How to Keep Track of Invoices and Get Paid Faster

Learn how to keep track of invoices with our friendly guide. Discover practical workflows and tools to manage payments and improve your cash flow.

Tags

Tired of that sinking feeling when you realize a payment is late? You're definitely not the only one. The secret to getting a handle on your invoices isn't some complex accounting wizardry. It’s actually about building a simple, repeatable system. The whole process boils down to three things: creating clear invoices, keeping all your documents in one place, and following up consistently. Nail these, and you'll have a reliable process that gets you paid on time, without all the usual headaches.

Stop Chasing Payments and Start Tracking Invoices

Lost or delayed payments do more than just mess with your bank account - they eat up precious time you should be spending on growing your business. I'm sure you know the feeling: the constant low-level anxiety about cash flow, drafting those slightly awkward follow-up emails, and the sheer frustration of digging through old files and sent folders. It's a massive drain.

Many freelancers and small business owners think the only way to get paid on time is to either get aggressive or shell out for expensive, complicated software. But that’s really not the case.

The real key is to get proactive and organized. It’s not about scrambling when an invoice is already overdue; it's about setting things up so it rarely happens in the first place. Think of it this way: a good invoice tracking system isn't just a financial chore. It's a reflection of your professionalism and a core part of your customer experience.

A well-managed invoicing system is the bedrock of healthy cash flow. It transforms your payment process from a source of stress into a predictable and professional part of your business operations.

When you shift your mindset from chasing payments to managing them, you’re back in control of your company's financial health. This guide is your roadmap to get there. We’re going to focus on three simple, powerful pillars.

Clarity in Your Invoices

This is all about making it incredibly easy for your clients to pay you. We're talking professional invoices with crystal-clear details - like a unique invoice number, a firm due date, and simple, no-nonsense payment terms. No room for confusion.

Centralization of Your Records

You need a single source of truth for all your invoices. This doesn't have to be fancy. It could be a well-organized folder in the cloud or a dedicated invoicing tool. The goal is to know exactly where every invoice is at a moment's notice.

Consistency in Your Follow-Up

This is where the magic happens. Having a reliable, non-pushy follow-up routine keeps the lines of communication open and gently reminds clients that your payment is a priority. It’s about being persistent, not pesky.

This isn’t just some abstract theory. Putting these steps into practice will help you build a durable system that dramatically reduces financial stress and frees you up to focus on the work you actually love to do.

Laying the Groundwork for Smart Invoice Tracking

Before you can even think about tracking invoices, you have to get the invoice itself right. A solid tracking system is built on a foundation of clear, professional invoices that leave no room for questions. Think of it this way: every invoice you send is a direct instruction to your client. The clearer those instructions, the quicker you'll see the money in your account.

At a bare minimum, every single invoice needs a few key things: a unique invoice number, a can't-miss-it due date, and crystal-clear payment terms. If any of these are fuzzy or missing, you're practically inviting delays. The whole point is to preemptively answer any question your client might have.

Crafting Invoices That Get You Paid Faster

A consistent invoice numbering system is your best friend here. It doesn't need to be fancy. I've seen freelancers have great success with a simple sequential system (like 001, 002, 003) or one based on the client and date (something like SMITH-2024-001). The specific format doesn't matter nearly as much as just sticking with one. A unique number on every invoice makes it impossible to create duplicates and makes talking about a specific bill with a client a breeze. Come tax time, you'll thank yourself.

Look at your payment terms, too. Are they truly clear? Instead of industry jargon like "Net 30," try spelling it out: "Payment due within 30 days of invoice date." That tiny tweak removes all ambiguity. I also recommend breaking down your work into detailed line items. This shows your client exactly what they’re paying for and nips potential disputes in the bud.

A great invoice does more than just ask for money. It quietly reinforces your professionalism and makes it incredibly easy for your client to pay you. It's the first, and maybe most important, step in managing your cash flow.

Creating a Central Hub for All Your Invoices

Okay, so your invoices are now models of clarity. What's next? You need one place - and only one place - where all these invoices live. Trust me, trying to manage them from your email attachments, downloads folder, and random files scattered on your desktop is a surefire path to chaos. You need a single source of truth.

