7 Invoice Management Best Practices for 2025

Discover 7 invoice management best practices to streamline your AP process. Learn to automate, optimize, and control your finances with Tailride.

Tags

Invoice management can feel like a constant battle against paper stacks, manual data entry, and endless approval chases. Finance teams often lose valuable hours to tasks that are repetitive, error-prone, and inefficient. But what if you could reclaim that time and refocus on strategic growth? This is where a clear strategy for invoice management best practices becomes essential for any modern business.

This guide reveals seven powerful techniques designed to eliminate friction and boost your bottom line. We'll move beyond generic advice and dive into actionable strategies that you can implement today, especially when powered by a platform like GetInvoice. Forget wrestling with late payments, compliance risks, or a lack of visibility into your spending.

You will learn how to:

- •Streamline data capture with automation.

- •Implement precise three-way matching to prevent fraud.

- •Standardize approval workflows for faster processing.

- •Leverage analytics for strategic financial insights.

These proven methods will help you build a smarter, more resilient accounts payable process. Let's explore the specific invoice management best practices that will transform your operations from a cost center into a strategic asset for your business.

1. Automated Invoice Processing

Manual invoice processing is a major time-sink for finance teams, plagued by slow data entry, human error, and lengthy approval cycles. Adopting automated invoice processing is one of the most impactful invoice management best practices because it directly tackles these inefficiencies. This approach uses technology like Optical Character Recognition (OCR) and Artificial Intelligence (AI) to transform paper or digital invoices into structured, usable data, eliminating manual keying.

Once captured, this data is automatically validated against purchase orders and routed through predefined workflows for approval. This frees up your team from tedious administrative tasks, allowing them to focus on more strategic financial analysis. Companies that embrace this see dramatic results. For example, Siemens successfully automated 85% of its invoice processing, and Coca-Cola slashed its processing time from 30 days down to a mere 5 days.

How to Implement Invoice Automation

Getting started with automation doesn't have to be an all-or-nothing endeavor. A phased approach ensures a smooth transition and maximizes your return on investment.

- •Start Small: Begin by automating high-volume, standardized invoices from your key suppliers. This allows you to refine the process before expanding.

- •Establish Data Standards: Define clear rules for data quality. Specify mandatory fields like invoice number, date, and PO number to ensure the AI can effectively validate information.

- •Train the System: Use your historical invoice data to train the AI. The more examples it has, the more accurate it will become at extracting and classifying data.

- •Define Exception Protocols: Create a clear workflow for handling exceptions, such as mismatched amounts or missing POs. This ensures flagged invoices are resolved quickly without disrupting the entire system.

