Master Accounts Payable Tracking for Better Business Finances

Improve your business with effective accounts payable tracking strategies. Boost efficiency, reduce errors, and gain financial control today!

Let's get one thing straight: accounts payable tracking isn't just about paying bills. At its core, it's the art and science of managing the money your business owes to suppliers and vendors. Think of it as the complete system for monitoring, managing, and ultimately paying what you owe to keep your operations running smoothly, your finances stable, and your supplier relationships strong.

Why Smart Accounts Payable Tracking Matters

Imagine your business's cash flow is like a complex plumbing system. The money you owe - your accounts payable (AP) - is the water flowing out. Without a good system of valves and gauges, you're just inviting trouble. You could end up with costly leaks like late fees, burst pipes from a sudden cash crunch, or even "contaminated" water in the form of fraud.

A solid accounts payable tracking process is your master control panel for that system. It stops being a tedious administrative chore and becomes a real strategic advantage. It helps you dodge financial emergencies, build great rapport with the suppliers you depend on, and gives you the clear-eyed view you need to make smart, forward-thinking decisions.

From Manual Hassle to Strategic Asset

For a long time, AP has been a notorious headache for businesses. The old way of doing things - shuffling paper, chasing approvals, and manually keying in data - is slow, expensive, and riddled with errors. In fact, processing a single invoice manually still takes an average of 14.6 days and costs around $15. Worse yet, nearly 39% of those invoices contain mistakes.

It's pretty shocking, but a whopping 68% of AP teams are still stuck entering data by hand. You can dig into more of these eye-opening AP statistics and trends over at Docuclipper.com. This reliance on outdated methods doesn't just create administrative drag; it opens the door to serious financial risks.

Thankfully, the tide is turning. With modern automation, what was once a bottleneck is becoming a source of incredibly valuable data.

A well-managed AP process gives you a real-time snapshot of your company's financial commitments. It transforms payables from a simple cost center into a source of strategic insight you can use for sharp cash flow management and forecasting.

A Quick Comparison: Manual vs. Automated

To really see the difference, it helps to put the old and new ways side-by-side. Here’s a quick look at how traditional manual tracking stacks up against modern automated systems.

Manual VS Automated Accounts Payable Tracking

| Aspect | Manual Tracking | Automated Tracking |

|---|---|---|

| Data Entry | Time-consuming, error-prone, and done by hand. | Automated data capture from invoices, nearly eliminating errors. |

| Processing Time | Days or even weeks to process a single invoice. | Minutes or hours, accelerating the entire cycle. |

| Cost Per Invoice | High (around $15), due to labor and inefficiencies. | Significantly lower, reducing operational costs. |

| Visibility | Poor. It's difficult to know the real-time status of an invoice. | Excellent. Real-time dashboards show exactly where everything stands. |

| Supplier Relations | Can be strained due to late payments and lack of communication. | Improved with on-time payments and self-service portals. |

| Fraud Risk | Higher, with fewer checks and balances to catch duplicates or fakes. | Lower, with built-in validation and approval workflows. |

As you can see, making the switch isn't just about saving a little time; it's about fundamentally changing how your business manages its money.

