7 Best Way to Track Invoices for Businesses in 2025

Discover the best way to track invoices for your business. Our guide covers 7 top tools and methods to streamline payments and save time.

Juggling invoices can feel like a full-time job. Missed due dates, messy spreadsheets, and unpaid bills create stress and seriously hurt your cash flow. You know there has to be a better way to manage it all, but with so many options, where do you even start?

The truth is, the best way to track invoices isn't a one-size-fits-all solution. Your perfect system depends entirely on your business size, transaction volume, and unique operational needs. Whether you're a freelancer tired of manual follow-ups, a bookkeeper managing multiple clients, or a growing business struggling to scale financial operations, the right system can transform chaos into clarity.

This guide is designed to cut through the noise and get you straight to the answers. We will explore seven distinct and powerful methods for tracking invoices, from dedicated platforms like Tailride and FreshBooks to comprehensive accounting suites such as QuickBooks Online and Xero. Each option is presented with clear pros and cons, screenshots, and direct links so you can find the perfect approach that not only gets you paid faster but also gives you back your most valuable asset: your time. Let's dive in.

1. Tailride

Tailride presents a powerful, AI-driven solution that positions itself as the best way to track invoices for businesses seeking comprehensive automation. It goes beyond simple tracking by creating a fully automated pipeline, from document capture to accounting software integration, virtually eliminating manual data entry. The platform seamlessly connects to your inboxes (Gmail, Outlook) and online portals, capturing every invoice, receipt, and financial document automatically.

Its sophisticated AI is the core strength, capable of reading various formats like PDFs, image files, and even email body text. This ensures no invoice is missed, whether it's from a supplier's email or a colleague's forwarded message. Tailride doesn't just collect documents; it intelligently extracts key data, classifies expenses, and prepares everything for reconciliation.

Key Strengths and How to Use Them

What makes Tailride a standout choice is its deep customization and robust feature set designed for real-world financial workflows. It’s not just about getting data in; it’s about making that data immediately useful.

- •Retroactive Scanning: Just getting started? Use Tailride to scan your entire email history for past invoices across a custom date range. This is perfect for cleaning up historical records, preparing for tax season, or establishing a complete financial picture from day one.

- •Custom AI Rules: Tailride's rule engine is a game-changer. You can train the AI to handle your specific business logic. For example, you can create a rule that automatically tags all invoices from "Amazon Web Services" as "Cloud Infrastructure Costs" and routes them for approval by the CTO. This level of granular control automates not just data entry but also internal categorization processes.

- •Bank Reconciliation: Connect your bank accounts and let the platform automatically match captured invoices against transactions. The system flags any missing invoices, giving you an accurate, real-time view of your liabilities and making month-end closing significantly faster.

Pro Tip: Leverage the messaging bots for on-the-go receipt capture. Snap a photo of a lunch or travel receipt and send it via WhatsApp or Telegram. Tailride’s AI will process it instantly, ensuring no expense is ever lost.

Why It's a Top Contender

Tailride excels by offering an enterprise-grade solution that is accessible to businesses of all sizes. The combination of real-time monitoring, historical data capture, and seamless integration with tools like QuickBooks, Xero, and Google Sheets creates a truly hands-off system for invoice management. Its focus on security, including GDPR compliance and a Tier-2 CASA certification, provides peace of mind for handling sensitive financial data.

While the free plan is limited to 10 documents per month, it offers a risk-free way to experience the platform's power. Paid plans are scalable, starting at $19 for 50 invoices, making it a cost-effective investment for the immense time savings it delivers.