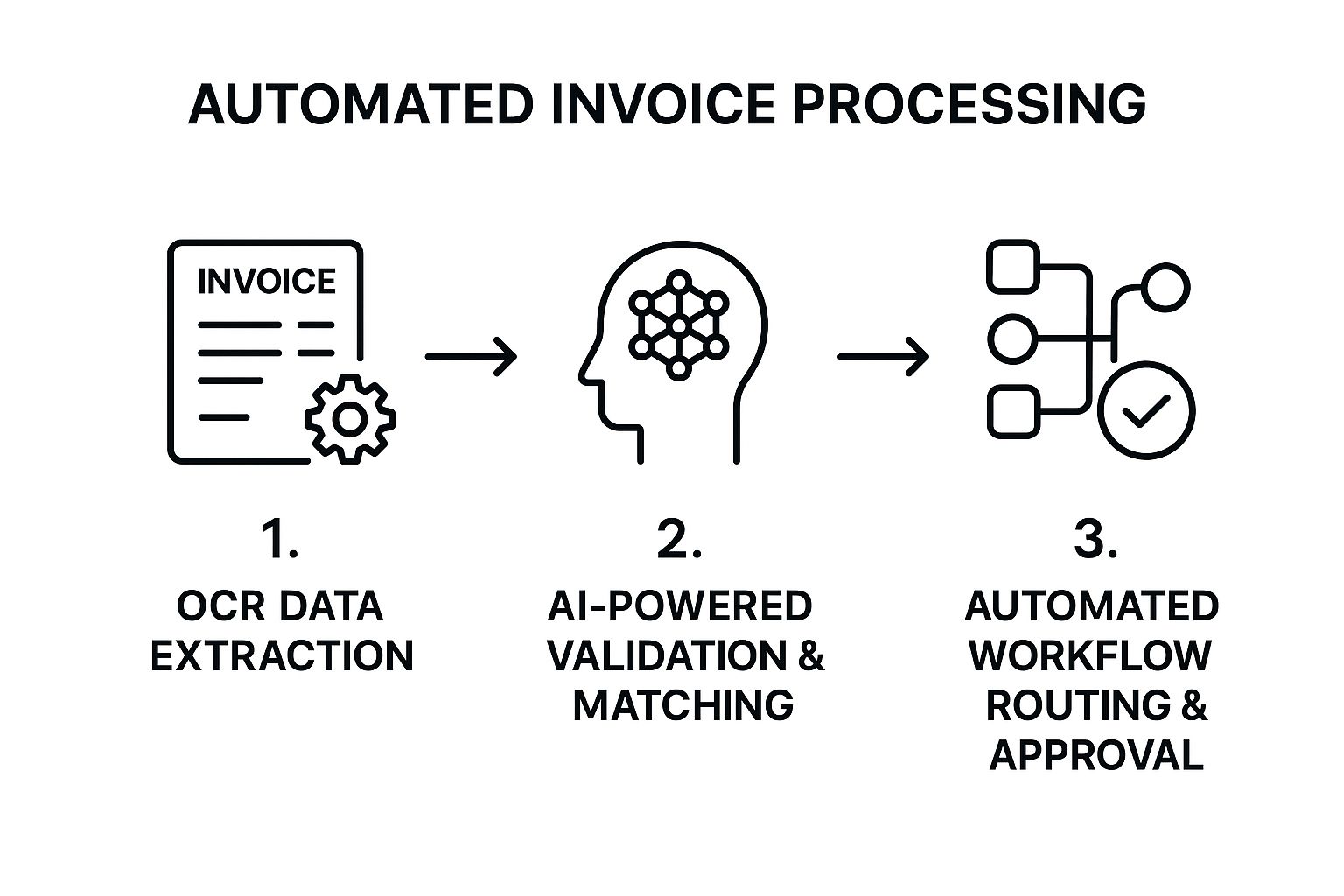

The following infographic illustrates the core stages of this automated workflow, from initial data capture to final approval routing.

This streamlined process shows how technology systematically handles each invoice, significantly reducing manual touchpoints and accelerating the entire accounts payable cycle.

For a deeper dive into how automation can transform your financial operations, this video provides an excellent overview.

2. Three-Way Matching Implementation

Erroneous payments, duplicate invoices, and fraud are significant financial risks that can drain a company's resources. Implementing a three-way matching process is a fundamental invoice management best practice that acts as a powerful internal control. This procedure validates vendor invoices by cross-referencing three crucial documents: the Purchase Order (PO), the Goods Receipt Note (GRN), and the invoice itself. This ensures you only pay for what you actually ordered and received.

This verification step is crucial for maintaining financial integrity and preventing cash leakage. For instance, General Electric significantly cut payment errors by adopting this method, while retail giants like Walmart rely on automated three-way matching to process millions of transactions with high accuracy. The goal is to catch discrepancies in quantities, prices, or terms before payment is ever issued, safeguarding your bottom line.

How to Implement Three-Way Matching

Successfully rolling out this control mechanism requires clear guidelines and collaboration between departments. A structured approach will help minimize friction and maximize effectiveness.

- •Establish Clear Tolerance Levels: Define acceptable variances for price and quantity. For example, you might allow a 1% price variance or a 2% quantity difference before an invoice is flagged for manual review.

- •Define Escalation Protocols: Create a clear workflow for handling mismatches. If an invoice fails the three-way match, designate who is responsible for investigating the issue with the procurement or receiving departments.

- •Train Your Teams: Ensure your procurement, receiving, and accounts payable teams understand the importance of accurate data entry. Emphasize that a correct PO and a detailed goods receipt are the foundation of a smooth matching process.

- •Leverage Exception Dashboards: Use your invoice management software to create dashboards that highlight exceptions. This provides a real-time view of problematic invoices, allowing for quick resolution and preventing bottlenecks.

By systematically comparing these documents, you create an audit-ready trail that verifies the legitimacy of every transaction.

For those looking to deepen their understanding, you can explore the intricacies of the invoice matching process on tailride.so.