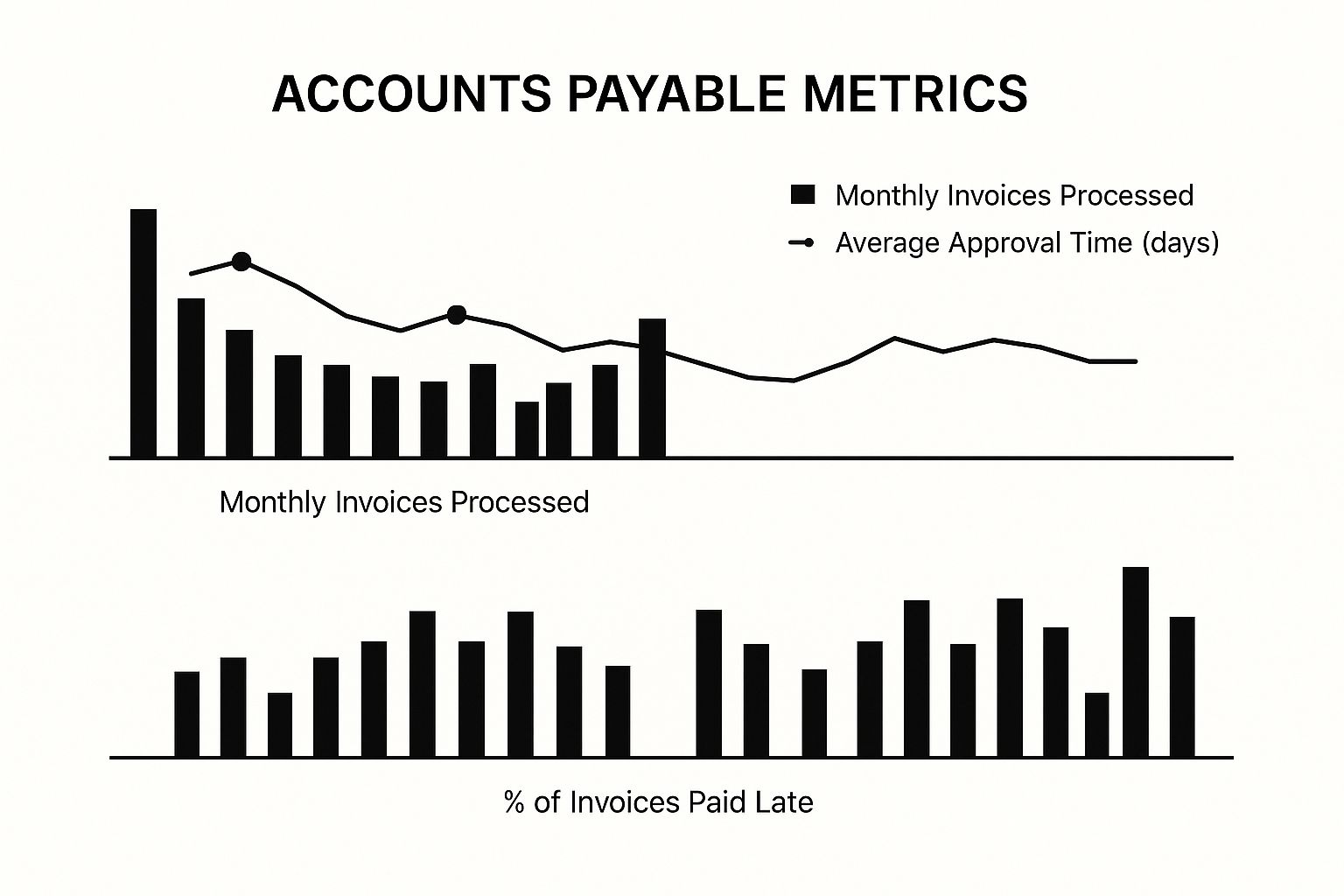

Visualizing Your AP Performance

You can't improve what you don't measure. Tracking key metrics is absolutely essential for understanding the health of your AP process. The chart below gives a great visual example of how a company might monitor its performance month-to-month.

A quick glance at a visual like this can tell you so much. You can immediately spot trends, like how a spike in invoice volume might be slowing down approval times and leading to more late payments. It’s this kind of insight that points you directly to the parts of your process that need attention.

What You Gain from Nailing Your AP Tracking

Thinking of accounts payable as just "paying the bills" is a missed opportunity. When you get AP tracking right, it’s not just an administrative task; it’s a powerful tool that brings real, tangible benefits to your entire company. It can turn a routine cost center into a source of strategic advantage.

The first thing you'll notice is a much better handle on your cash flow. Solid accounts payable tracking gives you a real-time, accurate picture of exactly what you owe and when it’s due. This clarity is what lets you manage your working capital like a pro.

Get a Tighter Grip on Finances and Unlock Savings

Picture this: you know the precise due date for every single bill. This lets you strategically schedule payments, holding onto your cash as long as possible without ever risking a late fee. This isn't about stiffing your vendors; it's about smart cash management.

This level of control also lets you consistently grab early payment discounts. Many suppliers offer a 2% discount if you pay within 10 days instead of the standard 30. That might not sound like much, but over a year, those small savings can make a serious dent in your expenses and boost your bottom line. It turns a "nice-to-have" into a reliable cost-saving strategy.

A strong AP tracking system is your frontline defense against financial leaks. It helps prevent duplicate payments, catches invoice errors before they’re paid, and provides the visibility needed to actively reduce costs.

Forge Stronger Relationships with Your Suppliers

Your suppliers are more than just vendors; they're your partners in business. And nothing builds a strong partnership like consistent, on-time payments. When suppliers see you as a reliable client, good things start to happen.

