Streamline Invoice Processing A How-To Guide

Discover how to streamline invoice processing with our expert guide. Learn to automate workflows, reduce errors, and improve business efficiency today.

Let's be real for a moment. Manual invoice processing isn't just a headache; it's a quiet but constant drain on your business. The true cost isn't just about the hours your team spends on paperwork. It's about the hidden bottlenecks, the missed opportunities, and the slow, steady erosion of your bottom line.

The Sneaky Costs of Sticking with Slow Invoicing

It’s so easy to overlook how much a slow, paper-choked accounts payable process really costs. We see the obvious part - the time an employee spends manually typing in data - but the real damage happens with the indirect costs. These are the expenses that never appear as a neat line item on a report but hit your profitability day in and day out.

Think about it. When was the last time an important invoice got buried in an overflowing inbox or lost on someone's desk? That one slip-up probably led to a late payment, which didn't just rack up a penalty fee. It also chipped away at the trust you've built with a key supplier, potentially leading to less flexible payment terms down the road. Suddenly, your cash flow and supply chain feel a lot less stable.

The hidden costs of manual invoice processing - late fees, missed discounts, and strained vendor relationships - are often far greater than the visible costs of employee time. They represent a constant, low-grade financial leak that automation can seal permanently.

How Manual Errors Create a Domino Effect

We’re all human, and mistakes happen. But in the world of invoicing, a simple typo - a wrong dollar amount or an incorrect PO number - can trigger a massive chain reaction of problems. These aren't just minor annoyances; they create a huge administrative mess that pulls your finance team away from work that actually moves the needle.

This isn't a niche problem, either. A staggering 68% of companies are still relying on someone to manually enter their invoice data. Not only does this old-school method cost an average of $15 per invoice to process, but it's also incredibly error-prone. In fact, up to 39% of invoices globally contain mistakes that need to be fixed.

These kinds of errors in traditional document handling can have very real financial consequences, highlighting the tangible costs of relying on outdated document handling.

To put this in perspective, here's a quick look at how the two approaches stack up.

Manual vs Automated Invoice Processing at a Glance

This table offers a quick comparison, highlighting the key differences in cost, speed, and accuracy between traditional manual methods and a modern automated solution like Tailride.

| Metric | Manual Processing | Automated Processing (with Tailride) |

|---|---|---|

| Cost Per Invoice | Averages $15+ due to labor | Drops to just a few dollars |

| Processing Speed | Days or even weeks | Minutes or hours |

| Accuracy Rate | Lower, with high potential for human error | Over 99% accuracy |

| Error Handling | Slow, manual, and frustrating | Automated flagging for quick review |

| Visibility | Poor; invoices get lost in emails/desks | Real-time tracking from receipt to payment |

| Scalability | Difficult; requires hiring more people | Easy; handles growth without extra staff |

As you can see, the contrast is pretty stark. One path is expensive and full of friction, while the other is built for efficiency and growth.

The Biggest Expense of All? Opportunity Cost.

Here's the cost that's hardest to measure but hurts the most: opportunity cost. Every single hour your team spends chasing down approvals, fixing data entry mistakes, or manually matching invoices is an hour they aren't spending on high-value work.

Think about all the opportunities you might be missing:

- •Early Payment Discounts: So many suppliers offer a 1-2% discount for paying early. A sluggish, manual process means you're literally leaving free money on the table, invoice after invoice.

- •Strategic Financial Insights: Your finance experts have the skills to analyze spending trends, negotiate better deals with vendors, or find ways to optimize cash flow. Instead, they're stuck being professional paper-pushers.

- •Scaling Your Business: As your company grows, a manual system just can't keep pace. Eventually, the bottleneck in your AP department will actively prevent you from expanding.

At the end of the day, sticking with an outdated invoice process isn't just inefficient - it's a strategic liability. It holds your business back, eats up precious resources, and directly hurts your financial health. Moving to an automated solution like Tailride isn’t just a nice-to-have upgrade; it's a crucial step toward building a more resilient, scalable, and profitable company.

How to Build an Automated Invoice Workflow

Alright, let's get into the nuts and bolts of it. Moving away from a manual system is where you'll see a night-and-day difference in your accounts payable process. This isn't just theory; it's a practical guide to setting up a truly automated workflow using a tool like Tailride. The dream here is to create a 'touchless' system - an invoice lands in your inbox and sails through to approval without anyone having to lift a finger.