3. Electronic Invoice Management (E-invoicing)

While automation focuses on processing received invoices, electronic invoicing (e-invoicing) revolutionizes how invoices are created and exchanged in the first place. It involves the direct digital transfer of invoice data between a supplier's and a buyer's financial systems using structured, standardized formats like XML or EDI. This is a critical invoice management best practice because it eliminates paper, PDFs, and manual data entry entirely, enabling true straight-through processing.

The impact of adopting e-invoicing is immense. The European Union has mandated it for all public sector transactions to boost efficiency and transparency. Similarly, Brazil's Nota Fiscal Eletrônica (NFe) system now handles over 60 billion electronic documents annually, streamlining tax compliance and commerce. On a corporate level, consumer goods giant Procter & Gamble successfully transitioned 90% of its key suppliers to e-invoicing, drastically reducing errors and payment delays.

How to Implement E-invoicing

Transitioning to a fully electronic system requires collaboration with your suppliers and a clear strategy. A phased rollout ensures a smoother adoption process for everyone involved.

- •Start with Key Suppliers: Prioritize your highest-volume suppliers first. Onboarding them successfully will deliver the biggest immediate impact on your processing efficiency and demonstrate the value of the new system.

- •Provide Supplier Support: Offer clear guidelines, training materials, and a dedicated point of contact to help your suppliers make the switch. A well-supported partner is a compliant partner.

- •Ensure Regulatory Compliance: E-invoicing standards and legal requirements vary by country. Work with your solution provider to ensure your system adheres to all local and international regulations, like those from OpenPeppol or national tax authorities.

- •Monitor Adoption Rates: Track which suppliers have transitioned and which haven't. Offering small incentives or highlighting the benefits of faster, guaranteed payments can encourage slower adopters to get on board.

4. Early Payment Discount Optimization

Failing to capture early payment discounts is like leaving free money on the table. Strategic management of payment timing is a crucial component of effective invoice management best practices, turning your accounts payable department from a cost center into a profit generator. This approach involves systematically analyzing supplier discount terms against your company's cash position to decide when paying early offers the best return.

This isn't just about saving a few dollars; the cumulative impact can be substantial. For example, Home Depot achieved 15% cost savings through its strategic early payment program, while Unilever optimized its payment terms to save an estimated €50 million annually. By treating discounts as a high-return, low-risk investment, you can significantly boost your bottom line without altering your core business operations.

How to Implement Early Payment Discount Optimization

A successful discount capture strategy requires a blend of data analysis, negotiation, and technology. You can start implementing this practice with a few focused steps.

- •Analyze Historical Performance: Begin by reviewing your past payments to determine your current discount capture rate. Identify missed opportunities and the reasons behind them, such as slow approval cycles or lack of visibility into payment terms.

- •Negotiate Better Terms: During contract renewals, make discount terms a key negotiation point. Propose terms like "2/10 net 30," which offers a 2% discount if paid in 10 days, and explain the mutual benefit of improved cash flow for your supplier.

- •Automate Payment Scheduling: Use your accounting or AP automation software to flag invoices with available discounts. Set up automated payment schedules that prioritize these invoices to ensure they are paid within the discount window without manual intervention.

- •Monitor Cash Flow Impact: Regularly assess how early payments affect your liquidity. Create simple models to compare the annualized return from a discount against the cost of capital to ensure each early payment is a financially sound decision.

The following video from the Institute of Finance & Management (IOFM) explains the financial metrics and strategic thinking behind building a world-class discount capture program.

5. Invoice Approval Workflow Standardization

Unclear or inconsistent approval processes create bottlenecks, leading to late payments, frustrated vendors, and a lack of accountability. Standardizing your invoice approval workflow is a crucial invoice management best practice that eliminates these ambiguities. This involves creating a clear, rule-based system that automatically routes invoices to the correct approvers based on predefined criteria like department, vendor, or invoice amount.

By establishing clear escalation paths and approval limits, you ensure every invoice follows a predictable and auditable journey. This systematic approach, influenced by frameworks like SOX and ISO 9001, provides transparency and control. For instance, Toyota implemented standardized workflows and cut its invoice approval time by 50%, while 3M improved its compliance scores by 40% after standardizing its global processes. These examples highlight the power of bringing order to a historically chaotic process.

