFile earns its spot as one of the best document management software for accountants by focusing heavily on the client experience and compliance. The platform's "Accounting Industry Advantage" plan includes pre-built templates for common engagements, like tax preparation, streamlining the information-gathering process significantly. Its broad compliance with regulations such as HIPAA and FINRA, coupled with granular permission controls and detailed audit trails, provides peace of mind when handling sensitive financial data.

Best For: Firms prioritizing a secure, branded client portal with built-in e-signature and workflow automation.

| Feature Highlights | Our Take |

|---|---|

| Branded Client Portal | Creates a professional and seamless experience for clients. |

| Integrated E-Signatures | Collect legally binding signatures on engagement letters and tax forms. |

| Automated Request Lists | Simplifies the client PBC (Provided by Client) list process. |

Pros & Cons

- •Pro: Strong compliance posture and security features, including Virtual Data Rooms.

- •Pro: Excellent for standardizing client interactions with templates and workflows.

- •Con: Accounting-specific templates are only available on higher-tier plans.

- •Con: Some plans come with minimum user counts, which may be a barrier for solo practitioners.

Website: https://www.sharefile.com/plans-pricing

7. Canopy (Practice Management + Document Management)

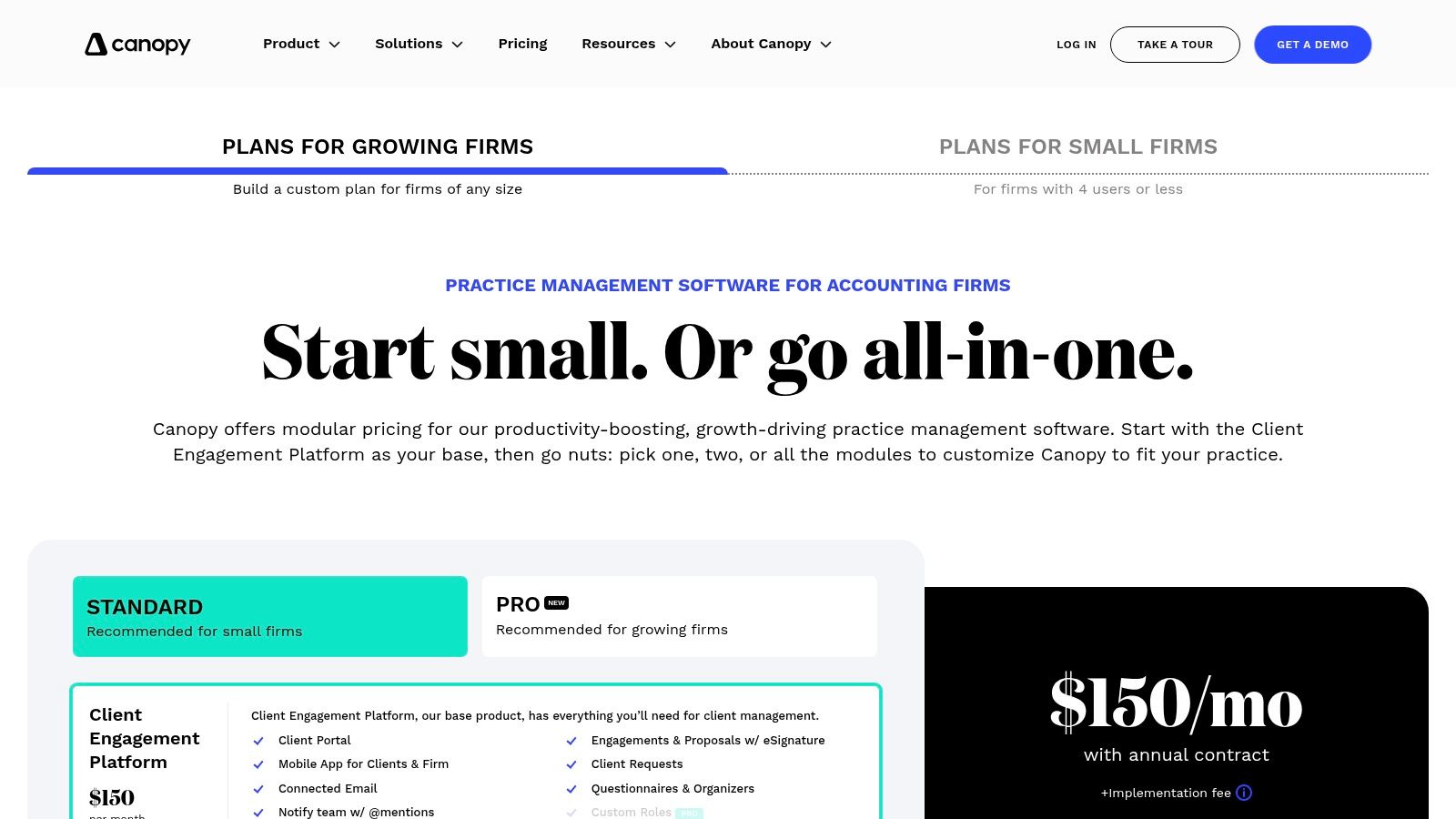

Canopy positions itself as a modern, all-in-one practice management suite where document management is a core, seamlessly integrated component rather than just an add-on. It's built for accounting firms that want to consolidate their tech stack, combining a client portal, CRM, workflow, time and billing, and document storage into a single, cohesive platform. The standout element is its modular approach, allowing firms to start with the essentials like document management and add other functionalities as they grow.

Why It Makes the List

Canopy earns its spot as one of the best document management software for accountants because it pairs robust storage with exceptional client-facing tools right out of the box. Every plan includes a secure client portal with unlimited storage and unlimited e-signatures, which is a massive value proposition for firms focused on client experience. Its transparent, modular pricing is a refreshing change in a market often dominated by opaque quotes, making it easier for small to mid-sized firms to budget and scale.

Best For: Growing firms seeking a scalable, all-in-one practice management platform with a strong client portal.

| Feature Highlights | Our Take |

|---|---|