Website: https://tailride.so

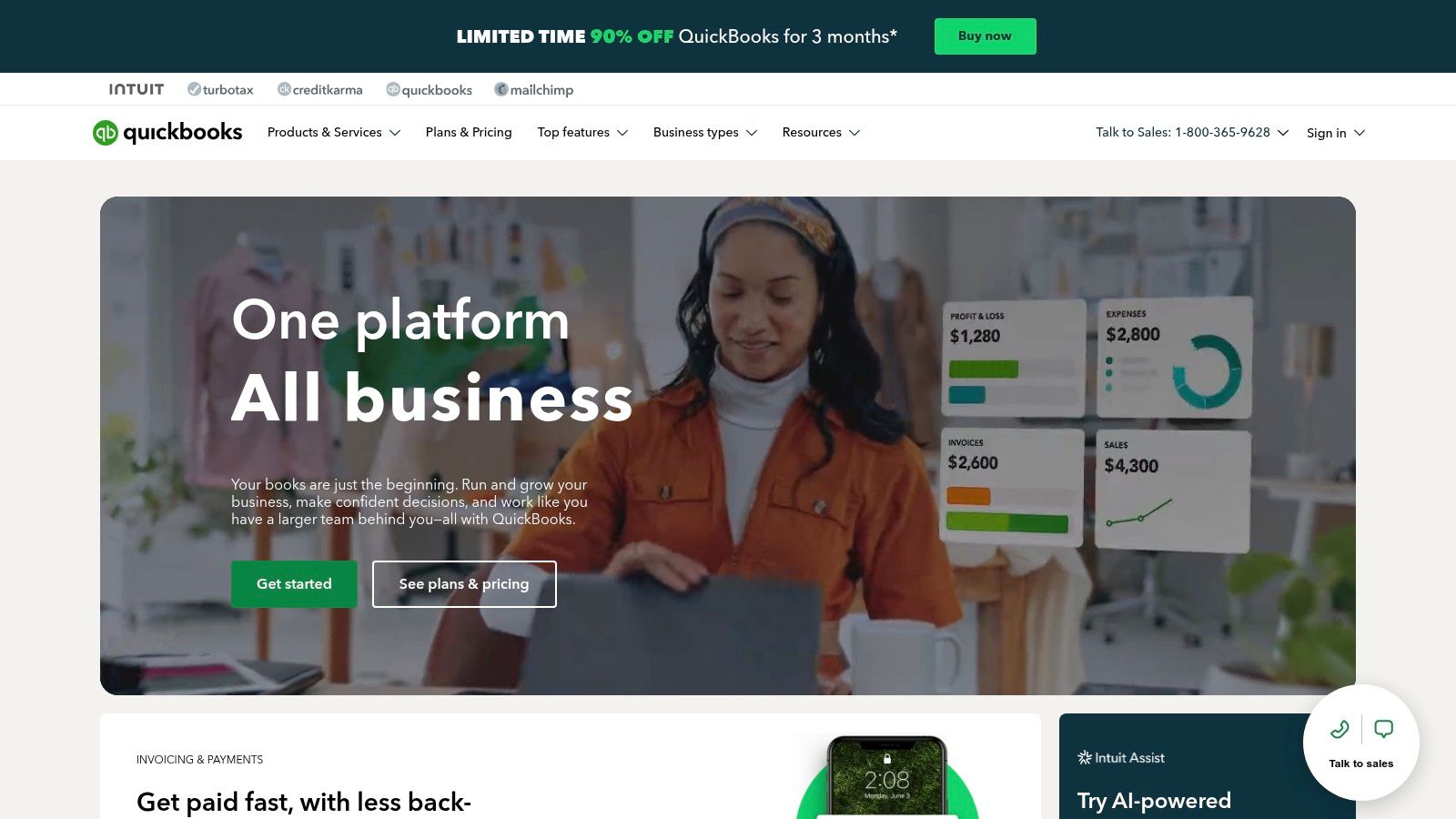

2. QuickBooks Online

For many small businesses and freelancers, QuickBooks Online is the gold standard, and for good reason. It’s more than just an invoicing tool; it’s a comprehensive accounting powerhouse that makes tracking invoices a seamless part of your overall financial management. This integrated approach is its key differentiator, providing a holistic view of your business’s health, where invoices are just one piece of the puzzle.

QuickBooks excels at connecting invoicing with your other financial data. You can easily convert an approved estimate into an invoice with a single click, pull in billable hours directly from its time-tracking feature, and attach receipts or expenses to an invoice for client reimbursement. This interconnectivity saves an incredible amount of time and reduces the manual data entry that often leads to errors.

