How to Reconcile Invoices Without Losing Your Mind

Learn how to reconcile invoices the right way. Our guide offers practical tips, error-proofing strategies, and automation insights to streamline your process.

Think of invoice reconciliation as a fundamental financial health check. It’s the process of making sure the bills you get from vendors perfectly match what you actually ordered and received. Essentially, you're lining up your purchase orders, receiving reports, and the final vendor invoice to catch any mistakes before money leaves your account.

This isn't just tedious paperwork; it's a critical safety net that prevents overpayments, catches costly errors, and keeps your financial records clean and accurate.

Your Starting Point for Flawless Reconciliation

Are mismatched invoices and surprise payment errors causing headaches? It’s a common frustration. Many businesses treat reconciliation as a low-priority admin task, but it's one of the most important things you can do to control your cash flow. It ensures every single dollar is accounted for.

Before we get into the nitty-gritty, let's make sure our foundation is solid. The whole process relies on having the right information ready to go. You have to get organized first.

For anyone dealing with physical products, this goes beyond just paperwork. Your inventory records must be spot-on. Following a good warehouse inventory management guide is the first step to preventing reconciliation problems down the line. After all, if your stock counts are wrong, your financial reports will be too.

The Key Documents You Need

At its core, invoice reconciliation is all about cross-referencing. You’re comparing a few key documents to make sure they all tell the same story about a single transaction. Each document is a piece of the puzzle, and you need all of them to see the full picture and avoid mistakes.

If you need a hand getting your paperwork in order, our post on how to organize invoices is a great place to start.

The goal is simple: confirm that the invoice you received accurately reflects the goods or services you ordered and obtained. Any deviation - whether in price, quantity, or terms - is a red flag that needs investigation.

To make this process as smooth as possible, you’ll want to gather a few specific documents before you even begin. Having these on hand will save you a ton of time and effort.

Here’s a quick look at the essential documents you'll be working with and why each one is so important.

Key Documents for Invoice Reconciliation

This table summarizes the essential documents required for the invoice reconciliation process and the role each one plays in verifying transactions.

| Document Type | Purpose in Reconciliation |

|---|---|

| Purchase Order (PO) | This is your official order document. It confirms what you agreed to buy, at what price, and under what terms. |

| Receiving Report | Also known as a goods received note, this confirms what you physically received, including quantities and condition. |

| Vendor Invoice | The bill from the supplier. You'll match this against the PO and receiving report to verify its accuracy before payment. |

With these three documents in hand, you have everything you need to confidently verify that what you're being charged for is exactly what you ordered and received.

Getting Your Hands Dirty: The Manual Reconciliation Process

Before we even talk about software, let's roll up our sleeves and get into the nitty-gritty of manual invoice reconciliation. I know, I know - it’s not the most glamorous task. But trust me, understanding how to do this by hand is a game-changer. It builds a solid foundation and gives you a much better grasp of what automation is actually doing for you later on.

The biggest mistake I see people make is letting invoices pile up until the end of the month. That’s a surefire way to create a stressful, error-prone mess. The trick is to find a rhythm. If you're dealing with a high volume of transactions, a daily check-in might be necessary. For most businesses, though, setting aside time once or twice a week is perfect. The goal is simple: stay ahead of the paperwork so it never becomes a monster.

