Top Accounting Automation Software for Streamlined Finances

Learn how accounting automation software can transform your finances. Discover key features and find the best solution today!

Tags

Picture this: your finance team, finally free from the endless paper shuffle, the mind-numbing data entry, and the constant chase for late payments. That's the promise of accounting automation software. It’s like having a super-efficient digital assistant on your team, one that works around the clock without ever making a typo or needing a coffee break.

So, What Exactly Is Accounting Automation Software?

At its heart, accounting automation software is a purpose-built tool designed to take over the repetitive, rule-based jobs that eat up so much of a finance department's day. We're talking about a serious upgrade from spreadsheets. Instead of just being a place to park numbers, this software actively runs your financial workflows. It becomes the command center for your company's financial operations.

This technology puts processes that were once painfully manual and error-prone on autopilot. It’s all about letting the software handle the robotic work so your people can focus on the strategic side of things - the stuff that actually requires a human brain. This isn't just a minor tweak for convenience; it's a completely different way of running your financial show.

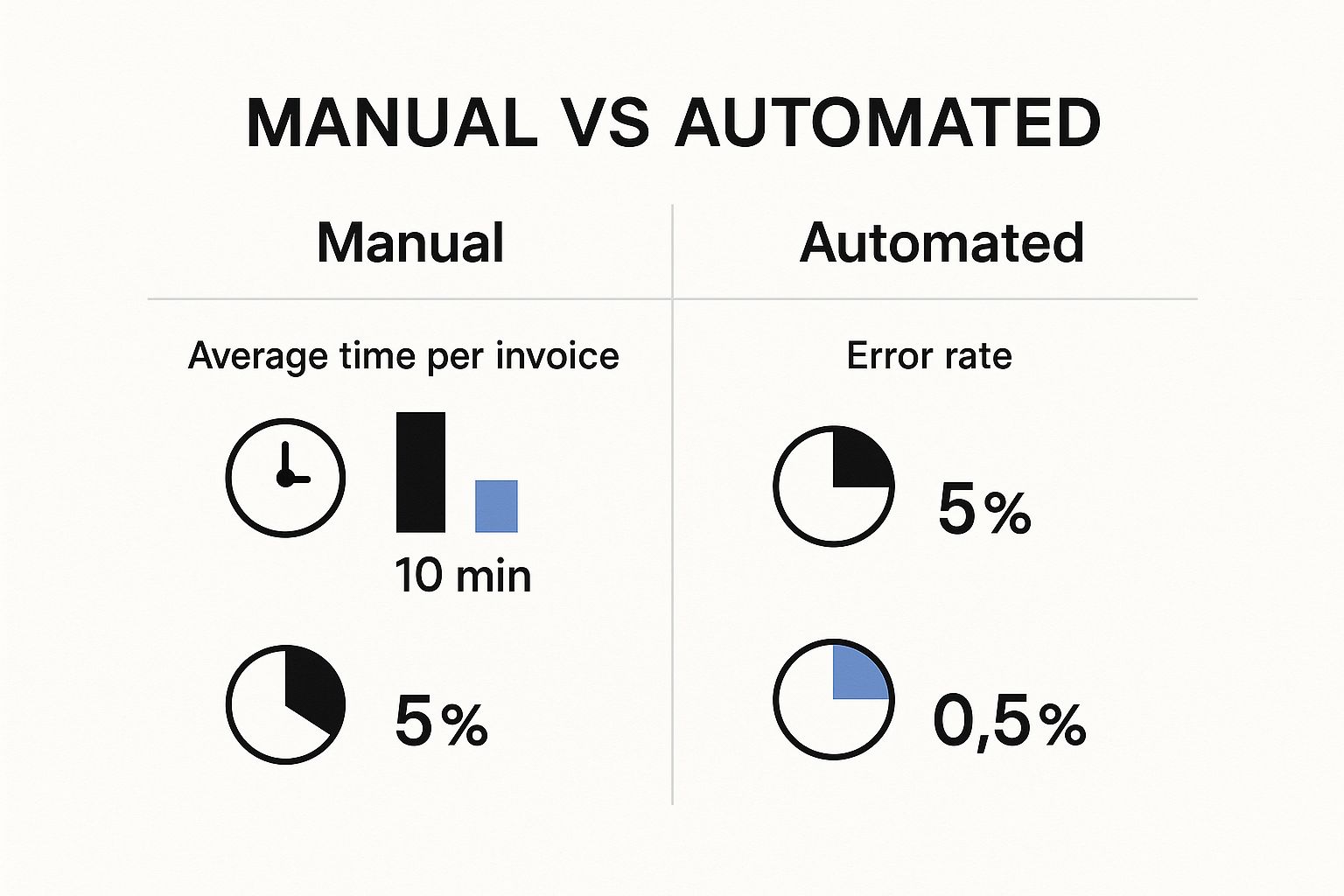

Manual vs Automated Accounting at a Glance

To really get a feel for the difference, let's look at a side-by-side comparison. The old way of doing things feels worlds apart from the new, automated approach.

| Aspect | Manual Accounting | Automated Accounting |

|---|---|---|

| Invoice Processing | Printing, physical matching, manual data entry. | Digital capture, AI data extraction, automated approval routing. |

| Error Rate | High risk of typos, lost documents, and compliance issues. | Extremely low, with built-in validation and checks. |

| Speed | Slow and bottlenecked, taking days or weeks. | Near-instantaneous, processing tasks in minutes. |

| Visibility | Opaque, with a delayed view of financial status. | Real-time dashboards and instant access to data. |

| Team Focus | Data entry, paperwork, and administrative tasks. | Data analysis, strategic planning, and financial advising. |

As you can see, the shift is dramatic. One path is bogged down by manual labor, while the other paves the way for speed, accuracy, and strategic insight.

A Few Real-World Examples

The difference between traditional bookkeeping and automated accounting is night and day. Manual work often involves someone printing out an invoice, walking it over to a filing cabinet to find the matching purchase order, and then typing every single detail into a ledger. Every step is a chance for a misplaced decimal or a lost piece of paper to throw everything off.

In stark contrast, automated systems create a smooth, connected flow.