This hub doesn't have to be complicated. A dedicated folder in a cloud service you already use, like Google Drive or Dropbox, works beautifully. Here’s a simple structure I’ve used myself that brings immediate order to the mess:

- •Main Folder:

Invoices 2024 - •Client Folders: Inside, create a folder for each client (

Client A,Client B, etc.) - •Status Folders: Then, inside each client's folder, create two more:

SentandPaid.

It’s a simple workflow. When you create and send a new invoice, you immediately save a PDF copy into that client’s Sent folder. As soon as the payment hits your bank, you just drag that file from Sent to Paid. Boom. At a glance, you can see who has paid and who still owes you. This manual digital filing cabinet is the perfect starting point and a crucial habit to build before you ever consider more complex software.

Choosing Your Invoice Tracking Toolkit

Picking the right tools for tracking your invoices can be a game-changer. Seriously. It can take one of the most tedious parts of running a business and make it smooth, organized, and almost painless. What works best for you really comes down to your business’s size, how complex your needs are, and where you're headed. Let's walk through the main options so you can find the perfect fit.

When you're just starting out, especially as a freelancer or a brand-new business, a simple spreadsheet can be your best friend. It’s free, you can tweak it however you like, and you have complete control. But that manual approach has a hidden cost: your time. And let's be honest, it's easy to make a typo that throws everything off.

The reality is, manual invoicing is a huge drag on businesses everywhere. It takes, on average, a staggering 14.6 days just to process one invoice by hand. On top of that, nearly 39% of those invoices have errors that need fixing. With 68% of companies still plugging in data manually, the whole process ends up costing around $15 per invoice.

From Manual Spreadsheets to Smart Software

As your client list grows, the cracks in that trusty spreadsheet start to show. Chasing down payments, remembering who owes what - it gets messy, fast. This is the point where dedicated invoicing software or a full-blown accounting platform starts to look very appealing. These tools are built to handle the heavy lifting, saving you time and a lot of headaches.

The goal isn't just to grab any tool. It's about finding the right tool for you, right now. A freelancer might thrive with a well-organized spreadsheet, but a growing small business needs automated reminders and easy payment options to keep cash flowing.