| Modular Platform | Lets you build your ideal software stack by adding modules as needed. |

| Unlimited Storage & E-Signatures | Incredible value included in the base package for client collaboration. |

| Desktop Sync & Print Driver | Makes it easy to save files directly to a client's folder from any application. |

Pros & Cons

- •Pro: Transparent module pricing and bundles designed for smaller firms.

- •Pro: Strong portal and e-signature tools are included, not expensive add-ons.

- •Con: Pricing can increase significantly as you add more modules and users.

- •Con: Being an all-in-one platform, its individual modules may not be as deep as a standalone, specialized tool.

Website: https://www.getcanopy.com/pricing

8. Suralink (Client PBC Request Lists + Workpaper Suite)

Suralink tackles document management from a unique angle, focusing on the client collaboration pain point that plagues every audit, tax, and advisory engagement: the "Prepared By Client" (PBC) request list. Instead of being a general-purpose file cabinet, Suralink is a purpose-built platform designed to streamline the evidence-gathering process. It replaces chaotic email chains and insecure file transfers with a centralized, auditable hub for requesting, receiving, and approving client documents, making it a critical tool for engagement efficiency.

Why It Makes the List

What makes Suralink one of the best document management software for accountants is its laser focus on eliminating friction in client communication. The platform provides a dynamic request list where both the firm and the client can see outstanding items, track progress, and communicate in real-time. This transparency drastically reduces the back-and-forth and follow-up work that consumes so much non-billable time. With its optional Workpaper Suite, Suralink extends this efficiency into the engagement itself, offering tools like OCR and data linking directly within the platform.

Best For: Audit, tax, and advisory firms focused on streamlining client PBC requests and engagement workflows.

| Feature Highlights | Our Take |

|---|---|

| Dynamic PBC Request Lists | A massive upgrade from spreadsheet and email-based tracking. |

| Reusable Engagement Templates | Standardizes and accelerates the setup for recurring client work. |

| Comprehensive Audit Trails | Provides a clear, compliant record of all client requests and submissions. |

Pros & Cons

- •Pro: Purpose-built to reduce chasing clients and eliminate messy email threads.

- •Pro: Highly scalable with unlimited client users and reusable templates for efficiency.

- •Con: Pricing is quote-based and not publicly listed, requiring a sales conversation.

- •Con: Some advanced features like e-signatures and AI are only available on higher-tier plans.