How to Implement Standardized Approval Workflows

Creating a robust workflow requires thoughtful planning and clear communication. A structured approach ensures everyone understands their role and responsibilities.

- •Define Approval Tiers: Establish clear approval limits and authorities. For example, invoices under $1,000 might be approved by a department manager, while those over $10,000 require CFO authorization.

- •Implement Mobile Approvals: Equip your team with mobile approval capabilities. This allows decision-makers to review and approve invoices on the go, preventing delays when they are away from their desks.

- •Monitor Cycle Times: Regularly track the time it takes for an invoice to move through each stage of the approval process. This data will help you identify and resolve bottlenecks to maintain efficiency.

- •Provide Clear Training: Train all relevant staff on the new workflow processes. Ensure everyone understands the rules, their specific responsibilities, and how to use the system correctly.

Standardizing this critical step not only accelerates payments but also strengthens internal controls and compliance. Learn more about how you can streamline your process with invoice approval automation on tailride.so.

6. Vendor Master Data Management

Inaccurate or outdated vendor information is a silent killer of efficiency in accounts payable, leading to payment errors, compliance risks, and even fraud. Establishing strong vendor master data management is a critical invoice management best practice because it creates a single, reliable source of truth for all supplier information. This involves a disciplined approach to collecting, validating, standardizing, and maintaining all data related to your vendors.

When your vendor master file is clean and well-governed, invoices are processed against accurate details, payments are sent to the correct bank accounts, and compliance checks are streamlined. This foundational work prevents costly mistakes and strengthens supplier relationships. For instance, Chevron successfully prevented $2.3 million in fraudulent payments by implementing robust vendor data controls, while General Motors reduced its vendor duplicates by an impressive 85% through a dedicated master data management initiative.

How to Implement Vendor Master Data Management

A clean vendor master file is not a one-time project but an ongoing commitment. Implementing a structured process ensures data integrity from the moment a vendor is onboarded.

- •Establish Data Governance Policies: Define clear ownership and rules for who can create, approve, and modify vendor records. Document the required fields and validation steps for new supplier onboarding.

- •Implement Vendor Verification: Before adding a new vendor, verify their business identity, tax information (like TIN or VAT number), and bank account details through trusted third-party services or direct confirmation.

- •Use Automated Duplicate Detection: Leverage tools within your AP or ERP system to automatically flag potential duplicate vendor entries during creation. This prevents the same supplier from being added under different names or subsidiaries.

- •Create Vendor Self-Service Portals: Empower vendors to update their own information, such as addresses or bank details, through a secure portal. This reduces administrative work for your team and improves data accuracy, with all changes subject to internal review and approval.

- •Regularly Audit and Cleanse Data: Schedule periodic reviews of your entire vendor list to deactivate dormant accounts, correct inaccuracies, and purge obsolete information, ensuring your master data remains pristine.

7. Invoice Analytics and Reporting

Without visibility into your accounts payable performance, you are essentially flying blind. Implementing a robust analytics and reporting system is a critical invoice management best practice because it turns raw invoice data into actionable business intelligence. This approach moves beyond simple record-keeping to actively monitoring processing efficiency, identifying financial trends, and uncovering opportunities for improvement. It transforms your AP department from a cost center into a strategic asset.

By leveraging analytics, companies gain a clear view of their entire procure-to-pay cycle. For instance, Nestlé uses analytics to optimize payment timing across its global operations, improving cash flow and supplier relationships. Similarly, Ford implemented predictive analytics to forecast potential bottlenecks, which successfully reduced invoice processing errors by over 60%. These examples show how data-driven insights can lead to significant financial and operational gains.

How to Implement Invoice Analytics

Effective reporting isn't just about generating charts; it’s about answering key business questions and driving decisions. A structured approach ensures your analytics efforts deliver tangible value.

- •Focus on Actionable KPIs: Track metrics that directly impact your goals, such as Invoice Processing Time, Cost Per Invoice, and Early Payment Discount Capture Rate. Avoid vanity metrics that don't lead to action.

- •Implement Real-Time Monitoring: Use dashboards that provide an up-to-the-minute view of invoice statuses, approval bottlenecks, and team performance. This allows you to address issues proactively rather than waiting for month-end reports.

- •Create Role-Based Dashboards: Customize reports for different stakeholders. An AP clerk needs to see their queue of pending invoices, while a CFO needs a high-level overview of cash flow and departmental efficiency.