Why It’s a Top Choice for Tracking Invoices

QuickBooks Online offers a robust and user-friendly platform that is arguably the best way to track invoices for businesses seeking scalability. Its features are designed to grow with you.

- •Automated Workflows: Set up recurring invoices for retainer clients or regular service agreements. You can also automate payment reminders, sending polite nudges to clients when an invoice is due or past due, saving you from awkward follow-up conversations.

- •Integrated Payments: Allow clients to pay directly from the invoice via credit card, debit card, or ACH bank transfer. When a payment is made, QuickBooks automatically records the transaction and marks the invoice as paid, simplifying your reconciliation process.

- •Comprehensive Reporting: The “Accounts Receivable Aging” report is a powerful tool. It instantly shows you which invoices are outstanding, who owes you money, and how long payments have been overdue. This visibility is critical for managing your cash flow effectively.

Pricing and Access

QuickBooks Online is a subscription-based service with several tiers, making it accessible for different business sizes. Plans typically start around $30/month for the "Simple Start" plan and go up to $200/month for the "Advanced" plan, which includes more users and advanced features. They often run promotions for new users, so it's worth checking their site for current deals.

Pro Tip: Use the QuickBooks mobile app to create and send invoices on the go. You can snap a picture of a receipt right after a business lunch and immediately bill it to a client project, ensuring you never miss a billable expense.