Happy suppliers are far more willing to:

- •Offer better pricing: They’ll often extend their best rates to the customers they can count on.

- •Provide flexible payment terms: Need a little extra time to pay during a tight month? A trusted partner is more likely to say yes.

- •Prioritize your orders: When inventory is tight, you can bet they’ll take care of their most dependable customers first.

This kind of reputation is a priceless business asset, and you build it one on-time payment at a time.

Reduce Fraud Risk and Breeze Through Audits

Messy, manual AP workflows are a playground for fraud. A structured tracking system, especially an automated one, creates a clear, permanent digital trail for every single transaction. This audit trail is a huge deterrent for anyone thinking about internal or external payment scams.

And when audit season rolls around? A well-documented AP system is a massive relief. Forget digging through filing cabinets or searching old email threads. You can pull up any invoice or payment record in a matter of seconds, making compliance checks smooth and stress-free.

To see how technology amplifies these perks, you can explore more accounts payable automation benefits. At the end of the day, disciplined tracking creates a more secure, transparent, and profitable business.

Navigating the Common Hurdles in AP Tracking

Even with the best intentions, the accounts payable process can get messy. The road to paying your bills smoothly is often littered with frustrating roadblocks that can trip up even the most organized businesses. The good news is that spotting these common hurdles is the first step to building a system that actually works.

One of the biggest culprits? Good old-fashioned human error. Manual data entry is practically an invitation for mistakes. A single mistyped invoice number, an extra zero added to a payment, or the wrong vendor details can snowball into overpayments, accidental duplicate payments, or hours of wasted time as your team tries to figure out what went wrong.

Then there’s the black hole of lost invoices. We've all been there. An email attachment gets buried, a paper invoice disappears under a stack of files, or a bill is sent to the wrong person entirely. When an invoice goes missing, your entire workflow grinds to a halt, putting you at risk for late fees and straining your relationships with valuable suppliers.

The Headaches of Matching and Visibility

For many finance teams, the most frustrating puzzle is matching up all the paperwork. Manually confirming that a purchase order (PO), receiving report, and vendor invoice all line up is a tedious, painstaking task. It’s absolutely critical for preventing fraud and making sure you only pay for what you actually ordered and received, but it takes forever.

A lack of real-time visibility is like driving with a foggy windshield. You can’t make smart financial decisions about the road ahead if you don’t have a clear view of your current liabilities and cash position.

This manual matching process is a classic bottleneck that causes major payment delays and frustrates everyone involved. If this particular pain point sounds familiar, you can learn more about taming it in our guide on the invoice matching process.

Finally, many businesses are simply flying blind. When your accounts payable tracking is a week or two out of date, you have no real-time visibility into your financial obligations. You can't forecast cash flow accurately, make strategic spending decisions, or give leadership a clear, up-to-the-minute snapshot of the company's financial health.

By understanding these common pain points ahead of time, you can build a process that dodges them, turning a potential liability into a smooth and reliable part of your operation.

Implement Best Practices for Modern AP Tracking

Turning your accounts payable process from a reactive chore into a strategic part of your business is easier than you think. It all comes down to building a few good habits. Getting these fundamentals right creates a solid system that saves time, cuts down on mistakes, and gives you a much clearer picture of your company's financial health.

First things first: you have to centralize every single invoice. Think about trying to cook a big dinner with your ingredients scattered all over the house - some in the garage, some upstairs, some in the kitchen. It’s a recipe for chaos. The same goes for invoices hiding in different email inboxes, sitting in piles on desks, or lost in various cloud folders.

Creating one central hub for all incoming bills is non-negotiable. This could be a dedicated email address or a specific folder in your document system. This simple move stops the frantic "where's that invoice?" search and makes sure nothing gets missed.

Standardize Your Approval Workflow

With all your invoices corralled in one place, the next step is to map out a standard approval workflow. This is basically your game plan for getting a bill from its arrival to its payment without any confusing detours or delays. A clear, repeatable process means everyone on your team knows exactly what they need to do and when.

A solid workflow should clearly spell out:

- •Who handles the initial review and codes the invoice to the right department or expense account.

- •The approval chain, detailing who needs to sign off based on the invoice amount or project.

- •What to do when there's an issue, like a price discrepancy or a missing PO number, so it can be fixed fast.

This structure is what prevents invoices from getting stuck on someone’s desk or buried in an email thread - two of the biggest culprits behind late payments. By defining the process, you create a system that's both efficient and accountable.