- •Invoicing: The software can grab an invoice from an email, use AI to read all the important data (who it's from, how much it is, when it's due), and send it off for approval without a single click from your team.

- •Expenses: An employee can just snap a picture of a receipt on their phone. The software instantly reads it, categorizes the expense, and preps it for reimbursement. Goodbye, clunky expense reports!

- •Reconciliation: By linking directly to your bank accounts, the system automatically matches payments to invoices and flags any discrepancies right away.

This image really drives home just how much more efficient the process becomes.

You can see the time spent per invoice plummets while the accuracy skyrockets. That’s the core value right there.

The Market is Responding

This isn't some fringe trend, either. It’s a massive shift in how businesses operate. The global accounting software market was valued at around USD 19.38 billion in 2024 and is expected to jump to an estimated USD 31.25 billion by 2030. That kind of growth is a direct response to a universal need for better accuracy and efficiency. You can explore the full market projections on accounting software to see just how widespread this movement is.

The real goal of accounting automation software is to free up your most valuable asset - your team's time and brainpower - from tedious, low-impact tasks. It lets them step up and become strategic advisors who analyze data instead of just keying it in.

When it comes down to it, this software gives business owners and finance leaders what they’ve always needed: a clear, accurate, and up-to-the-minute view of their company's financial health. That kind of clarity leads to smarter decisions, healthier cash flow, and a strong foundation for real, sustainable growth.

The Real-World Benefits of Automating Your Finances

Let’s be honest: adopting accounting automation software isn't just about saving a bit of time. It's about fundamentally rewiring your company's financial core for the better. We’re talking about solving those all-too-familiar headaches, from the dreaded month-end scramble to the quiet, nagging fear of a costly human error.

Think about it. Imagine finally being able to take a vacation without constantly checking your phone. You’re not worried if payroll will run smoothly or if that huge invoice got paid, because you know the system is handling it. That’s the kind of peace of mind automation brings to the table.

When you take the manual grind off your team's plate, you free them up to do more valuable work. They can shift from just entering data to actually analyzing it, spotting trends, and offering insights that genuinely push the business forward.

Radically Reduce Human Error

We've all been there. Manual data entry is a breeding ground for tiny mistakes that can cause massive headaches. A single misplaced decimal or a couple of swapped numbers can throw off your entire financial picture, leading to bad decisions or a painful audit. Even your most careful team member is bound to slip up after hours of staring at spreadsheets.