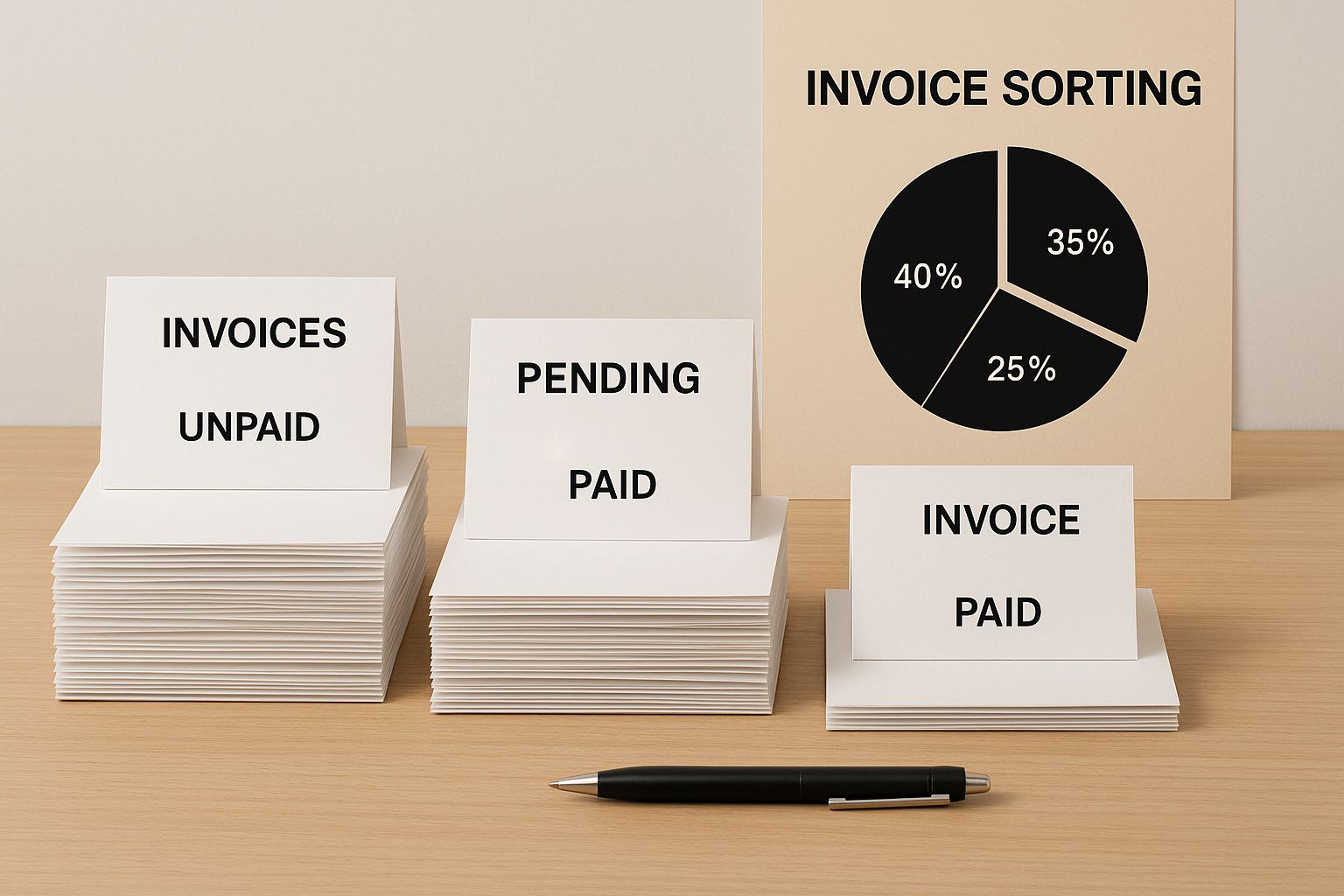

No matter what tool you end up with, the first step is always organization. Getting your invoices sorted is the foundation of any good tracking system.

As you can see, whether you're dealing with a stack of paper or digital files, having a clear system is what really matters.

Invoice Tracking Methods Compared

To make the choice a bit clearer, I've put together a quick comparison of the main methods. Seeing the pros and cons side-by-side can really help you pinpoint what makes the most sense for your business.

| Tracking Method | Pros | Cons | Best For |

|---|---|---|---|

| Spreadsheets | Free, incredibly flexible, and gives you total control over your data. | Very time-consuming, prone to human error, and completely lacks automation features. | Freelancers or new businesses with a very low number of monthly invoices. |

| Invoicing Software | Automates follow-ups, offers online payment options, and creates professional templates. | Comes with a monthly subscription fee and might have limited accounting features. | Growing businesses and freelancers looking to reclaim their time and get paid faster. |

| Accounting Platforms | An all-in-one hub for invoicing, bookkeeping, payroll, and financial reports. | Can be complex to learn and is often more expensive than standalone tools. | Established businesses that need a complete, integrated view of their finances. |

Looking at this table, you can see how the right tool aligns with your business's stage of growth.

For freelancers, finding software that fits your specific workflow is key to staying organized and profitable. If you're in that boat, it's worth exploring the top invoicing tools for freelancers to see what's out there.

Many of these platforms provide a dashboard that gives you a bird's-eye view of your financial health at a glance. It's a massive upgrade from scrolling through rows in a spreadsheet. As your business continues to expand, you might find yourself wanting even more power. To get a better sense of what's possible, our guide on invoice automation software is a great next step.

Designing a Workflow That Prevents Late Payments

Having an organized system is a great start, but it's the workflow you build around it that really makes the difference. The goal isn't just to track invoices - it's to create a process that stops late payments before they even happen. It’s all about being proactive instead of constantly reacting to problems.

A solid workflow is just a series of predictable steps that you follow for every single invoice, from the moment it’s created to the moment it’s paid. When you have a consistent routine, you build habits that ensure nothing gets missed. It also has the added benefit of setting clear, professional expectations for your clients.

I've learned over the years that most payment issues aren't about a client's ability or willingness to pay. It’s usually a process problem. In fact, some studies show that up to 70% of payment reminders are needed because of simple things like a lost invoice or a miscommunication. A better workflow is almost always the fix.