The first move is to automate how you even get the invoices into your system. Forget downloading attachments and uploading them one by one. Modern platforms can watch specific sources for you. A common and incredibly effective setup is to link a dedicated email address - think invoices@yourcompany.com - directly to Tailride. As soon as a vendor emails their invoice, the system grabs it and pulls it into the workflow. No more manual entry.

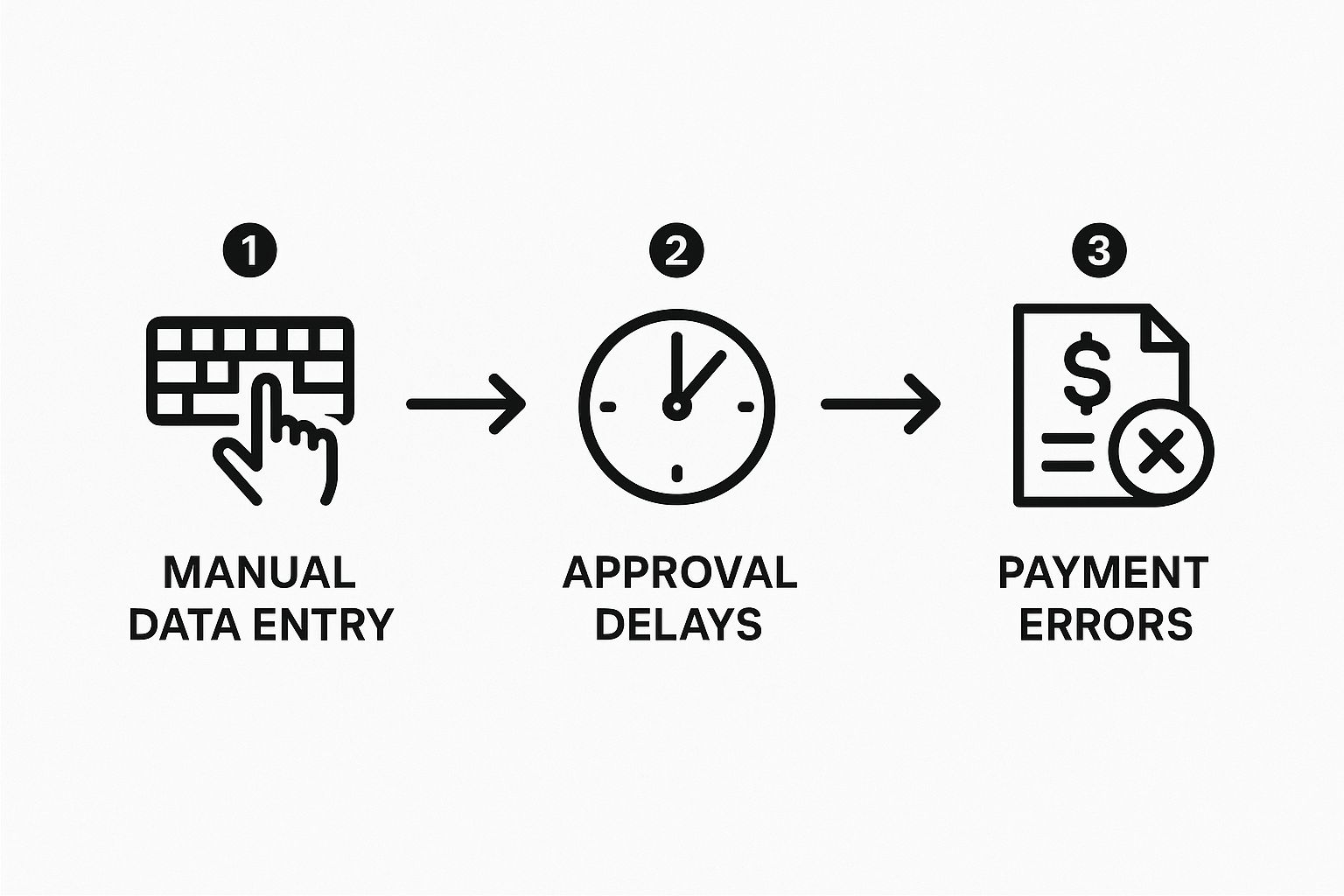

This image really drives home the common pain points that automation is designed to fix.

You can see how one simple manual error can cause a domino effect, leading to late payments and frustrated vendors. Automation stops that first domino from ever falling.

Setting Up Smart Data Extraction

Once an invoice is in the system, the next challenge is getting the information off it accurately. This is where AI-powered Optical Character Recognition (OCR) is a game-changer. Right out of the box, a solid platform like Tailride has already learned from thousands of different invoice layouts. But the real magic happens when you fine-tune it for your specific suppliers.