Website: https://quickbooks.intuit.com/

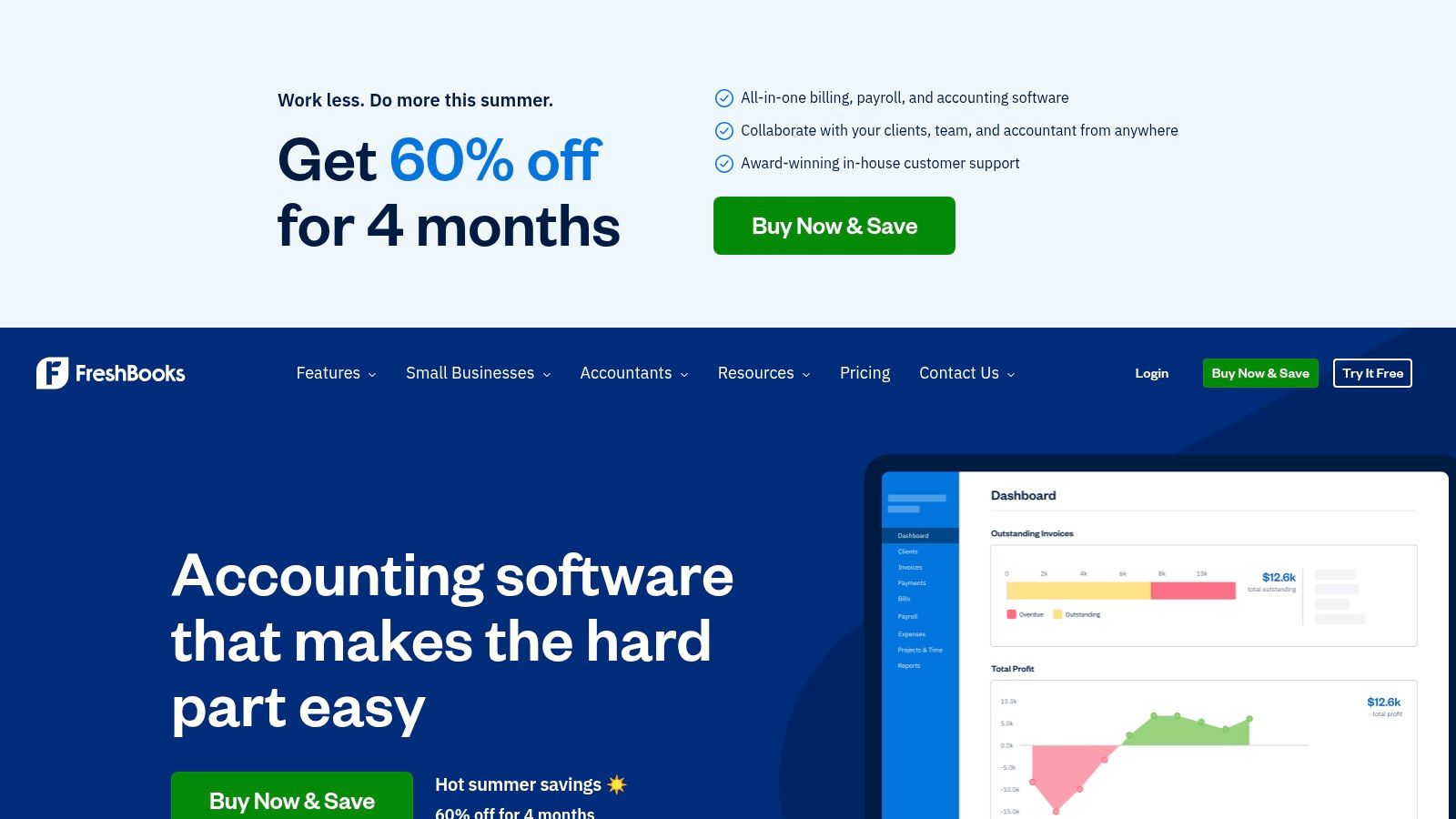

3. FreshBooks

Designed with freelancers and small service-based businesses in mind, FreshBooks is renowned for its incredibly intuitive and user-friendly interface. It strips away the complexity often associated with accounting software, focusing instead on making invoicing and expense tracking as simple as possible. Its main selling point is its approachability; you don’t need an accounting degree to master it, making it a fantastic starting point for entrepreneurs who handle their own finances.

FreshBooks was "built for owners," and this philosophy shines through in its design. It prioritizes speed and ease of use, allowing you to create and send professional-looking invoices in minutes. The platform seamlessly integrates time tracking and project management, so you can easily pull billable hours into an invoice without juggling multiple apps. This simplicity is its greatest strength, offering a clean, non-intimidating way to manage your income.

Why It’s a Top Choice for Tracking Invoices

For solo entrepreneurs and small teams, FreshBooks offers the best way to track invoices without the steep learning curve. Its features are crafted to save you time and help you get paid faster.

- •Professional Invoice Customization: Easily add your logo, personalize the thank-you email, and choose from several professional templates to ensure your brand looks its best.

- •Automated Late Payment Reminders: Take the awkwardness out of follow-ups. FreshBooks can automatically send polite reminders to clients for overdue invoices, helping you maintain good relationships while improving cash flow. You can customize the timing and message of these nudges.

- •Time Tracking and Project Management: Log hours directly against specific clients and projects. When it’s time to bill, you can add all unbilled time to an invoice with just a few clicks, ensuring every minute of your work is accounted for. For a deeper dive into how it stacks up against competitors, you can review this invoice software comparison.

Pricing and Access

FreshBooks offers several pricing tiers based on the number of billable clients you have. The "Lite" plan starts at around $19/month for up to 5 clients. The "Plus" and "Premium" plans offer more clients and features, with custom pricing available for businesses with more complex needs. They frequently offer significant discounts for the first few months.

Pro Tip: Use the "Retainers" feature to manage ongoing work. You can set up a retainer agreement, track time against it, and provide your client with a clear summary of how their funds were used, simplifying recurring billing.

Website: https://www.freshbooks.com/

4. Zoho Invoice

For freelancers and small businesses looking for a powerful, dedicated invoicing tool without the price tag, Zoho Invoice is a standout choice. It offers a surprising depth of features for a completely free platform, making it a perfect entry point for those who need more than a spreadsheet but aren't ready for a full-blown accounting suite. Its primary focus is on making the invoicing process as smooth and professional as possible.