Think of the entire invoicing process as a series of conversations. Each email and reminder is a chance to gently guide your client toward paying on time while showing them you’re a professional they can count on.

The Proactive Communication Timeline

Instead of just sitting back and waiting for an invoice to go past its due date, you need a timeline of friendly nudges and clear communication. This approach keeps your invoice on their to-do list without you having to be pushy, which dramatically cuts down on the chances of a payment falling through the cracks.

Here’s a simple, effective timeline you can start using right away:

- •Send It Immediately: The absolute best time to send an invoice is the moment the work is done or the product is delivered. The value you've provided is fresh in your client's mind, making them much more likely to pay you quickly.

- •Confirm They Got It: A day or two after you send it, follow up with a quick, polite email just to make sure they received the invoice. This simple step catches all sorts of issues, from emails getting stuck in a spam filter to being sent to the wrong person in accounting.

- •The Friendly Reminder: About 3-5 days before the due date, send a gentle reminder. This isn't a demand - it's a helpful heads-up that keeps your invoice on their radar as they plan their payments.

- •The Overdue Notice: If the due date comes and goes, send a firm but polite notice on the day it becomes overdue. Make sure to re-attach the original invoice and clearly state that the payment is now late.

Handling Overdue Payments Gracefully

Even with the best system in the world, a late payment will occasionally happen. The trick is to handle it without burning bridges. After your first overdue notice, keep a consistent follow-up schedule - maybe once a week.

Always keep your tone professional, and make it incredibly easy for them to pay by including the invoice and a payment link in every single email.

Automating these communications is a game-changer. It saves a ton of time and adds a level of consistency that’s hard to achieve manually. Businesses are quickly learning that a smart approach to their accounts is the secret to healthy cash flow. In fact, learning how to automate accounts payable can streamline your own operations even more.

At the end of the day, a great workflow is your best defense against the stress of chasing down money you’ve already earned.

Common Invoice Tracking Mistakes to Avoid

Even with a great workflow in place, it’s surprisingly easy for small mistakes to create massive payment delays and headaches. I’ve seen it happen time and time again. Knowing what these common tripwires are is the best way to build a system that actually works.

Think of this as your "what not to do" list, pulled straight from real-world experience.

One of the biggest culprits? Inconsistent invoice numbering. When you're just starting out, it's tempting to use random numbers or, even worse, reuse old ones. This creates total chaos. The moment a client calls with a question, you're scrambling to find the right file, and it turns tax time into an absolute nightmare.

A simple, sequential system is your best friend here. Something like 2024-001, 2024-002, and so on, keeps everything in perfect order.

Another classic mistake is using vague or unclear payment terms. Just slapping "Net 30" on an invoice might seem standard, but it can be confusing. Be crystal clear instead. Spell it out: “Payment due within 30 days of invoice date.” This leaves no room for misinterpretation and sets a professional tone from the get-go.

Failing to Follow Up Promptly

This one is probably the most damaging mistake of all: letting a due date slide by without a word. When you don't follow up, you're subconsciously telling your client that getting paid isn't a top priority. This is exactly where businesses lose control and watch invoices get older and older.

A slow follow-up is a quiet acceptance of a late payment. Your process should be as diligent about reminders as it is about sending the initial invoice.

So, how do you keep these errors from creeping in? The best defense is a good offense, which often means using the right tools. Most of these problems happen when invoices and records are scattered all over the place - in emails, on your desktop, you name it.

A dedicated system can bring everything into one central hub and automate the most tedious parts of your workflow. To get a better handle on this, check out our guide on accounting document management software and learn how to create a single source of truth for all your financial documents.

The Future of Invoicing Is Digital

Let's be honest, the way we all handle invoices is changing fast. The days of filing cabinets overflowing with paper and spending hours on manual data entry are coming to a close. We're in the middle of a massive global shift towards digital and electronic invoicing (e-invoicing), and it’s not just a passing trend.

This change is being pushed by governments and entire industries around the world. Why? They're all chasing the same things: better efficiency, more transparency, and tighter control over financial data. If you've been wondering how to keep track of invoices in this environment, you need to understand this shift. It’s no longer just about making things easier for yourself; it's about staying compliant and competitive.