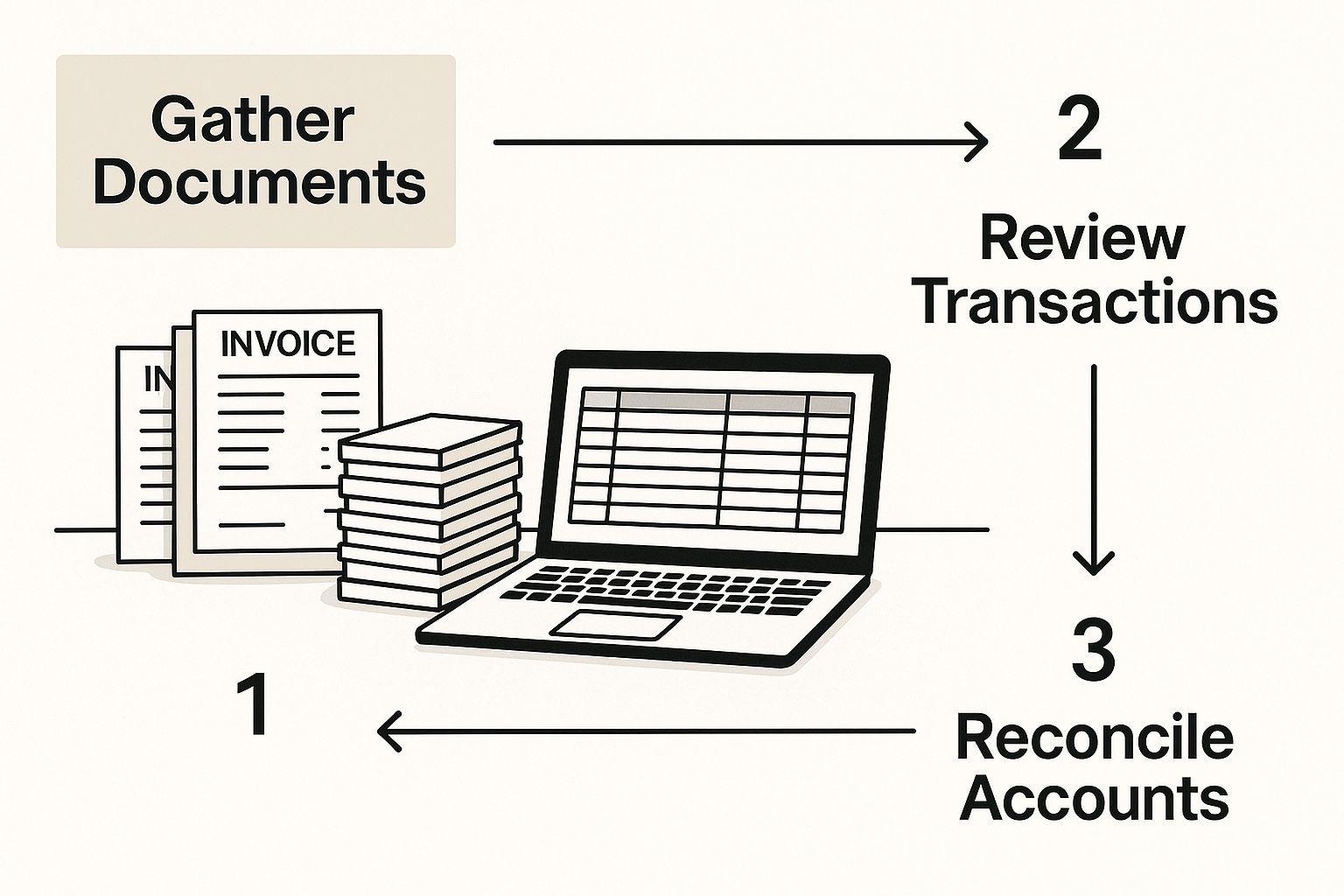

This flow chart lays out the basic journey, starting with the most critical first step - getting all your documents in one place.

As you can see, gathering your invoices, purchase orders, and receiving reports is where it all begins. Without these, you're flying blind.

The Heart of the Matter: The Three-Way Match

At the core of any good reconciliation process is the three-way match. This isn't just jargon; it's your single best defense against overpayments and fraud. It's a careful, line-by-line comparison of three key documents.

Here's what you're actually checking:

- •Purchase Order (PO) vs. Invoice: You’re making sure the bill you received reflects what you agreed to buy. Are the items, quantities, and prices exactly what's on the PO? Any deviation, like a surprise "service fee" or a price hike, is a red flag.