Zoho Invoice simplifies the entire lifecycle of an invoice, from creation to payment. You can generate professional-looking invoices from a gallery of customizable templates, track billable hours and expenses to add to an invoice, and provide clients with a self-service portal where they can view their history and make payments. This focus on a clean, efficient invoicing workflow is what makes it a fantastic free alternative.

Why It’s a Top Choice for Tracking Invoices

Zoho Invoice is arguably the best way to track invoices for entrepreneurs and small businesses prioritizing cost-effectiveness without sacrificing core functionality. Its robust, user-friendly features are designed to professionalize your billing process from day one.

- •Customization and Professionalism: Choose from a wide range of templates and customize them with your brand's logo and colors. It also supports multiple currencies and languages, making it ideal for businesses with an international client base.

- •Client Portal: Give your clients access to a dedicated portal where they can view all their invoices, see account statements, and make payments directly. This transparency builds trust and reduces back-and-forth communication.

- •Automated Reminders and Time Tracking: Set up automated payment reminders to politely follow up on outstanding invoices. The built-in time tracker allows you to log hours for projects and convert them into an invoice with just a few clicks, ensuring you bill accurately for your work.

Pricing and Access

This is where Zoho Invoice truly shines: it is completely free. There are no tiers, hidden fees, or catches. The free plan allows you to manage up to 1,000 invoices per year, which is more than enough for most freelancers and small businesses. It also integrates seamlessly with other applications in the Zoho ecosystem, offering a pathway to scale your operations as your business grows. The primary limitation is the lack of integration with Zoho Inventory.

Pro Tip: Use the estimates feature to send quotes to potential clients. Once they accept the estimate through the client portal, you can convert it into a professional invoice instantly, saving time and ensuring all project details are carried over correctly.

Website: https://www.zoho.com/invoice/

5. Wave

For freelancers, solopreneurs, and small businesses just starting out, Wave presents an almost unbeatable proposition: powerful, professional invoicing and accounting software that is completely free. This isn't a "freemium" model with hidden limitations; Wave offers core accounting and unlimited invoicing without a monthly subscription fee. Its primary appeal is providing essential financial tools to those who need to keep overhead costs at an absolute minimum without sacrificing professionalism.

Wave’s strength lies in its simplicity and accessibility. It strips away the complexity found in more advanced accounting suites and focuses on the essentials: creating, sending, and tracking invoices effectively. You can design professional, customized invoices with your logo, set up recurring billing for regular clients, and automatically send payment reminders to ensure you get paid on time. This makes it a fantastic entry point into digital financial management.

Why It’s a Top Choice for Tracking Invoices

Wave is arguably the best way to track invoices for new businesses and freelancers on a tight budget. It provides a robust, no-cost solution that covers all the fundamental needs of invoice management, making it an incredible value.

- •Unlimited Free Invoicing: Unlike many competitors that limit the number of clients or invoices on their free plans, Wave imposes no such restrictions. You can send as many invoices to as many clients as you need, with customizable templates to maintain brand consistency.

- •Integrated Payments and Accounting: Clients can pay you directly from the invoice via credit card or bank payment (standard transaction fees apply). These payments are automatically recorded in your Wave accounting records, which simplifies reconciliation and gives you a clear view of your income.

- •Expense and Receipt Tracking: The free mobile app allows you to scan receipts on the go, helping you track business expenses that can be linked to your projects. Properly categorizing these expenses is crucial, and you can learn more about how invoice data capture software streamlines this process.

Pricing and Access

This is where Wave truly shines. The core accounting, invoicing, and receipt scanning software is 100% free. There are no setup fees, monthly charges, or hidden costs for these features. Wave makes money through optional, pay-per-use services like online payment processing (with competitive, per-transaction fees) and payroll services. Customer support is primarily offered through a help center and email.

Pro Tip: Use Wave’s bank connection feature to automatically import your business transactions. This gives you a real-time overview of your cash flow and makes it incredibly easy to see when invoice payments have landed in your account, saving you from manual cross-checking.