Website: https://www.suralink.com/

9. Liscio (Client Portal + Secure Document Exchange)

Liscio approaches document management from a client experience perspective, wrapping secure file exchange within a modern, mobile-friendly communication platform. It’s designed to eliminate the friction of endless email chains and client follow-ups by centralizing all interactions, tasks, and files into a single, unified timeline for each client. This focus on streamlined, real-time collaboration makes it an excellent choice for firms wanting to improve client responsiveness and satisfaction.

Why It Makes the List

Liscio stands out because it treats document management as a component of the overall client relationship, not just a storage problem. Its AI-assisted features help manage incoming messages and files, while integrated file requests and task management keep projects moving. This comprehensive approach is why it's considered one of the best document management software for accountants focused on service delivery. The platform’s design significantly reduces the administrative burden of chasing clients for information, a common pain point for many firms. You can explore how online client portals are transforming accounting here.

Best For: Firms prioritizing a modern, mobile-first client experience to drive faster responses.

| Feature Highlights | Our Take |

|---|---|

| Unified Client Timelines | Combines secure chat, files, and tasks for a complete client view. |

| Mobile-First Design | Excellent mobile apps for both firm staff and clients for on-the-go access. |

| AI-Assisted Management | AI helps categorize messages and files, reducing manual organization. |

Pros & Cons

- •Pro: Measurably improves client response times and satisfaction.

- •Pro: Flexible pricing plans that can scale from solo practitioners to large firms.

- •Con: Some features like e-signatures have usage-based costs beyond included quotas.

- •Con: Primarily a client interaction platform, not a deep, archival back-office system.

Website: https://www.liscio.me/

10. Microsoft SharePoint (Microsoft 365) - SharePoint Online

For firms already operating within the Microsoft 365 ecosystem, SharePoint Online represents a powerful and cost-effective foundation for building a custom document management system. Rather than being a ready-made accounting DMS, SharePoint provides the core building blocks: document libraries, version control, granular permissions, and robust metadata. Its real power lies in its deep integration with tools accountants use daily, like Outlook, Teams, and OneDrive, creating a cohesive and familiar digital workspace.

Why It Makes the List

SharePoint makes the list because of its unparalleled flexibility and value for tech-savvy firms willing to invest in setup. It can be configured to replicate the functionality of expensive, purpose-built systems, from client-specific sites to complex retention policies. With tools like Power Automate, firms can design custom workflows for document approval or new client onboarding. This makes it one of the best document management software for accountants who want total control over their digital environment without a massive per-user software expense.

Best For: Firms with existing Microsoft 365 licenses and the IT resources to configure a tailored solution.

| Feature Highlights | Our Take |

|---|---|

| Document Libraries & Versioning | Provides strong core features for version control and retention. |

| Deep Microsoft 365 Integration | Seamlessly works with Outlook, Teams, and OneDrive for unified workflows. |

| Extensible with Power Automate | Enables the creation of custom, automated processes for any firm need. |

Pros & Cons

- •Pro: Extremely low per-user cost, often included with existing Microsoft 365 licenses.

- •Pro: Highly customizable to fit a firm's unique operational structure.

- •Con: Requires significant upfront planning and configuration to mimic CPA-specific DMS patterns.

- •Con: Not specifically designed for accounting out of the box; lacks pre-built templates for firms.

Website: https://www.microsoft.com/en-us/microsoft-365/sharepoint/compare-sharepoint-plans