Regularly reconciling your accounts payable ledger with your general ledger is like a routine health check for your finances. It’s the best way to catch small issues like duplicate payments or data entry errors before they become major problems.

Beyond just paying bills on time, a well-run AP process helps you manage your money better. It gives you the real-time data needed to implement 5 Strategies to Manage Cash Flow Effectively because you always know exactly what you owe.

Embrace Technology and Automation

The most powerful practice you can adopt is bringing technology into the mix. Manual methods might work when you're just starting out, but they quickly become a bottleneck as your business grows. Automation is the secret to building a financial backbone that’s truly efficient and error-proof. The fact that the accounts payable software market is expected to jump from $1.53 billion to $1.67 billion next year shows just how many businesses are ditching the old manual grind.

Adopting technology doesn't mean you have to flip a switch overnight. You can start small and gradually build up to a fully automated system. Our guide on accounts payable automation best practices is a great resource for figuring out that journey. The real goal here is to let software handle the tedious, repetitive work so your team can focus on more valuable, strategic tasks.

Choose the Right AP Automation Software

Picking the right software for your accounts payable tracking can feel like a huge task, but it really just comes down to matching the tool to your unique business needs. Think of it like a mechanic choosing a wrench. You wouldn't use a massive pipe wrench on a tiny bolt; you need the right fit for the job at hand. The same goes for your AP software - it needs to fit your company's size, invoice volume, and existing financial systems.

The world of accounts payable is definitely not standing still. Artificial intelligence and automation are changing the game, with more than half of all businesses expected to adopt AI in their AP processes soon to get a handle on costs and work smarter. This isn't just about efficiency, either. It’s also a smart move for keeping your team happy. A surprising 72% of finance professionals are thinking about leaving the field, often because they're burned out from the endless cycle of manual, repetitive work. By bringing in automation, companies are not only sharpening their workflows but are also building more resilient and flexible finance departments. You can dive deeper into these global trends in accounts payable on Medius.com. This rapid shift makes finding the perfect platform more crucial than ever.

Core Features You Cannot Ignore

When you start comparing different platforms, a few key features should be on your "must-have" list. These are the tools that truly separate a simple digital filing system from a powerhouse that gives you back hours in your day.

Your checklist should absolutely include:

- •Optical Character Recognition (OCR): Think of this as the magic wand that reads invoices for you. It automatically scans and pulls out key details like vendor names, invoice dates, and total amounts, which means no more tedious manual data entry and a lot fewer typos.

- •Automated Three-Way Matching: If your business runs on purchase orders, this feature is a lifesaver. It automatically confirms that the purchase order, the goods receipt, and the final invoice all line up perfectly. This simple check is a powerful defense against overpayments and potential fraud.

- •Customizable Approval Workflows: Every business has its own way of approving payments. Your software should bend to your process, not force you into a box. Look for tools that let you easily build rules to send invoices to the right approvers based on the dollar amount, department, or project code.

A solid platform will bring all of this information together into a clean, easy-to-read dashboard. For instance, top-tier AP software often gives you a bird's-eye view of every invoice's status.

This kind of visual command center gives you an immediate feel for your entire payables pipeline, from the moment an invoice arrives to the moment it's paid.

To help you sort through the options, here's a table of essential features to look for when you're shopping around.

Essential Features in AP Automation Software

A checklist of key features to evaluate when selecting an accounts payable automation tool for your business.

| Feature | What It Does | Why It's Important |

|---|---|---|

| OCR Data Capture | Automatically reads and extracts data from invoices, such as vendor name, dates, and amounts. | Eliminates manual data entry, reduces human error, and speeds up invoice processing. |

| Centralized Invoice Hub | Provides a single, unified dashboard to view and manage all incoming invoices and their current statuses. | Gives you complete visibility and control over your entire AP workflow from one place. |

| Automated 3-Way Matching | Instantly compares purchase orders, goods receipts, and invoices to ensure they match. | Prevents overpayments, catches discrepancies early, and protects against fraudulent bills. |

| Custom Approval Workflows | Lets you create rule-based paths to route invoices to the correct people for approval. | Enforces company policy, gets approvals faster, and eliminates bottlenecks. |

| ERP/Accounting Integration | Syncs directly with your existing accounting software (like QuickBooks, NetSuite, Xero). | Ensures your general ledger is always up-to-date and provides a single source of truth. |

| Reporting & Analytics | Offers dashboards and reports on spending, cash flow, and supplier performance. | Helps you make smarter, data-driven financial decisions and identify cost-saving opportunities. |

Having this checklist handy will make it much easier to compare platforms and find one that truly supports your business goals.