Website: https://www.waveapps.com/

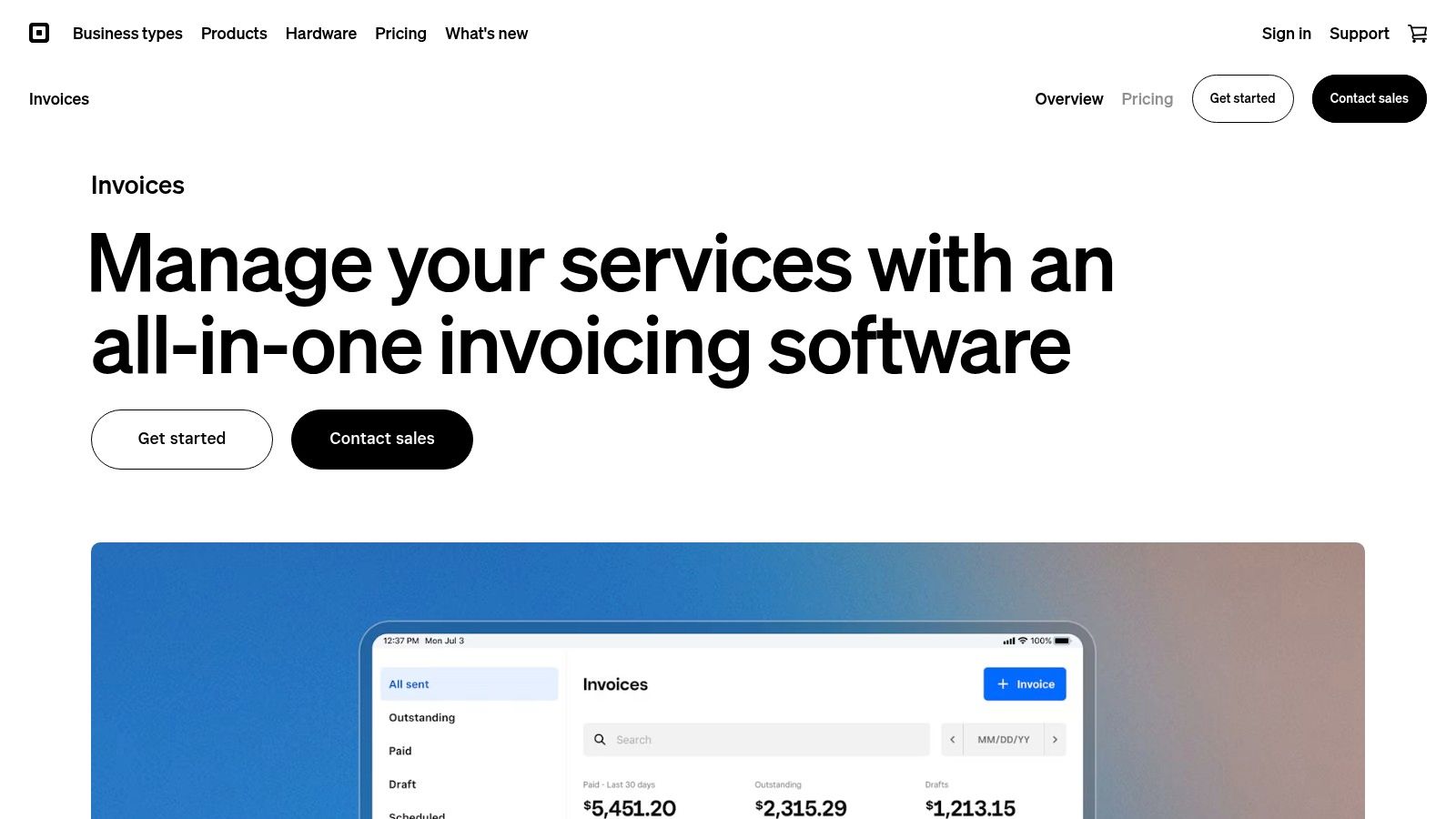

6. Square Invoices

For businesses that operate in both the physical and digital worlds, Square Invoices provides a powerful, cohesive solution. It's part of the broader Square ecosystem, which is renowned for its point-of-sale (POS) systems. This integration is its standout feature, allowing you to manage in-person sales and online invoices from a single, unified dashboard. If you're a retailer, a coffee shop owner, or a service provider who takes payments on-site and also bills clients remotely, this platform is built for you.