- •Receiving Report vs. Invoice: This one's simple: did you get what you're being billed for? Your receiving report (sometimes called a goods received note) is your proof. It confirms the correct quantity of items showed up and weren't damaged.

- •PO vs. Receiving Report: Finally, you're confirming that the warehouse received what the purchasing team ordered. This little check catches any fulfillment errors on the vendor's end before you even look at the bill.

If everything lines up perfectly across these three documents, you can confidently send that invoice off for payment. But what about when things don't match?

A tiny discrepancy - a single transposed digit in an item number or an extra zero on a line item - can have a massive impact. The three-way match is your safety net, designed to catch these costly mistakes before a single dollar leaves your account.

Building a System That Actually Works

A solid manual process isn’t about just one person knowing what to do. It’s about creating a repeatable system that anyone on your team could step in and follow. This means having clear, documented internal policies.

Your guide should spell out exactly who is responsible for each part of the workflow, from collecting the documents to giving the final sign-off. This creates real accountability and gets rid of the classic "I thought you were handling that" problem.

You also need a clear escalation path for when things go wrong - because they will. If a team member finds a mismatch, who do they tell? What information should they include in their report? Establishing a simple protocol, like requiring a screenshot of the discrepancy and a brief summary, helps get the issue resolved so much faster.

Keeping a detailed audit trail of all these checks and communications is also essential for compliance and just good business. If you're looking to build out these kinds of internal controls, exploring invoice reconciliation best practices from financial leaders can provide a great roadmap. A structured approach is what keeps payments accurate and protects your company from risk.

Common Reconciliation Pitfalls and How to Sidestep Them

Every finance team has its reconciliation war stories - those moments when a simple task somehow spirals into a full-blown detective case. I've seen it countless times. Knowing how to reconcile invoices isn't just about following steps; it's about anticipating the traps before you fall into them.

Even the most buttoned-up teams run into these snags.

Think of this as learning from others' mistakes so you don't have to repeat them. One of the most common headaches I see is the simple missing invoice. It gets buried in an inbox, stuck in a spam filter, or maybe the vendor just forgot to send it. Either way, payment is still expected, and suddenly your books are out of whack.

The best defense is a good offense. Set up a standardized follow-up process. If a purchase order is aging and there's still no invoice, have a polite, pre-written email ready to fire off. A simple, consistent check-in can solve 90% of these missing document issues before they snowball.

Handling Data Entry and Payment Errors

Let's be honest, human error happens. A single typo can turn a $1,500 invoice into a $15,000 nightmare, and a botched currency conversion can silently bleed cash. These aren't just hypotheticals; I've seen them happen when teams are rushing to close out the month.

Duplicate payments are just as dangerous. This classic blunder often happens when a vendor sends the same invoice twice, or when two different people on your team accidentally process the same bill. It’s a direct hit to your cash flow and can be surprisingly difficult to unravel later.

The most insidious reconciliation errors aren't the big, obvious ones. They're the small, repetitive mistakes - like duplicate payments or minor typos - that accumulate over time, creating significant financial leakage.

To sidestep these costly mistakes, implement a clear "check and balance" system. It can be as simple as having one person enter the invoice data and another review it before payment is approved. This two-step verification adds a crucial layer of protection. For an even more robust defense, it's worth exploring proven accounts payable automation best practices to strengthen your internal controls.

Navigating Complex Payment Scenarios

Beyond simple typos, you'll run into more complex situations that can really throw a wrench in the works. From my experience, these are often the source of the biggest delays and frustrations.

Here are a few common scenarios and how to get ahead of them:

- •Mismatched Reference Numbers: A vendor uses their own order number on the invoice instead of your PO number. Instantly, matching becomes a nightmare. A simple policy change - making your PO number a mandatory field on all incoming invoices - can solve this for good.

- •Partial Payments: You might only pay a portion of an invoice upfront, with the rest due later. Tracking these split payments and their remaining balances requires meticulous record-keeping to avoid overpaying or creating confusion down the line.