Integration and Reporting Capabilities

A great tool is only as good as its ability to play nicely with the other software you rely on every day. This is where seamless integration becomes a deal-breaker.

Your AP automation software should not be an isolated island. It must connect directly to your accounting system - like QuickBooks, Xero, or NetSuite - to ensure data flows smoothly without needing double entry.

This tight connection keeps your general ledger in perfect harmony with your payables, creating a single, reliable source of truth for your company's finances.

Finally, don't overlook the power of reporting and analytics. The best platforms don't just process payments; they give you dashboards packed with immediate insights into your spending patterns, cash flow position, and overall financial health. This empowers you to stop reacting and start making strategic, data-driven decisions for your business.

Got Questions About AP Tracking? We've Got Answers.

As you start to really dig into your company's finances, it's totally normal for questions to bubble up. When you're dealing with the money you owe, getting clear answers can make all the difference. We've gathered the most common questions about accounts payable tracking right here to give you the straightforward insights you need.

What's the Difference Between Accounts Payable and Accounts Receivable?

Think of your business finances as a two-way street.

Accounts Payable (AP) is all the money flowing out of your company to pay suppliers for the things you've bought. On your balance sheet, it's a liability - it’s money you owe.

On the other side of the street, you have Accounts Receivable (AR). This is all the money flowing in from customers who bought from you. It’s an asset because it’s cash that rightfully belongs to your business.

So, AP is about managing what you owe, while AR is about collecting what you’re owed. Good AP tracking makes sure that outbound traffic lane runs smoothly, preventing financial traffic jams.

When Should a Small Business Start Using AP Automation Software?

There’s no magic number of invoices that tells you it's time, but there are definitely some tell-tale signs. You should seriously consider an automation tool if any of these sound familiar:

- •You're losing hours every week. Is your team drowning in manual data entry, chasing down approvals, or playing detective to match invoices with purchase orders? That's valuable time that could be spent on growing the business.

- •Disorganization is costing you money. Late payment fees are frustrating. Missing out on early payment discounts is like throwing money away. If this is happening because invoices get buried, it’s a clear sign you need a better system.

- •Invoices are falling through the cracks. When a bill gets lost in an email thread or sits on someone's desk for weeks, it doesn't just delay payment; it can frustrate your suppliers and damage important relationships.

- •You can't get a clear financial picture. If someone asks, "How much do we owe right now?" and you can't answer quickly and confidently, you're flying blind. You need real-time visibility to make smart financial decisions.

If you found yourself nodding along to any of these points, the efficiency gains and cost savings from an automation platform will likely pay for themselves in no time.

How Does Accounts Payable Tracking Affect a Business Credit Score?

It has a huge and direct impact. Business credit bureaus, like Dun & Bradstreet, pay very close attention to how reliably your company pays its vendors and suppliers.

Consistent, on-time payments are one of the single most important factors in building a strong business credit score. This is a direct result of disciplined accounts payable tracking.

A solid payment history signals to lenders and partners that you're a low-risk, reliable business. This can open doors to better loan terms, more favorable credit lines, and even new contracts. On the flip side, a history of late payments will drag your score down, making your business look riskier and potentially leading to credit denials or just plain bad terms.

What Is Three-Way Matching in Accounts Payable?

Three-way matching is a classic, rock-solid internal control that helps prevent payment errors and catch fraud before it happens. It’s a verification step where you compare three critical documents before you cut a check.

The "three ways" you're matching are:

- •The Purchase Order (PO): The document that shows what your company officially ordered.

- •The Receiving Report: Proof of what goods or services your company actually received.

- •The Vendor's Invoice: The bill from the supplier asking for payment.

By lining up all three - checking that quantities, prices, and item descriptions match - you ensure you're only paying for exactly what you ordered and received. This simple cross-reference is fantastic for catching duplicate payments, spotting overcharges, and flagging sketchy invoices. The best part? Modern AP automation software can do this check in seconds, turning a tedious manual task into an instant, automated safeguard.

Ready to stop chasing invoices and start making smarter financial decisions? Tailride automates your entire accounts payable process, from capturing invoices directly from your email to syncing perfectly with your accounting software. Discover how much time you can save and see your first invoices processed in seconds.