Let's say you work with a local printer whose invoices have a quirky, unique format. The first time you process one, you can essentially "show" the system where the key details are.

- •Invoice Number: Point and click on its location.

- •Total Amount: Highlight the final number.

- •Due Date: Show it where to find the payment deadline.

From that moment on, the system remembers. Every future invoice from that printer will be read perfectly. This little bit of initial training is what elevates an OCR tool from good to great, pushing you toward that 99% accuracy rate and drastically cutting down the time spent double-checking data.

A truly automated workflow isn't just about capturing documents; it's about understanding them. Training your system to recognize specific vendor formats is the key to building a process you can actually trust.

Building Smart Approval Hierarchies

Okay, so the data is in and it's accurate. Now, who needs to approve it? In a manual world, this means someone has to remember who's in charge of what, then forward an email and hope for the best. It's slow and a recipe for mistakes. An automated workflow uses rules you define to route the invoice instantly.

With Tailride, you can build these approval chains based on just about any piece of information the system pulls from the document. The logic is completely up to you.

For example, you could create rules like:

- •By Amount: Any invoice under $500 gets auto-approved. Anything over $5,000 needs a sign-off from the CFO.

- •By Department: If an invoice is coded to "Marketing," it goes straight to the marketing director. No pit stops.

- •By Vendor: All invoices from that critical software supplier? They go directly to the Head of IT for review first.

By connecting these three pieces - automatic capture, smart data extraction, and rule-based approvals - you're not just tweaking your old process. You're building a whole new, fundamentally better system. This is how you eliminate bottlenecks and give your finance team the breathing room to focus on strategy instead of chasing paperwork.

Getting Data Capture and Validation Right

Let's be honest: any automated workflow is only as good as the data flowing through it. It’s a classic "garbage in, garbage out" situation. I've seen countless businesses get excited about automation only to stumble at the first, most critical hurdle - capturing and verifying invoice information accurately.

To truly get a handle on your invoice processing, you need a system you can actually trust. The aim isn't just to scan documents; it's to build a rock-solid validation process that acts as your first line of defense against errors. This proactive approach stops bad data in its tracks, long before it ever messes up your accounting records. If you want to get into the nitty-gritty of the tech, our guide on https://tailride.so/blog/invoice-data-capture-software is a great place to start.

This intense focus on data quality is a huge reason why the global market for this software is booming. Valued at roughly $33.59 billion, it’s expected to climb to $40.82 billion next year as more companies smarten up their finance operations.

Your First Line of Defense: Three-Way Matching

One of the most effective tools in your arsenal is 3-way matching. This isn't just a fancy feature; it's a fundamental practice for data integrity, and it’s a core part of what makes a platform like Tailride so powerful.

Here’s how it works. The system automatically cross-references three critical documents:

- •The Purchase Order (PO) you originally sent.

- •The Goods Receipt Note that confirms what was delivered.

- •The Vendor's Invoice asking for payment.

If the numbers, prices, or even item descriptions don't line up perfectly across all three, the system immediately flags the invoice for a human to review. Simple as that. It catches overcharges or incorrect quantities before a single dollar is sent out the door.

I always tell people that effective validation isn't about finding mistakes later. It's about building a system that prevents them from ever happening. Three-way matching is your automated gatekeeper.

Fine-Tuning with Custom Validation Rules

Once you have the basics down, you can add another layer of intelligence with custom rules. Think of these as specific "if-then" instructions that you teach the system based on your own business's quirks and common issues. Getting this right is central to modern invoicing, and it aligns perfectly with the essential document management best practices that keep digital files in order.

With Tailride, setting these up is straightforward. You can create rules to automatically flag common headaches like:

- •Duplicate Invoices: No more accidentally paying the same bill twice.

- •Missing PO Numbers: A great way to enforce your company’s purchasing policies.

- •Incorrect Tax Amounts: Keeps you compliant and your financial reports clean.

When you combine automated 3-way matching with your own custom logic, you create a seriously robust defense system. This is how you shift your accounts payable from a reactive, error-prone chore into a proactive and highly efficient operation you can depend on.

Connecting Tailride to Your Other Tools

Your invoice processing software can't live on an island. If it isn't talking to the other financial tools you rely on, you haven't really solved the problem. You've just created another data silo.

Think about it. Without a proper connection, your team is stuck manually exporting and importing data - the exact tedious work you're trying to get rid of. True efficiency comes when these systems communicate seamlessly.