Accounting automation software is your best defense against this. It grabs data directly from invoices, receipts, and bank statements, virtually wiping out the typos and slip-ups that are so common with manual entry. This level of accuracy means you can finally trust the numbers you're seeing.

Automation turns your financial data from a source of anxiety into a reliable foundation for solid decision-making. You can trust the numbers because they haven’t been touched by tired human hands.

This reliability isn't just about clean reports; it's about giving you confidence. When you know your data is spot-on, you can make bold, strategic moves without that nagging voice in the back of your head questioning the information.

Strengthen Data Security and Compliance

Let’s face it: scattered spreadsheets, inboxes overflowing with PDF invoices, and dusty filing cabinets are not secure. They leave your most sensitive financial data wide open to prying eyes, accidental deletion, or even physical damage from a coffee spill.

Modern accounting automation software is built from the ground up with security in mind.

- •Centralized Storage: All your financial documents live in one secure, digital hub - not spread across a dozen different computers and inboxes.

- •Access Controls: You get to decide exactly who sees what. You can set specific permissions so team members only access the information they absolutely need for their job.

- •Audit Trails: The software automatically logs every single action, creating a clear, unchangeable record of who did what and when. This is a lifesaver for internal controls and a dream come true for external auditors.

This organized approach doesn’t just protect your data; it makes staying compliant with financial regulations so much easier.

Achieve Real-Time Financial Clarity

One of the biggest frustrations with old-school accounting is the waiting game. You often don't get a clear picture of your finances until days or even weeks after a period closes. This forces you to make decisions based on outdated, historical information.

Automation, on the other hand, gives you a live, up-to-the-minute view of your company’s financial health. Since data is constantly flowing into the system, you can pull up a real-time dashboard anytime you want. It’s a complete game-changer.

This growing hunger for instant insight is fueling a huge boom in the market. The accounting software sector, valued at USD 21.56 billion in 2025, is expected to soar to USD 33.47 billion by 2030. This global push for smarter financial tools is undeniable.

Having immediate access to this information lets you spot opportunities, fix cash flow problems before they become crises, and steer your business with incredible agility. Automated systems also help fine-tune the very processes that affect your bottom line. To see how this plays out, check out our guide on the https://tailride.so/blog/accounts-payable-automation-benefits.

For instance, good automation can drastically improve your cash flow by handling things like dunning - the process of chasing down overdue payments. To get better at collecting what you're owed, you might want to explore some effective dunning management techniques.

Must-Have Features in Your Accounting Software

Shopping for accounting automation software can feel a bit like walking onto a car lot - every model seems to have an endless list of features. But just like you wouldn't drive a car off the lot without an engine and brakes, some software features are completely non-negotiable for your company's financial health.

This isn't about finding the tool with the most bells and whistles. It's about zeroing in on the core functions that will actually fix your headaches, give you back your time, and put you in the driver's seat of your finances. Let's break down the essentials that absolutely need to be on your checklist.

Automated Invoicing and Accounts Payable

If cash flow is the lifeblood of your business, then automated invoicing and accounts payable (AP) are the heart and arteries keeping it pumping. The old way of doing things - with teams physically handling paper invoices - is notoriously sluggish and full of errors that can stall payments to vendors and from your clients.

Good accounting automation software completely overhauls this workflow. It can snatch invoices from your email, instantly scan them for key details like due dates and amounts, and then route them for approval without anyone lifting a finger. This acceleration is a game-changer. It means you pay your vendors on time, keeping those relationships strong, and get paid by clients faster, which keeps your cash reserves healthy.

Automating the invoicing cycle isn't just a small tweak; it can fundamentally improve your day-to-day cash position. It's the difference between hoping money trickles in and building a steady, predictable stream.

Look for tools that offer recurring invoices for your subscription clients and automatic payment reminders to give late payers a gentle nudge. These small automations stack up, leading to massive improvements in your financial stability.

Smart Expense Tracking and Management

Let's be honest: managing employee expenses can be a frustrating mess for everyone. It’s usually a chaotic jumble of paper receipts, confusing spreadsheets, and long waits for reimbursement that can really kill team morale.

Smart expense tracking brings this entire process into the modern age. The best platforms let employees simply snap a photo of a receipt with their phone. From there, the software’s AI takes over, automatically reading the vendor, date, and amount, and categorizing the expense based on your company's rules.