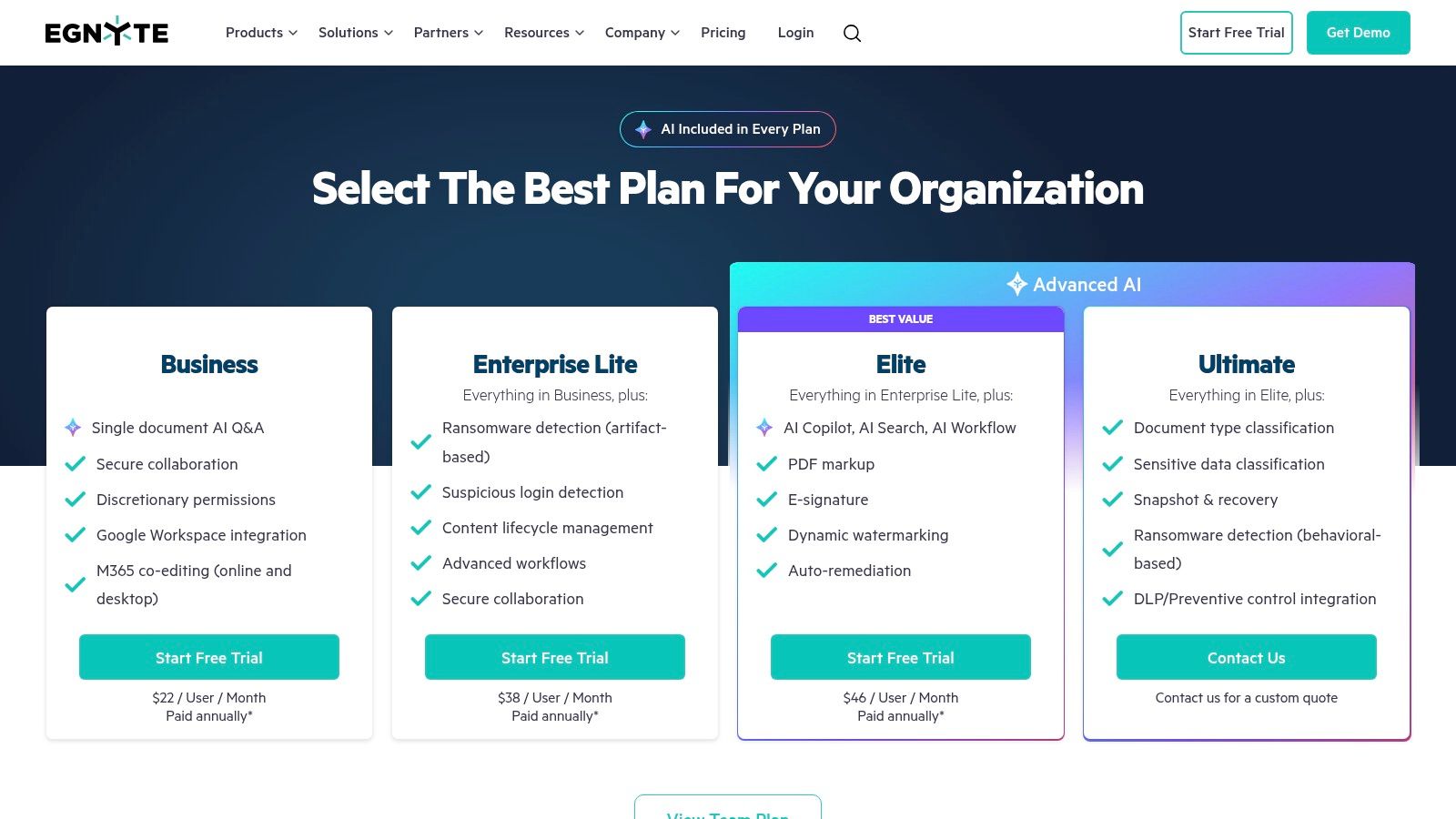

11. Egnyte (Secure Content Platform with Financial Services Solution)

Egnyte positions itself as a secure content platform rather than just a document management system, making it a strong contender for accounting firms focused on governance and risk mitigation. While not built exclusively for accountants, its financial services solution provides the security architecture that advisory and CAS teams need. Egnyte excels at managing content across hybrid environments, offering a unified platform for files stored on-premise and in the cloud.

Why It Makes the List

Egnyte earns its spot as one of the best document management software for accountants due to its enterprise-grade security and compliance features, which are often more robust than accounting-specific solutions. It provides granular, role-based access controls, detailed audit trails, and sophisticated data classification. Higher-tier plans even include ransomware detection and recovery, offering a crucial layer of protection for sensitive client data. Its ability to integrate seamlessly with both Microsoft 365 and Google Workspace makes it a versatile replacement for less secure, general-purpose cloud storage.