- •Establish Regular Reporting Cycles: Schedule weekly or monthly reviews of your key metrics. This creates a culture of continuous improvement where the team consistently looks for ways to optimize performance.

To explore this topic further, our detailed guide offers more insights. You can learn more about Invoice Analytics and Reporting on tailride.so to see how you can apply these principles.

7 Key Invoice Management Practices Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Automated Invoice Processing | High - involves OCR, AI & integration | High - technology & training needed | Large time savings, error reduction, cost cut | High-volume invoicing, mixed formats | Fast processing, error minimization, cost saving |

| Three-Way Matching Implementation | Moderate - requires strong data integration | Moderate - cross-department coordination | Fraud prevention, payment accuracy | Companies needing strict payment controls | Strong compliance, error reduction, audit readiness |

| Electronic Invoice Management (E-invoicing) | Moderate to High - system integration & standards | Moderate - onboarding suppliers, technical setup | Cost reduction, faster processing, improved cash flow | Organizations seeking end-to-end digital invoicing | Eliminates paper, speeds up payment cycle, regulatory compliance |

| Early Payment Discount Optimization | Moderate - requires cash flow analysis & scheduling | Moderate - finance tools & monitoring | Cost savings, improved supplier relations | Firms with available cash aiming profitability | Profit maximization, supplier leverage, working capital efficiency |

| Invoice Approval Workflow Standardization | Moderate - workflow design & role assignment | Moderate - change management & tools | Faster approvals, reduced risk & bottlenecks | Companies needing control & accountability in approvals | Clear authorization, audit readiness, reduced delays |

| Vendor Master Data Management | Moderate - data cleanup & governance setup | High - ongoing maintenance & tools | Fraud reduction, data accuracy | Organizations with large supplier databases | Fraud prevention, improved data quality, process efficiency |

| Invoice Analytics and Reporting | High - data integration & analytics setup | High - analytics expertise & technology | Insightful KPIs, process improvements | Firms investing in continuous AP performance improvement | Data-driven decisions, predictive insights, strategic planning |

From Best Practice to Daily Reality with Tailride

Moving from theory to execution is where the real transformation in your accounts payable process begins. Throughout this guide, we've explored a comprehensive set of invoice management best practices, from automating data capture to leveraging powerful analytics. These aren't just isolated tips; they are interconnected pillars that support a modern, resilient, and strategic finance function. The core message is clear: manual, error-prone processes are no longer sustainable in a competitive business environment.

Let's recap the essential takeaways. We established that automating invoice processing and implementing three-way matching are fundamental for creating an efficient and secure foundation. Shifting to electronic invoicing and standardizing approval workflows eliminates physical bottlenecks and ensures consistency. Proactively managing vendor data and optimizing for early payment discounts turns your AP department from a cost center into a value-generating powerhouse. Finally, robust analytics provide the visibility needed to make informed, strategic decisions.

Turning Insight into Action

Adopting these principles is the key to unlocking a more strategic accounts payable function. The journey from manual chaos to automated clarity isn't just about redesigning workflows; it's about embedding these best practices into your daily operations with the right technology. This is where a dedicated platform becomes indispensable, acting as the engine that powers your new, streamlined process.

The true value emerges when these practices work in harmony:

- •Automated data capture feeds clean information into your system.

- •Standardized workflows route invoices to the correct approvers without delay.

- •Three-way matching automatically flags discrepancies before they become costly problems.

- •Clean vendor data ensures payments are accurate and timely, unlocking early payment discounts.

- •Comprehensive reporting gives you a 360-degree view of your spending, cash flow, and supplier relationships.

This integrated approach elevates your finance team’s role. Instead of chasing down paper invoices and correcting data entry errors, your team can focus on higher-value activities like cash flow forecasting, budget analysis, and strengthening vendor partnerships. Mastering these invoice management best practices is more than an operational upgrade; it's a strategic imperative that builds a foundation for scalable growth, financial control, and enhanced business intelligence. You're not just paying bills faster; you're building a smarter, more agile organization.

Ready to transform your invoice management from a manual chore into an automated, strategic asset? Tailride is built to turn these best practices into your everyday reality, automating everything from data extraction to approval routing. Start automating with Tailride today and empower your finance team to drive real business value.