- •Credit Memos and Adjustments: When a vendor issues a credit, it has to be applied to your account correctly. A misfiled credit memo is a frequent culprit behind payment discrepancies and can leave you thinking you owe more than you actually do.

The key here is to have a clear, documented protocol for each of these scenarios. When your team knows exactly what to do with a mismatched number or a credit memo, they can resolve it quickly instead of letting it become a roadblock that holds up the entire process.

Using Automation for Smarter Reconciliation

While getting the manual process down pat builds a rock-solid financial foundation, let's be honest - it's slow, repetitive, and a magnet for human error. This is where modern software doesn’t just help; it completely changes the game. Automating how you reconcile invoices turns a time-draining chore into a slick, accurate, and far more affordable operation.

Instead of your team spending hours painstakingly matching documents, automation tools can execute a three-way match in seconds. They instantly scan and compare purchase orders, invoices, and receiving reports, flagging only the real exceptions that genuinely need a human eye.

This shift frees up your finance pros to focus on what they do best: strategic work like financial analysis and cash flow forecasting, rather than getting buried in administrative quicksand. The value isn't just in saving time; it's about putting that time back into activities that actually grow the business.

The Power of Integration and AI

The real magic kicks in when these tools talk directly to your existing systems. By integrating with your Enterprise Resource Planning (ERP) and accounting software, you create a smooth, hands-off flow of data. No more exporting spreadsheets or manually keying in information from one platform to another.

This is what a modern, automated platform looks like in action - pulling invoice data directly into a clean, easy-to-use dashboard.

This single, centralized view gets rid of data silos and gives your speed and accuracy a massive boost. Everything is in one place, updated in real time.

Modern solutions like Tailride use AI-powered data extraction to "read" invoices in any format, whether it's a PDF, a scanned image, or just text in an email. The software intelligently identifies and grabs key information like invoice numbers, due dates, and line-item details, which all but eliminates the risk of data entry mistakes. You can get a deeper look into how this works in our guide on invoice processing automation.

Automation doesn’t just make the old process faster; it creates a new, more reliable one. It establishes a single source of truth for your accounts payable, providing a clear, auditable trail for every transaction from receipt to payment.

The Real-World Business Benefits

Switching to automation is more than just a nice-to-have; it's a strategic move with a clear return on investment. Those efficiency gains translate directly into cost savings. In fact, a 2025 report from Ardent Partners found that businesses using invoice reconciliation software see processing costs drop by as much as 60%, and they can reduce manual effort by up to 80%. That’s a powerful argument for the financial impact of automation.

Here are the key benefits you can expect to see:

- •Fewer Costly Errors: Automation catches the typos, duplicate entries, and other manual mistakes that lead to overpayments and headaches.

- •Faster Processing Times: Invoices fly from receipt to approval in a fraction of the time, helping you snag early payment discounts and keep your vendors happy.

- •Tighter Financial Control: With automated audit trails and real-time visibility, you gain much better control over your spending and stay compliant.

For businesses looking to automate other financial workflows, it can be a great move to explore how to build no-code internal business tools. By bringing in automation, you’re not just optimizing a single task - you’re building a more resilient and efficient financial engine for the future.

What's Next? A Look at the Future of Reconciliation with AI and Advanced Tech

While today's automation is already a huge leap forward for invoice reconciliation, what’s coming down the pike is even more exciting. We're on the verge of moving past simple, rule-based matching and into a new chapter where AI and other tech can predict issues, learn from mistakes, and secure your financial data in ways we couldn't before.

This isn't just about speeding up the same old tasks. It's about fundamentally changing our approach to financial accuracy. Think about a system that doesn't just spot an error but learns from it, ensuring it never happens again. That’s where we're headed.

Smarter, Predictive Reconciliation

The next wave of innovation is all about more sophisticated AI. We're talking about systems that don't just follow a script but are built to adapt and almost think.