When Tailride is properly hooked into your accounting software - whether that's QuickBooks, Xero, or NetSuite - something magical happens. As soon as an invoice is approved, it zips right over, along with all its data. This completely cuts out manual entry, slashes the risk of human error, and gives you a constantly updated, accurate picture of your cash flow.

Native Connections vs. Custom APIs

So, how do you make this connection happen? You generally have two options: native integrations or an API.

- •Native Integrations: These are the "plug-and-play" options. They're pre-built connectors for popular software that you can set up in minutes with a few clicks. If you're using a common accounting platform, this is almost always the fastest and easiest way to go.

- •APIs (Application Programming Interfaces): This is the more powerful, flexible route. An API lets your developers build a custom bridge from Tailride to any other system you use, including proprietary or less common software. It's a blank canvas, but it does require someone with technical skills to build and maintain it.

I’ve seen companies succeed with both approaches. A small e-commerce shop using Xero can get connected instantly with a native integration. On the other hand, a larger enterprise with a homegrown ERP system can use the API to build a workflow that fits their unique processes like a glove.

The real goal of integration isn't just to shuttle data back and forth. It's to make your AP software feel like an invisible part of your main financial system. When you don't even have to think about it, you know the integration is working perfectly.

So, where should you start? Always check the native integrations first. If your accounting system is on the list, you've got a clear and simple path forward.

Getting this connection right is a cornerstone of your invoice processing automation strategy. It’s what ensures information flows where it needs to go without anyone lifting a finger, saving you time and giving you the clarity to make smarter financial decisions.

Using Analytics for Smarter Financial Decisions

Once you've automated your invoice workflow, you’ve done more than just save time. You've unearthed a goldmine of clean, organized financial data. This is the point where your accounts payable team stops being just a cost center and becomes a strategic part of the business. You’re no longer just crunching numbers; you're using them to make smarter decisions.

Modern tools like Tailride are designed for this exact purpose. They don’t just shuffle invoices from one digital pile to another. Instead, their built-in analytics dashboards bring your financial data to life. It’s not just about looking back at what you spent last quarter; it's about using that history to see what’s coming next and get ahead of it.

Turning Data Into Actionable Insights

So, where do you start? The first step is figuring out what to track. You need to identify the Key Performance Indicators (KPIs) that actually matter for your business. The beauty of an automated system is that these metrics are no longer hidden away in dusty spreadsheets. They’re right there on your dashboard, updated in real time.

I always tell my clients to start with these three:

- •Invoice Cycle Time: How long does it take from the moment an invoice hits your inbox to the moment it's paid? A shorter cycle isn't just a sign of efficiency - it leads to happier vendors.

- •Cost Per Invoice: This is a big one. You need to know exactly what it costs to process a single invoice. As you dial in your automation, you’ll be thrilled to watch this number plummet.

- •On-Time Payment Rate: Keep a close eye on this to avoid pesky late fees and build strong, lasting relationships with your suppliers. A good reputation is worth its weight in gold.

These platforms have come a long way. Digging into the advanced reporting capabilities available today shows just how deep you can go. The true power of automation isn't just about speed; it's about the financial clarity you gain. There's a whole world of accounts payable automation benefits that can really elevate a finance team’s impact.

The real magic of analytics is its ability to uncover patterns you’d never spot on your own. It's like flipping on the lights in a dark room - suddenly, everything becomes clear, and you can see exactly where the opportunities are.

Tracking the right data is a game-changer. Here's a quick look at the metrics that provide the most value when you're getting started.

Key Metrics to Track in Your New Workflow

| KPI | What It Measures | Why It Matters |

|---|---|---|

| Invoice Cycle Time | The average time from invoice receipt to final payment. | Reveals bottlenecks in your approval process and overall AP efficiency. |

| Cost Per Invoice | The total direct and indirect cost to process one invoice. | A direct measure of your AP department's operational cost and the ROI of automation. |

| On-Time Payment Rate | The percentage of invoices paid by their due date. | Directly impacts vendor relationships, negotiation power, and avoiding late fees. |

| Early Payment Discount Capture Rate | The percentage of available early payment discounts that you actually take. | Shows if you're leaving money on the table; a direct boost to your bottom line. |

Getting a handle on these numbers gives you a real-time pulse on your financial operations, moving you from reactive problem-solving to proactive strategy.