Square Invoices bridges the gap between different revenue streams effortlessly. You can send an invoice to a client for a custom project and, in the same afternoon, use your Square reader to accept a credit card payment from a walk-in customer. All this transaction data flows into one place, giving you a clear and complete picture of your sales activity without needing to juggle multiple systems.

Why It’s a Top Choice for Tracking Invoices

Square Invoices is arguably the best way to track invoices for businesses that need a seamless blend of online and in-person payment processing. Its strength lies in its simplicity and powerful integration.

- •Unified Payment Ecosystem: The core benefit is its connection to Square’s suite of tools. All payments, whether from an online invoice, a POS transaction, or a keyed-in entry, are tracked together. This simplifies cash flow management and sales reporting immensely.

- •Unlimited Invoicing for Free: The free plan allows you to send unlimited invoices, estimates, and contracts, making it incredibly accessible for startups and small businesses. You only pay standard processing fees when a client pays an invoice online.

- •Real-Time Tracking and Reminders: Easily monitor the status of every invoice from your dashboard or mobile app. You can see when an invoice is viewed and when it’s paid. The system can also send automatic payment reminders to clients, reducing the need for manual follow-ups.

Pricing and Access

Square offers a very compelling pricing model. The "Free" plan lets you send unlimited invoices with no monthly fee; you just pay a processing fee of 2.9% + 30¢ for online card payments. For more features like project tracking and custom fields, the "Plus" plan is available for $20/month, which also comes with lower processing fees for certain payment types.

Pro Tip: Leverage the Square mobile app to its fullest. You can create and send professional invoices directly from your phone moments after finishing a job, significantly speeding up your payment cycle and improving your cash flow.

Website: https://squareup.com/us/en/invoices

7. Xero

Often seen as a direct competitor to QuickBooks, Xero offers a beautifully designed, cloud-based accounting platform that excels in user experience and powerful integrations. For small and medium-sized businesses, especially those with a global footprint, Xero presents a compelling alternative. Its strength lies in its clean interface and robust automation, making complex accounting tasks feel approachable and streamlined.

Xero is built around the idea of making your financial data accessible and easy to manage from anywhere. You can create professional, customized invoices in moments, schedule them to send automatically, and track their status from draft to paid. The platform's real-time view of your cash flow and outstanding invoices ensures you are always informed about your financial position.

Why It’s a Top Choice for Tracking Invoices

Xero’s comprehensive feature set and focus on scalability make it the best way to track invoices for growing businesses that need more than just basic invoicing. Its powerful ecosystem helps automate your entire financial workflow.

- •Multi-Currency Support: A standout feature for businesses with international clients. Xero handles exchange rates automatically, allowing you to invoice and receive payments in over 160 currencies without the manual calculation headaches.

- •Vast Integration Marketplace: With connections to over 800 third-party apps, you can link Xero to your CRM, project management tools, or payment gateways. This creates a centralized hub where data flows seamlessly, eliminating duplicate entry.

- •Automated Reminders: Customize and automate invoice reminders to gently nudge clients about upcoming or overdue payments. This feature is crucial for maintaining healthy cash flow and saves you significant follow-up time.

Pricing and Access

Xero’s pricing is subscription-based, with plans tailored to different business needs. The "Early" plan starts around $15/month but has limitations on the number of invoices you can send. The more popular "Growing" and "Established" plans, ranging from about $42 to $78 per month, offer unlimited invoices and quotes, along with more advanced features.

Pro Tip: Use the Xero mobile app to reconcile bank transactions on the go. You can match incoming payments to their corresponding invoices in just a few taps, keeping your accounts up-to-date and accurate wherever you are.