Best For: Firms prioritizing security, governance, and compliance over accounting-specific workflows.

| Feature Highlights | Our Take |

|---|---|

| Hybrid Cloud Support | Unifies access to files stored both on-premise and in the cloud. |

| Advanced Governance | Strong data classification, retention policies, and ransomware protection. |

| Broad Integration | Works well as a secure back-end for Microsoft 365 and Google Workspace. |

Pros & Cons

- •Pro: Top-tier security and governance with clear, public pricing tiers.

- •Pro: Excellent fit for firms looking to replace Box or Dropbox with a more secure alternative.

- •Con: Not an accounting-specific platform, so it may require initial configuration to fit firm workflows.

- •Con: Advanced security and compliance features are locked behind more expensive plans.

Website: https://www.egnyte.com/pricing

12. NetDocuments

While its roots are firmly in the legal sector, NetDocuments has become a go-to platform for mid-to-large professional services firms, including accounting practices that demand enterprise-grade security and governance. This cloud-native system is built for scalability, offering a highly secure environment for managing both documents and emails with powerful search capabilities, including OCR and analytics. Its robust infrastructure and extensive Microsoft 365 integration make it a strong contender for firms needing a mature, centralized repository.

Why It Makes the List

NetDocuments stands out for its uncompromising approach to security and compliance, backed by a 99.9% uptime guarantee. This makes it one of the best document management software for accountants at firms where data integrity and availability are non-negotiable. Its extensive partner ecosystem and mature integration marketplace allow firms to build complex, customized workflows that connect their DMS to other critical business applications. For growing firms looking beyond basic storage, its ndMAX AI add-ons offer advanced capabilities for document intelligence and automation.

Best For: Mid-to-large accounting firms requiring enterprise-level security and complex workflow integrations.

| Feature Highlights | Our Take |

|---|---|

| Enterprise-Grade Security | Top-tier governance, deep admin controls, and compliance features. |

| Extensive M365 Integration | Seamlessly connects with Outlook, Teams, Word, and Excel. |

| Large Integration Marketplace | Connects to a wide array of business software via certified partners. |

Pros & Cons

- •Pro: Highly scalable and reliable platform built for demanding environments.

- •Pro: Mature solution with a powerful feature set for document and email management.

- •Con: Pricing is not public and implementation often requires expensive certified partners.

- •Con: Can be overly complex for smaller firms that don't need its full range of features.

Website: https://www.netdocuments.com/en-us/products/plan

Top 12 Document Management Software Comparison for Accountants

| Platform | Core Features / Unique Selling Points | User Experience / Quality Metrics | Target Audience 👥 | Value Proposition / Pricing 💰 | Recommended 🏆 |

|---|---|---|---|---|---|

| Tailride | AI-powered invoice capture from emails & portals ✨, multi-format support, reconciliation, Chrome extension, messaging bots | ★★★★☆ Highly rated for speed & accuracy | Finance teams, accountants, SMBs | Free plan (10 invoices), upgrades from $19/month 💰 | 🏆 Recommended |

| Wolters Kluwer - CCH Axcess Document | CPA firm-focused, strong governance, role-based security, client portal | ★★★★ Reliable with audit trails | CPA firms using Wolters Kluwer | Pricing on quote 💰 | |

| Thomson Reuters - GoFileRoom | Mature DMS, indexing/search, MFA, Windows & Office add-ins | ★★★★ Good onboarding & CPA workflow support | Tax/accounting firms | Pricing not public | |

| SmartVault (Document Management + Portal) | Unlimited cloud storage, QuickBooks integration, eSign, workflow automation | ★★★★ Transparent pricing, US support | Accounting/tax firms | Transparent pricing, min users on some plans 💰 | |

| ShareFile (formerly Citrix ShareFile) | Secure client portal, tax templates, e-signature, compliance (HIPAA, FINRA) | ★★★★ Branded portals, broad compliance | Tax engagements | Min users on plans, pricing tiers 💰 | |

| Canopy (Practice + Document Mgmt) | Modular add-ons, secure portal, e-signatures, annotations | ★★★★ Strong portal & tools | Small to mid-size accounting firms | Transparent module pricing, can increase with add-ons 💰 | |

| TaxDome (All-in-One Platform) | Unlimited storage, automation, AI organization, e-signatures | ★★★★ Award-winning, widely adopted | US accounting firms | Per-seat pricing, annual billing suggested 💰 | |