One of the coolest developments I've seen is what's being called agentic AI. This kind of AI gets smarter with every single reconciliation it handles. When you fix a vendor name that was slightly off or categorize an unusual expense, the system doesn't just process the correction - it learns from it. Over time, it gets incredibly accurate because it's constantly tailoring itself to your company's unique quirks.

Then you have AI-powered prediction engines, which are a total game-changer. These tools comb through your past transactions to predict which invoices and payments belong together, even when there isn't a clear PO number to go by. This shifts the whole process from reactive cleanup to proactive problem-solving.

The real breakthrough here is moving from systems that find problems to systems that see them coming. This lets finance teams get ahead of issues before they ever mess up the books.

Locking Down Transactions with New Tech

It's not all about AI, either. Other technologies are stepping up to add powerful new layers of security and clarity to reconciliation. This is where things like blockchain and Natural Language Processing (NLP) really shine.

- •

Blockchain for Bulletproof Audits: By creating a permanent, unchangeable record of every transaction, blockchain offers incredible transparency. It makes audits a breeze and dramatically cuts down on the risk of someone trying to sneak a fraudulent invoice through.

- •

NLP for Reading Between the Lines: Think about all the crucial details buried in the "notes" field of a remittance slip or in a quick email. NLP gives software the ability to understand that human language, correctly interpreting things like partial payments or complex adjustments that older systems would simply ignore.

The reconciliation world is moving fast to embrace these tools. With transaction volumes only going up, smart finance leaders are investing now to keep their operations clean, reduce errors, and free up their people for more strategic work. To get a deeper understanding of how these pieces fit together, it's worth exploring the role of AI in financial data infrastructure. Keeping an eye on these innovations is the best way to make sure your financial processes are ready for the future.

A Few Common Reconciliation Questions, Answered

Even with the best process in place, questions always come up. Getting good at reconciling invoices means knowing how to handle those tricky "what if" scenarios. Here are some quick, straightforward answers to the questions I hear most often.

How Often Should I Reconcile Invoices?

Honestly, it all comes down to your transaction volume. If you're running a busy e-commerce store with hundreds of daily orders, you’ll probably want to reconcile every single day just to keep a clear picture of your cash flow.

For most small and medium-sized businesses, though, a weekly or bi-weekly schedule usually hits the sweet spot. The real goal is to avoid that dreaded end-of-the-month scramble. Consistency is what truly matters, so pick a rhythm you can actually stick to.

A bit of personal advice: Don't let perfect be the enemy of good. Reconciling weekly is infinitely better than aiming for daily and constantly falling behind. The key is building a sustainable habit that keeps your books accurate.

Why Is the Three-Way Match So Important?

Think of the three-way match as your company's built-in fraud detection and quality control system. It's the most reliable method out there to make sure you're only paying for what you ordered and what you actually received.

When you skip this, you're rolling out the welcome mat for all sorts of expensive errors. I've seen it happen time and again:

- •Paying for phantom items that never showed up.

- •Letting incorrect vendor pricing slide through.

- •Accidentally paying the same invoice twice.

It’s your best line of defense against overpaying and helps keep your relationships with vendors transparent and built on trust.

How Can I Start Automating Without Overwhelming My Team?

Bringing in new software can feel like a huge project, but you don't have to tackle everything at once. My advice? Start small.

The easiest first step is to use an automation tool simply to grab and organize all your incoming invoices from email. That one change alone gets rid of the frustrating document hunt.

Once your team gets the hang of that, switch on the automated data extraction. Let the software do the heavy lifting of pulling out the key details, and have a team member just give it a quick check. From there, you can gradually introduce features like automated matching and approval workflows. This step-by-step approach makes the whole transition feel manageable and helps your team see the tool as a helpful assistant, not another headache.

Ready to stop wrestling with paperwork and start streamlining your reconciliation process? Tailride plugs right into your inboxes and vendor portals to automatically capture, extract, and match invoice data. It’s designed to cut down on manual work and give you back hours of your day. See how it works and find out if it's the right fit for you.