Website: https://www.xero.com/

Invoice Tracking Solutions Comparison: Top 7 Tools

| Product | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Tailride | Moderate setup for custom AI rules 🔄 | Moderate, AI and integration setup⚡ | High automation, 99% manual processing reduction📊 | Finance teams, accountants, enterprises | Advanced AI automation, real-time monitoring, seamless integrations⭐ |

| QuickBooks Online | Low to Moderate 🔄 | Moderate, subscription-based ⚡ | Comprehensive accounting with invoicing 📊 | Growing businesses needing full accounting | Broad accounting features, user-friendly⭐ |

| FreshBooks | Low 🔄 | Low to Moderate ⚡ | Easy invoicing and billing automation 📊 | Small businesses, freelancers | Intuitive UI, strong support⭐ |

| Zoho Invoice | Low 🔄 | Low, free plan available ⚡ | Efficient invoicing with basic features 📊 | Small businesses, no-cost solution seekers | Free, integrates with Zoho ecosystem⭐ |

| Wave | Low 🔄 | Low, free and unlimited usage ⚡ | Basic invoicing and accounting 📊 | Small businesses, freelancers seeking free tools | Unlimited free invoicing, simple interface⭐ |

| Square Invoices | Low 🔄 | Low, free plan with fees on usage⚡ | Unlimited invoicing, payment integration 📊 | Retailers, point-of-sale users | Integration with Square POS, multiple payment options⭐ |

| Xero | Moderate 🔄 | Moderate to high, subscription ⚡ | Scalable invoicing with robust accounting 📊 | SMBs needing extensive integrations | Strong app integrations, multi-currency⭐ |

Making the Final Choice: Which Invoice Tracking Method Is Right for You?

We've journeyed through a comprehensive landscape of top-tier invoice tracking solutions, from all-in-one accounting giants to specialized automation powerhouses. The central takeaway is clear: the best way to track invoices isn't a one-size-fits-all answer. Instead, it's a personalized solution that aligns perfectly with your business's unique size, complexity, and future ambitions.

You've seen how tools like Wave offer a fantastic, no-cost entry point for freelancers and solo entrepreneurs, while FreshBooks excels for service-based businesses that prioritize client relationships and project tracking. For those needing a complete financial command center, QuickBooks Online and Xero provide robust, scalable ecosystems that can manage everything from payroll to inventory. Meanwhile, Square Invoices seamlessly bridges the gap between online and in-person sales, making it a natural choice for retailers and service providers with physical locations.

How to Pinpoint Your Perfect Match

To move from information to action, you need to conduct a quick internal audit. This self-assessment will illuminate the path forward and ensure you invest your time and resources in the right platform.

Start by asking these critical questions:

- •What is your current invoice volume? Are you handling 10 invoices a month or 100 a day? High volume points directly toward a need for automation.

- •Where does your time go? Pinpoint your biggest time sink. Is it creating and sending invoices, chasing late payments, or the tedious manual data entry from vendor bills and receipts?

- •What is your budget? Are you looking for a free solution to get started, or are you ready to invest in a premium tool that delivers significant ROI by saving you hours of labor?

- •What are your integration needs? Does your new tool need to speak to your CRM, project management software, or payment gateway? List your must-have connections.

- •What is your growth plan? The tool you choose today should support your business tomorrow. Will your chosen method scale with you as you hire more people and take on more clients?

From Manual Mayhem to Automated Efficiency

If your audit reveals that the most significant bottleneck is the manual collection and processing of invoices from emails and supplier portals, then a specialized automation tool is your answer. While traditional accounting software helps manage invoices once they are in the system, they don't solve the "getting them in" problem. This is where a solution like Tailride creates transformative value. It acts as an intelligent layer on top of your existing software, automating the most error-prone part of the process.

Ultimately, finding the best way to track invoices is an investment in your business’s financial health and operational sanity. By choosing wisely, you’re not just buying software; you’re buying back time, reducing stress, and building a resilient financial foundation that empowers you to focus on what you do best: growing your business.

Ready to eliminate manual data entry and create a truly automated workflow? Discover how Tailride connects directly to your inboxes and portals to capture every invoice, saving you hours of tedious work. See how Tailride can supercharge your invoice tracking today.