What to look for in expense management:

- •Mobile Receipt Capture: This lets your team submit expenses on the go, finally freeing them from that wallet stuffed with crumpled paper.

- •Automated Policy Enforcement: You can set up the system to automatically flag or even block out-of-policy spending, stopping compliance issues before they start.

- •Direct Reimbursement: Look for integration with your payroll or payment systems. This enables quick, hassle-free reimbursements that keep your employees happy.

This kind of system doesn't just save your finance team from hours of mind-numbing manual review; it gives you a real-time dashboard of company spending.

Effortless Bank Reconciliation

Bank reconciliation - that tedious chore of matching every single transaction in your books to your bank statement - is one of the first things you should automate. Doing it by hand is a time-sucking puzzle that can eat up days at the end of every single month.

A top-tier accounting automation platform connects securely and directly to your bank accounts. It automatically pulls in all your transaction data and uses smart algorithms to match payments to invoices and expenses, handling the vast majority of the work in seconds.

The system will instantly flag any weird discrepancies, like a mismatched amount or a missing transaction, so your team only has to step in and investigate the exceptions. This feature alone can free up dozens of hours each month, letting your team focus on more valuable strategic analysis. It turns a dreaded monthly task into a quick, simple review.

Customizable Reporting and Dashboards

Finally, all the data your software is busy collecting is pretty useless if you can't make sense of it. Generic, static reports just don't cut it anymore. Your business needs financial insights that are directly tied to your specific goals and Key Performance Indicators (KPIs).

Your accounting software should offer customizable dashboards that show you the most important information at a glance. You need the power to build and save reports that actually matter to you, whether that’s a cash flow projection, a profit-and-loss statement broken down by department, or a simple overview of your biggest expenses.

This level of visibility is what allows you to be agile. When you can see exactly where your money is going and where it's coming from in real time, you're empowered to make smarter, data-backed decisions that will steer your business toward growth.

How Cloud and AI Are Reshaping Modern Accounting

Behind every great accounting automation software today, you'll find two game-changing technologies working in tandem: cloud computing and artificial intelligence (AI). These aren't just trendy buzzwords; they're the engines making financial tools smarter, faster, and more accessible than we ever thought possible.

To really get it, think of it this way: cloud technology changes where your accounting gets done, while AI changes how it's done. One gives you freedom, the other gives you intelligence. Together, they break down old, rigid workflows and create something truly dynamic.

The Power of the Cloud: Your Financial Hub, Anywhere

Remember the old days of accounting software? It was stuck on one computer, in one office. If you weren't there, you were out of luck. Cloud-based software completely flips that script.

It's a lot like the difference between your old DVD collection and a service like Netflix. A DVD is physically tied to a single player. But with Netflix, your entire library is available on any device with an internet connection, wherever you are. That’s exactly how cloud accounting works. Your financial data isn't locked away on a local hard drive; it lives in a secure, central hub online.

This shift brings some incredible, immediate benefits:

- •Work From Anywhere: Your team can process invoices, check cash flow, or pull reports from the office, from home, or even from a coffee shop on the other side of the world.

- •True Collaboration: An accountant in one city and a business owner in another can look at the exact same live data. No more emailing outdated spreadsheets back and forth and wondering who has the latest version.

- •Peace of Mind: Your financial records are automatically backed up and protected from local disasters - think hardware crashes, theft, or that dreaded coffee spill on the company server.

This isn't just a niche trend. It's a massive shift in how businesses operate. In fact, around 67% of accountants globally now rely on cloud solutions to help businesses run more efficiently. This widespread adoption shows just how essential this technology has become.

Artificial Intelligence: The Brains Behind the Operation

If the cloud gives you anytime, anywhere access, then AI provides the "smarts." When we talk about AI in accounting, we're not talking about science-fiction robots. We're talking about practical software that learns patterns, makes smart suggestions, and handles tasks that used to require a ton of human effort.

Think of it as a digital assistant that gets sharper and more helpful over time.

For instance, when an invoice comes in, an AI-powered system doesn't just save the file. It reads it. It identifies the vendor, figures out the total, and suggests the right expense category. And if you correct it once, it remembers for next time, becoming more accurate with every single transaction.

AI is what elevates accounting automation from just doing things faster to doing them smarter. It turns a mountain of raw data into genuinely useful insights, spotting patterns and flagging issues a person might easily overlook.