| Suralink (Client PBC & Workpapers) | PBC request lists, audit trails, unlimited clients/storage | ★★★★ Scalable, reduces client chasing | Auditors, advisory, tax firms | Quote-based pricing 💰 | |

| Liscio (Client Portal + Secure Exchange) | Secure messaging, AI-assisted file mgmt, tax organizers | ★★★★ Excellent client experience | Solo to enterprise tax teams | Flexible tiers, usage-based beyond quotas 💰 | |

| Microsoft SharePoint (Microsoft 365) | Document/version management, Teams/OneDrive integration, Power Automate | ★★★ Familiar MS tools, low per-user cost | Firms with MS365 licenses | Included in MS365 licensing | |

| Egnyte (Secure Content Platform) | Role-based controls, ransomware protection, industry templates | ★★★★ Strong security & governance | Advisory, CAS teams | Clear tiers, advanced features in higher plans 💰 | |

| NetDocuments (Enterprise DMS) | Secure doc/email mgmt, OCR, AI add-ons, 99.9% uptime | ★★★★ Mature, scalable, deep admin controls | Large firms, legal & professional services | Quote-based, often costly implementation 💰 |

Making the Final Choice for Your Firm

Choosing the best document management software for accountants is more than just an IT decision; it's a strategic move that fundamentally reshapes your firm's operational efficiency, data security, and client experience. We've journeyed through a comprehensive landscape of tools, from enterprise-grade powerhouses like Wolters Kluwer and NetDocuments to nimble, all-in-one practice management platforms like Canopy and TaxDome. The key takeaway is clear: there is no single "best" platform for every firm. The right choice is deeply personal, tied directly to your specific needs, challenges, and growth ambitions.

This process isn't about finding the software with the longest feature list. It's about identifying the one that solves your most pressing problems, whether that's streamlining client collaboration with a secure portal like SmartVault or Liscio, or tackling the chaos of PBC requests with a specialized tool like Suralink. Your ideal solution hinges on the unique DNA of your practice.

How to Navigate Your Decision

To move from analysis to action, your team needs to ask the right questions. Don't get lost in marketing jargon; focus on the practical realities of your daily workflows. A thoughtful internal audit is the most critical step you can take.

Start by mapping out your current document lifecycle. Where do documents originate? How are they processed, reviewed, approved, and archived? Pinpointing the bottlenecks and security risks in this existing process will illuminate precisely what you need a new system to fix.

Consider these crucial questions as a team:

- •What is our primary pain point? Is it chasing clients for documents, manual data entry from invoices, disorganized workpapers, or insecure file sharing via email? Your biggest problem should guide your primary search criteria.

- •What is our integration strategy? Does the new software need to seamlessly connect with our existing accounting software (like QuickBooks or Xero), tax software, and other critical applications? A tool that creates data silos is a step backward, not forward.

- •What level of client interaction do we need? A simple, secure portal like ShareFile might suffice for basic file exchange. However, if you want a deeply integrated client experience with messaging and task management, platforms like Liscio or TaxDome are more appropriate.

- •What is our budget and scalability plan? Be realistic about your budget, considering not just the subscription cost but also implementation, training, and potential data migration fees. More importantly, will this software grow with you, or will you need to replace it in three years?

Your Actionable Next Steps

With your internal audit complete, you can now build a shortlist of 2-3 top contenders from this article that align with your needs. The next phase is all about hands-on evaluation.

- •Schedule Personalized Demos: A demo is your opportunity to grill the sales team with real-world scenarios specific to your firm. Don't settle for a generic product tour.

- •Initiate Free Trials: There is no substitute for getting your hands on the software. Use the trial period to process a few real (or anonymized) client files to test the workflow from end to end.

- •Involve Your Team: Your staff will be the daily users of this system. Involving them in the trial and decision-making process ensures better adoption and uncovers practical insights you might have missed.

Investing in the right document management software for your accounting practice is an investment in your future. It’s about building a more resilient, scalable, and ultimately more profitable firm that can deliver exceptional value to clients without burning out your team.

Tired of the endless cycle of manual data entry and chasing down invoices? If your firm's biggest document headache is accounts payable, Tailride offers a specialized solution. See how our AI-powered platform automates invoice processing and streamlines your AP workflow by visiting us at Tailride.