Strategic Reporting for Better Budgeting

This newfound clarity opens the door to more than just standard month-end reports. With a tool like Tailride, you can build custom reports to answer the specific questions that keep you up at night.

Ever wonder if you're spending too much with a certain supplier? Run a report. Need to break down expenses for the marketing department's latest campaign? A few clicks, and the data is all there.

This is what truly effective budget management and cash flow forecasting look like. By analyzing your past spending trends, you can predict future costs with much greater accuracy, spot chances to save money, and build a more resilient financial plan. You're not just managing invoices anymore - you're strategically managing the business.

Making Sense of Global E-Invoicing and Compliance

Expanding your business across borders is exciting, but it also means stepping into a complex world of invoicing rules. What flies in one country can cause major headaches in another. The reality is, navigating global compliance isn't a "one-size-fits-all" situation.

The shift to mandatory e-invoicing is picking up speed around the globe. This isn't just a suggestion anymore; it's quickly becoming law. Governments are pushing for electronic processing to crack down on tax fraud and get a clearer picture of economic activity. You can see how this trend is unfolding globally and what it means for companies like yours.

This makes having a smart, automated invoicing system more critical than ever. You need a setup that can handle different international rules without missing a beat.

A Look at Different Rulebooks

Let's talk about some real-world examples. Many countries in Latin America operate on what’s called a "clearance" model. Before you can even think about sending an invoice to your customer, you have to submit it electronically to the government's tax authority for approval. Without that official digital stamp, your invoice simply isn't valid.

Then you have the European Union, which uses networks like Peppol to standardize how businesses and government agencies exchange documents. But even within the EU, individual countries add their own specific formats or require you to use their unique portals. It creates a complicated patchwork of requirements.

Trying to keep up with all these global compliance rules by hand isn't just a headache - it’s a massive business risk. A single mistake could lead to steep fines, delayed payments, or even your goods getting stuck at the border.

The good news? You don’t have to become a global tax expert overnight.

This is exactly where a tool like Tailride comes in. It's built from the ground up to handle these very complexities. The platform is designed to adapt to different regional formats and regulations, so it can automatically generate compliant e-invoices no matter where you do business. This effectively future-proofs your AP department, letting you operate confidently across the globe without constantly looking over your shoulder for the next regulatory curveball.

Answering Your Top Invoice Processing Questions

Making the leap to a new system is a big deal, and it's totally normal to have a few questions. When you're thinking about automating your accounts payable, you want to be sure you're making the right move. Let's walk through some of the most common things that come up when businesses like yours decide it's time to get organized.

"Am I Going to Need an IT Degree to Set This Up?"

This is probably the first thing people ask, and it's a great question. You're busy running a business, not debugging code.

Honestly, with modern tools like Tailride, you really don't need to be a tech wizard. These platforms are built for the people who actually use them day-to-day. The setup is usually a guided process that feels more like connecting a social media account than configuring complex software. If you can link an email, you're pretty much good to go.

"How Do I Know My Financial Data Is Safe?"

Handing over sensitive documents is a matter of trust, and security is non-negotiable. It's something we take incredibly seriously.

Any reputable provider will be using enterprise-grade security to protect your information. Think of it like a digital Fort Knox. This includes things like:

- •End-to-end encryption, which scrambles your data as it travels and while it's stored.

- •Strict adherence to compliance standards like GDPR.

- •Regular security audits to stay ahead of potential threats.

"Will This Play Nicely with My Accounting Software?"

This is the big one. For any new tool to be truly useful, it has to fit into your existing workflow, not disrupt it. Your invoice processing platform absolutely must connect with your accounting system, whether you're using QuickBooks, Xero, or something else.

The best systems make this incredibly simple with pre-built, one-click integrations. For those of you with custom-built software, a good API (Application Programming Interface) is key. It gives your developers a toolkit to build a seamless bridge between systems.

A great system should feel like a natural extension of what you already do, not another clunky app you have to manage. The magic is in the integration - that’s where you get that effortless, hands-off automation.

"Okay, But How Long Until I Actually See a Difference?"

You'll feel some of the benefits almost right away. From day one, you'll notice the time you get back from not having to key in every single line item from an invoice. It's a huge relief.

The deeper, game-changing results? Those tend to show up after a couple of months. Once the system has had a chance to process a full billing cycle, you'll start to see the powerful analytics and major cost savings kick in. That's when you really see the full picture of your spending and efficiency gains.

Ready to stop chasing paperwork and start making smarter financial decisions? Tailride eliminates manual data entry and gives you back control over your accounts payable. See how it works and get started in seconds.