A fantastic example of AI making a real-world impact is the rollout of tools like Microsoft Copilot for Finance, which puts an AI assistant right inside the tools finance pros use every day. To see more ways this is changing the game, check out our guide to accounting AI to learn why these tools are becoming a must-have.

Here’s where AI really shines:

- •Automated Categorization: The system learns your spending habits and automatically codes expenses, slashing hours of tedious manual sorting down to mere seconds.

- •Fraud Detection: By scanning thousands of transactions, AI can spot anomalies - like a duplicate invoice or a surprise payment to an unfamiliar vendor - that could signal fraud.

- •Predictive Forecasting: More advanced AI can even analyze your financial history to forecast future cash flow, giving you the foresight to make better decisions about spending, hiring, and growth.

When you put cloud accessibility and AI intelligence together, you get something special. You get a financial system that isn't just efficient and accurate, but one that’s truly insightful and strategically powerful for your business.

Choosing the Right Accounting Automation Software

This GetInvoice dashboard shows just how clean and clear a modern financial tool can be, giving you a quick, at-a-glance look at your finances. But picking the right accounting automation software is a huge decision that goes way beyond a pretty interface. It’s about finding a tool that fits your business like a glove, not trying to cram your unique processes into a one-size-fits-all box.

The trick is to look past the flashy feature lists and start with an honest assessment of your own company. What are your biggest time-wasters right now? Where are mistakes constantly popping up? What information do you wish you had instantly? Answering these questions first gives you a clear roadmap for your search.

Assess Your Business Needs First

Before you even start Googling software options, you need to get crystal clear on your own requirements. Every business is different, so the "best" tool out there is simply the one that solves your specific problems.

Think about it: a small e-commerce shop swimming in hundreds of Shopify and Stripe invoices has completely different needs than a consulting firm that bills clients by the hour. The best first step is to map out your current financial workflows. Pinpoint the bottlenecks and identify the tasks that make your team groan the loudest.

Choosing software is like hiring a new team member. You wouldn't hire someone without a clear job description, and you shouldn't choose a tool without first defining the exact problems you need it to solve.

Once you have a solid grasp of your pain points, you can start evaluating platforms based on how well they actually fix those issues, rather than just getting swayed by slick marketing. This self-assessment is, without a doubt, the most important step in the whole process.

Ask the Right Questions During Your Search

With your needs clearly defined, you can approach your search with a focused game plan. This isn't just about features; it’s about finding a long-term partner that works for your business.

Here are the essential questions you need to ask:

- •Can it truly scale with us? The software that works for you today has to work for you in three years. Can it handle a massive spike in transactions without grinding to a halt? Does the pricing model still make sense as you grow?

- •How good are the integrations, really? Your accounting software can't operate on an island. It needs to play nicely with your bank, payment gateways, CRM, and payroll systems to create a single source of truth and eliminate frustrating data silos.

- •Is it genuinely easy to use? A powerful tool is worthless if your team finds it too confusing. A platform with an intuitive interface, like the one shown for GetInvoice, means less time spent on training and more people actually using it - which is how you get your money's worth.

Applying the Criteria: A Real-World Example

Let's put this into practice with a platform like GetInvoice. Imagine your biggest headache is dealing with a flood of PDF invoices coming into your email. Manually downloading, opening, and punching in data from each one eats up hours every single week and is a recipe for typos.

A tool like GetInvoice tackles this problem head-on. Its core purpose is to connect to your inbox, automatically grab those PDF invoices, and use AI to pull out all the important data. This is a direct solution to your main pain point, handled with a smart, automated workflow.

When you're exploring options, looking at the leading invoice automation software solutions is a great way to see this kind of specialized automation in action. If you want to dive deeper into this specific area, our own guide to https://tailride.so/blog/invoice-automation-software offers even more focused advice.

This ability to solve a specific, nagging problem is exactly what you should be looking for. Does the software have a clear, demonstrable answer to your most pressing challenges? By connecting features directly to your real-world business needs, you can turn a vague search into a confident decision that truly sets you up for success.

Got Questions About Accounting Automation? We've Got Answers.

Jumping into any new technology feels like a big step, and it's totally normal to have a few questions rolling around in your head. You want to be absolutely sure that automating your accounting is the right move for your business. It's a significant decision, after all.