The Global Push for E-Invoicing

This isn't some far-off prediction. It's happening right now. All over the world, countries are rolling out complex systems that require businesses to run their invoices through official government portals before they can even send them to a client.

This "clearance model" gives tax authorities a real-time window into business transactions, which helps slash errors and ensure everyone is playing by the rules. What started in a few regions has caught on globally. If you’re still clinging to old-school manual methods, you risk falling behind, facing compliance headaches, and struggling to keep up with competitors who have already made the switch.

The global adoption of e-invoicing isn't just about digitizing a piece of paper. It represents a complete overhaul of financial workflows, forcing businesses to integrate more deeply with national tax systems and adopt more transparent practices.

We've seen e-invoicing evolve right before our eyes. Brazil was a pioneer back in 2008, creating a clearance model that required tax authorities to approve invoices pre-issuance. This dramatically improved their tax compliance and inspired a wave of similar systems across Latin America. Over in Europe, Italy made e-invoicing mandatory for government contracts in 2014 and then for all B2B and B2C transactions by 2019. You can dive deeper into the global deployment of e-invoicing and what it means for businesses to see just how widespread this has become.

All of this official pressure is naturally speeding up the adoption of modern invoice management tools.

Why This Matters for Your Business

So, what does this all mean for you, the freelancer or small business owner? In short, the skills and tools you need to manage your finances are evolving. That trusty spreadsheet or simple folder system might be getting the job done today, but it’s not built for where things are headed.

Here’s how this shift directly helps your day-to-day operations:

- •Faster Processing and Payments: Digital invoices are sent instantly, processed automatically, and can often be paid with a click. This shrinks your payment cycle significantly.

- •Fewer Errors: Automation gets rid of the human typos and calculation mistakes that can cause frustrating payment delays.

- •Enhanced Security: A good digital system creates a secure, verifiable trail for every invoice, reducing the risk of fraud or a bill getting "lost in the mail."

Jumping on board with digital invoicing now doesn't just solve today's problems. It prepares your business for a future where this isn't just a good idea - it's the law. You'll be ahead of the game and ready for whatever financial or regulatory changes come next.

Your Invoice Tracking Questions Answered

Even with a rock-solid system, questions are bound to pop up. Let's tackle some of the most common things I hear from business owners trying to get a handle on their invoicing.

A classic one is, "What's the real difference between an outstanding invoice and an overdue one?" It's a great question. Think of it this way: an outstanding invoice is any invoice you've sent out that hasn't been paid yet. It's simply "out there," waiting for payment. An overdue invoice, on the other hand, is one that has officially blown past its due date.

So, while all overdue invoices are technically outstanding, not every outstanding invoice is late.

How Should I Maintain My Records?

If I could give you one piece of advice here, it would be this: be consistent. It doesn't matter if you're using a simple cloud folder or sophisticated software - what matters is that you have a system and you stick to it.

I've always found it easiest to organize everything by client first, then by the invoice's status (like "Sent," "Paid," or "Overdue"). This simple structure means you can pull up any document in seconds, without a frantic search.

Another non-negotiable habit is a regular review of your accounts receivable. Block out a little time each week to glance at your aging report. This is your command center - it tells you which payments are coming up and, more importantly, which ones are already late.

Proactive record-keeping isn't just about tidy files; it's a core financial discipline that directly fuels your cash flow. A clean system gives you clarity, and that clarity gives you control over your money.

The worldwide move to e-invoicing just underscores how vital digital records have become. The e-invoicing market ballooned to around $15.9 billion in 2024 and is projected to hit a staggering $68.7 billion by 2033 as more businesses ditch paper. If you're curious about this shift, you can dig into the full research on the future of e-invoicing and its market growth.

This digital trend is making the entire process of paying and tracking invoices simpler for everyone involved.

Ready to stop chasing payments and get your time back? Tailride automates the entire invoice and receipt management process, from capturing documents in your email to syncing data with your accounting software. Eliminate manual entry and gain full control over your finances. Start tracking invoices effortlessly with Tailride today!