Over the years, we’ve heard the same smart questions from business owners just like you. Let's tackle them head-on, so you can feel confident about what this change really means.

How Secure Is My Financial Data in the Cloud?

This is almost always the first question, and for a very good reason. Your financial data is incredibly sensitive, and the idea of handing it over can feel a bit nerve-wracking. But here’s the reality: modern cloud software is almost always far more secure than keeping files on your office computer or, worse, in a filing cabinet.

Think of it this way: your local server is like a well-made home safe. It offers decent protection, but it’s still vulnerable to things like fire, theft, or a simple hard drive crash. A top-tier cloud platform, on the other hand, is like a Swiss bank vault - protected by layers upon layers of security built and monitored by a team of dedicated experts.

Here’s what that security actually looks like:

- •Bank-Level Encryption: Your data is scrambled into unreadable code both when it’s traveling over the internet and when it’s sitting on a server.

- •Granular Access Controls: You decide exactly who sees what. You can let a team member submit their expenses without ever giving them access to see company payroll.

- •24/7 Threat Monitoring: These platforms have security pros whose only job is to watch for suspicious activity and stop threats before they can cause a problem.

Honestly, your financial information is often safer in a reputable cloud system than it is scattered across employee inboxes and various hard drives. The security is just on a completely different level.

By bringing all your data into one secure, professionally managed place, you’re actually minimizing your risk, not increasing it.

Is This Software Going to Be a Headache to Learn?

Ah, the fear of the steep learning curve. Nobody wants to invest in a powerful new tool only to have the team avoid it because it’s too complicated. It’s a completely valid concern, but the good news is that software designers are obsessed with this problem.

Today's accounting automation software is built with the user in mind. The whole point is to create something that feels intuitive and doesn't require a week-long training seminar. Most teams are genuinely surprised at how fast they get the hang of it.

The initial setup is usually a breeze:

- •Guided Onboarding: The software typically walks you through connecting your bank accounts, credit cards, and email inboxes step-by-step.

- •Clean Dashboards: The main screens are designed to be clean and simple, showing you the most important information at a glance without overwhelming you.

- •Plenty of Help: Good software companies provide a ton of support, from video tutorials and help articles to real humans you can talk to.

Think of it less like learning to code and more like getting used to a new app on your phone. The basic functions are designed to be easy for everyone, not just the tech gurus on your team. That focus on usability means you’ll start seeing a return on your investment almost immediately.

Will Automation Replace My Accountant?

This is a big one. Let's be crystal clear: accounting automation is designed to empower your accountant, not replace them. It’s all about shifting their focus from being a data-entry clerk to being a high-value strategic partner.

Think about it. Right now, your accountant might be spending 20 hours a month just manually typing in invoices, chasing down receipts, and matching up bank statements. That’s 20 hours of their expensive expertise spent on work a machine could do.

Now, imagine the software handles all of that automatically. Your accountant suddenly has those 20 hours back. They can use that time to help you:

- •Analyze spending patterns to find ways to save money.

- •Build accurate cash flow forecasts so you can plan for growth.

- •Offer strategic advice on tax planning and your overall financial health.

Automation handles the “what” - what was spent, what was earned. This frees up your accountant to focus on the “so what?” and the “what’s next?” It makes their expertise more valuable to you than ever.

Okay, So What's This Going to Cost Me?

Finally, the bottom line. Most modern accounting tools run on a simple subscription model - a predictable monthly or annual fee. This is a lot easier for most businesses to manage than a huge, one-time software license fee.

The key is to see this cost not as an expense, but as an investment that pays for itself over and over. Your return on investment (ROI) comes from a few key areas:

- •Saved Labor Costs: Just calculate the hourly cost of your team and multiply it by the hours they’ll save each month. The software often pays for itself right there.

- •Fewer Costly Errors: The price of one missed payment deadline, a late filing penalty, or a bad decision made with faulty data can easily be more than the software’s annual cost.

- •Better Cash Flow: By automating your invoicing and getting paid faster, the software can put more cash in your bank account, sooner.

When you add up these real, tangible returns, that monthly fee starts to look less like a cost and more like one of the smartest investments you can make for your business.

Ready to stop wasting time on manual data entry and see what automation can do for you? Tailride connects directly to your inboxes and portals to capture, classify, and process every invoice and receipt automatically. Discover how much time you can save.